|

The Week Ahead: Highlights

Europe Preview

Is Europe Weathering a Storm or Experiencing the Calm

Before?

By Marco Babic, Econoday Economist

There were some positive economic signs in Europe last week

as manufacturing orders and industrial production rose in Germany during March

from the previous month. At the same time, Europe's largest economy saw its

trade surplus increase on the back of strong exports.

The US and UK reached a trade agreement, although details

remain scarce. It appears that 10 percent tariffs are still in place which

makes it unclear what win the UK got, if any. Also opaque is whether the UK is

seeking to become a trade conduit between the US and Europe.

What's the Current Thinking?

On Tuesday, Germany's ZEW reports May economic sentiment,

and is one of the earliest indicators to be released. In April, financial

professionals judged current conditions a bit more favorably than in the

previous month. Expectations on the other hand plunged dramatically, falling to

-14.0 in April from 51.6. That could be the first indication that official data

is not yet reflecting the unfolding macro environment.

In light of that, sentiment and anecdotal evidence can add

some context and direction. On Thursday, the European Central Bank releases the

summary minutes from its April meeting when it reduced its three main interest

rates by 25 basis points.

Germany, France, and Italy report their final consumer price

index readings for April, and none have inflation rates that should trouble the

ECB for now.

Following Germany's strong trade report last week, the UK,

Italy, and the Eurozone are up next week. In February, the Eurozone trade

surplus reached 21 billion euro, up from January's 14 billion. Still, this is

lagging data and more timely data from ports shows a decline in container

activity.

Economic Report Cards in the form of GDP are scheduled for

the UK, Eurozone, and Switzerland for the first quarter. While the results are

for the three months immediately prior to the imposition of US tariffs in

April, the level from which European economies start the year will be important

to watch.

Official indicators for the next few months perhaps still

need to catch up to the realities on the ground and at sea.

US Preview

US CPI, Retail Sales in Focus

By Theresa Sheehan, Econoday Economist

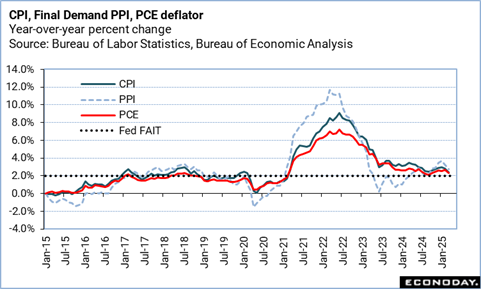

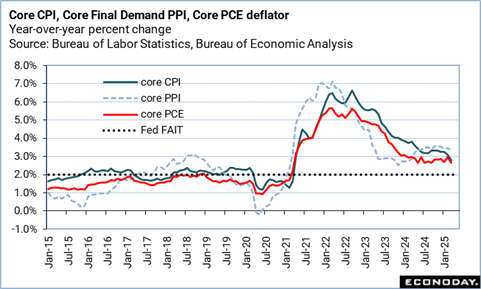

The two reports likely to dominate the conversation about

the US economy in the May 12 week are the April consumer price index (CPI) at

8:30 ET on Tuesday and the April report on retail sales at 8:30 ET on Thursday.

The CPI for April is unlikely to repeat the month-over-month

dip of 0.1 percent in March or the narrow 0.1 percent increase in the core CPI.

Some easing in upward pressure on food prices is expected, while energy costs

could well decline again. Gasoline prices fell in April contrary to the normal

rise when refineries start to switch over to summer reformulations for motor

fuels which tend to increase prices. Elsewhere, consumer prices may feel the

bite of the first higher tariffs imposed on goods and services.

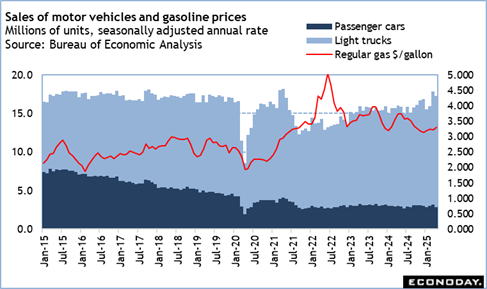

Data on sales of retail and food services could start the

second quarter 2025 off strong. Sales of motor vehicles remained solid in April

with a 17.3 million units annual pace, although it is a bit slower than 17.8

million units in March. Mild weather and spring holidays probably brought out

shoppers for seasonal goods like building materials, gardening supplies,

clothing, and home entertainment. However, many consumers are budget conscious

and looking for bargains or to stock up on hard goods and nonperishables before

prices go up. This will eat into demand for the coming months. Moderation in

gasoline prices means that the dollar value of sales will be lower, although

there could be some offset from holiday travel.

Note that the Census Bureau issued annual revisions to the

retail data on April 25.

Asia/Pacific Preview

Aussie Jobs Data in Focus

By Brian Jackson, Econoday Economist

Australian labour market data will be the highlight of the

Asia-Pacific data calendar, with both quarterly wage data and monthly

employment data scheduled for release. In the minutes for last month's Reserve

Bank of Australia policy meeting, officials judged the labour market "to be

tighter than was consistent with full employment"

and cautioned that this could "have a more pronounced

effect on inflation than anticipated." Australian consumer and

business confidence surveys should also provide information

on the impact of global trade tensions and

market volatility in recent weeks on sentiment.

Singapore and India will report trade data for April.

Singapore's PMI survey published last week reported some front-loading

of export orders in April ahead of expected tariff increases. India will

also publish both consumer and wholesale inflation data,

with officials from the Reserve bank of India noting when they cut policy

rates at their meeting last month that they see risks to the inflation

outlook as "evenly balanced."

The Week Ahead: Econoday Consensus Forecasts

Monday

United States Treasury Budget Statement for April (Tue

0830 EDT; Tue 12:30 GMT)

Consensus Forecast: $245.5 B

Consensus Range: $195.0 B to $260 B

The budget is seen in surplus by $245.5 billion for April, a

big month for tax receipts, up from $209.5 billion in the year-ago month.

Tuesday

United Kingdom Labour Market Report for April (Tue 0700

BST; Tue 0600 GMT; Tue 0200 EDT)

Consensus Forecast, Claimant Count Unemployment Rate:

4.5%

Consensus Range, Claimant Count Unemployment Rate: 4.4%

to 4.5%

The consensus forecast sees ILO unemployment ticking up to

4.5 percent from 4.4 percent in the last reading as the employment market is

cooling slowly.

Germany ZEW Survey for May (Tue 1100 CEST; Tue 0900 GMT;

Tue 0500 EDT)

Consensus Forecast, Current Conditions: -77.0

Consensus Range, Current Conditions: -78.0 to -76.0

Consensus Forecast, Economic Sentiment: 0

Consensus Range, Economic Sentiment: -16.0 to 10.0

Current conditions expected at minus 77.0 in May versus

minus 81.2 in April. Economic sentiment is seen up to 0 from minus 14.0 in

April after a tremendous drop from 51.6 in March as investors reacted to

economic uncertainty unleashed by US tariffs.

United States NFIB Small Business Optimism Index for

April (Tue 0600 EDT; Tue 1000 GMT)

Consensus Forecast, Index: 94.9

Consensus Range, Index: 93.0 to 97.0

Uncertainty around Trump administration policies continues

to depress business sentiment. The consensus looks for the NFIB small business

sentiment index to fall to 94.9 in May after dropping for a third straight

month to 97.4 in April, down from100.7 in March. Pressure from the business

community is rising on President Trump to deescalate the trade war or at least

to provide greater policy visibility.

United States CPI for April (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.2% to 0.6%

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.3% to 2.5%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.6%

Consensus Forecast, Ex-Food & Energy - Y/Y: 2.8%

Consensus Range, Ex-Food & Energy - Y/Y: 2.8% to 2.9%

Headline inflation is expected at 0.3 percent on month and 2.4

percent on year in April versus a decline of 0.1 percent and unchanged from an

increase of 2.4 percent on year in March. Core CPI is also seen at 0.3 percent

and 2.8 percent in April versus increases of 0.1 percent and 2.8 percent in

March.

Wednesday

Japan PPI for April (Wed 0850 JST; Tue 2350 GMT; Tue 1950

EDT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.7% to 0.6%

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.0% to 4.4%

Producer inflation in Japan is expected to ease clearly to a

five-month low of 3.8% in April as a trade war initiated by President Trump

with his stiff tariffs on U.S. imports dampened global demand for metals and

other materials. The year-on-year increase in the prices charged among

businesses unexpectedly picked up slightly to 4.2% in March from 4.1% in

February. Utilities costs are seen subdued just above 6%, capped by three-month

electricity and natural gas subsidies that are reflected in bill payments from

February to April. The upstream goods inflation is expected to be led by farm

produce prices as rice shortages, and thus high prices for the staple, continue

despite the government's release of rice reserves through rounds of tenders to

wholesalers.

On the month, the corporate goods price index is forecast to

post its first drop in eight months, down 0.2% after rising a solid 0.4% the

previous month.

At its latest meeting on April 30-May 1, the Bank of Japan's

nine-member board voted unanimously to maintain the target for overnight

interest rate at 0.5%, as widely expected, amid high uncertainty over global

growth and inflation sparked by stiff Trump tariffs, after having stood pat in

March. Previously, the panel voted 8 to 1 to raise the policy rate by another

25 basis points to 0.5% in a third rate hike during the current normalization

process that began in March 2024. The BOJ appears to be still on course for two

more 25 basis point rate hikes that would eventually take the overnight

interest rate target to 1%. The bank is in the process of normalizing its

policy by gradually lifting the rates that had been in a range of zero and

slightly negative until March 2024.

Australia Wage Price Index for First Quarter (Wed 1130

AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.8% to 0.8%

Wages are expected up 0.8 percent on quarter in Q1 versus

0.7 percent in Q4.

Germany CPI for April (Wed 0800 CEST; Wed 0600 GMT; Wed

0200 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.4%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.1% to 2.1%

The consensus sees no revision in increases of 0.4 percent

on month and 2.1 percent on year already reported for April.

Thursday

Australia Labour Force Survey for April (Thu 1130 AEST;

Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Employment - M/M: 24K

Consensus Range, Employment - M/M: 15K to 40K

Consensus Forecast, Unemployment Rate: 4.1%

Consensus Range, Unemployment Rate: 4.1% to 4.2%

Employment is expected up 24,000 on the month in April

versus 32,000 in March. The unemployment rate is seen flat at 4.1 percent

versus 4.1 percent in March.

United Kingdom Monthly GDP for March (Thu 0700 BST; Thu

0600 GMT; Thu 0200 EDT)

Consensus Forecast, M/M: 0%

Consensus Range, M/M: -0.1% to 0.1%

Forecasters see GDP flat on the month in March after a

surprising 0.5 percent increase in February.

United Kingdom GDP for First Quarter (Thu 0700 BST; Thu

0600 GMT; Thu 0200 EDT)

Consensus Forecast, Q/Q: 0.6%

Consensus Range, Q/Q: 0.5% to 0.8%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: 0.9% to 1.3%

Manufacturing expected to lead respectable 0.6 percent

growth in Q1. The consensus sees GDP up 1.1 percent on year.

United Kingdom Industrial Production for March (Thu 0700

BST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Industrial Production - M/M: -0.7%

Consensus Range, Industrial Production - M/M: -1.0%

to -0.2%

Consensus Forecast, Industrial Production - Y/Y: -1.0%

Consensus Range, Industrial Production - Y/Y: -1.3%

to 0.3%

Consensus Forecast, Manufacturing Output - M/M: -0.8%

Consensus Range, Manufacturing Output - M/M: -1.0% to

-0.3%

Consensus Forecast, Manufacturing Output - Y/Y: -0.7%

Consensus Range, Manufacturing Output - Y/Y: -3.6% to

0.5%

Output expected to fall back 0.7 percent on the month in

March after surging by 1.5 percent in February.

United Kingdom Merchandise Trade Balance for March (Thu

0700 BST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Balance: -Stg19.4 B

Consensus Range, Balance: -Stg19.8 B to -Stg18.9 B

The deficit is expected to narrow slightly to Stg19.4

billion in March from Stg 20.81 billion in February.

France CPI for April (Thu 0845 CEST; Thu 0645 GMT; Thu

0245 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.5% to 0.5%

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.8% to 0.8%

The consensus sees no revision in increases of 0.5 percent

on month and 0.8 percent on year already reported for April.

Eurozone GDP Flash for First Quarter (Thu 1100 CEST;

Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.4% to 0.4%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

GDP is expected unrevised with a quarterly gain of 0.4

percent in Q1 and an increase of 1.2 percent on the year.

Eurozone Industrial Production for March (Thu 1100

CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, M/M: 1.6%

Consensus Range, M/M: 0.9% to 2.6%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 1.5% to 2.1%

Output is seen extending its bounce with a strong 1.6

percent increase in March on the month and up 2.1 percent on year. In February,

industrial production was up 1.1 percent on the month and 1.2 percent on year.

Canada Housing Starts for April (Thu 0815 EDT; Thu 1215

GMT)

Consensus Forecast, Annual Rate: 230K

Consensus Range, Annual Rate: 212K to 235K

Starts are expected better at 230K in April after slipping

to 214,000 in March from 221,000 in February from 232,000 in January.

United States Jobless Claims for Week 5/10 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 229K

Consensus Range, Initial Claims - Level: 220K to 230K

Claims are seen pretty flat at 229K from 228K in the

previous week.

United States PPI-Final Demand for April (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.0% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.4% to 2.5%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.0% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 3.0% to 3.3%

Consensus Forecast, Ex-Food, Energy & Trade Services

- M/M: 0.3%

Consensus Range, Ex-Food, Energy & Trade Services - M/M:

0.1% to 0.3%

United States Retail Sales for April (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Retail Sales - M/M: 0.1%

Consensus Range, Retail Sales - M/M: -0.4% to 0.3%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: 0.2% to 0.6%

Retail sales are seen up 0.1 percent in April and up 0.3

percent ex-autos. Sales have receded as households fret over the economic

outlook. Strong gains of 1.4 percent and 0.5 percent, respectively, in March partly

reflected consumers front-running expected price increases on big-ticket

durables.

Canada Manufacturing Sales for March (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, M/M: -1.9%

Consensus Range, M/M: -1.9% to 0.2%

The consensus agrees with the Statistics Canada preliminary

estimate calling for a large decrease of 1.9 percent.

United States Philadelphia Fed Manufacturing Index for

May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Index: -10.0

Consensus Range, Index: -20.0 to 5.5

The Philly Fed index is expected to correct upward but

remain in contraction at minus 10.0 in May after plunging to minus 26.4 in

April.

United States Empire State Manufacturing Index for May (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, Index: -7.5

Consensus Range, Index: -8.0 to -2.1

Not much change expected with index mired in contraction at

minus 7.5 in May versus minus 8.1 in April.

United States Industrial Production for April (Thu

0915 EDT; Thu 1315 GMT)

Consensus Forecast, Industrial Production - M/M: 0.2%

Consensus Range, Industrial Production - M/M: -0.1%

to 0.5%

Consensus Forecast, Manufacturing Output - M/M: 0.0%

Consensus Range, Manufacturing Output - M/M: -0.3% to

0.2%

Consensus Forecast, Capacity Utilization Rate: 77.9%

Consensus Range, Capacity Utilization Rate: 77.2% to 78.0%

Industrial output expected up a modest 0.2 percent with

manufacturing flat.

United States Business Inventories for March (Thu

1000 EDT; Thu 1600 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.4%

The consensus sees inventories up 0.2 percent.

United States Housing Market Index for May (Thu 1000 EDT;

Thu 1400 GMT)

Consensus Forecast, Index: 40.0

Consensus Range, Index: 38.0 to 41.0

No change expected at 40.0 for May as housing remains

depressed.

Friday

Japan GDP for First Quarter (Fri 0850 JST; Thu 2350

GMT; Thu 1950 EDT)

Consensus Forecast, Q/Q: -0.1%

Consensus Range, Q/Q: -2.1% to 0.1%

Consensus Forecast, Annual Rate: -0.4%

Consensus Range, Annual Rate: -2.1% to 0.5%

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.2% to 2.0%

Japan's gross domestic product for the January-March quarter

is forecast to post its first contraction in four quarters, down a slight 0.1%

on quarter, or an annualized 0.4%, in payback for a technical jump in net

exports in the previous quarter but also hit by sluggish consumption amid high

costs of living and the murky outlook for global growth triggered by the

protectionist U.S. trade policy. From a year earlier, the Q1 GDP is forecast to

have posted the third straight increase, up 1.6%, after a 1.1% gain.

The expected GDP slip would follow the 0.6% rise (annualized

2.2%) in the October-December quarter, when the solid growth was led by a

technical rebound in net exports that was caused by a sharper-than-expected

slump in imports and masks weak exports and domestic demand. It would also come

after the U.S. economy recorded its first contraction in three years in Q1,

down an annualized 0.3%, shrinking after the 2.4% expansion in Q4, largely due

to rush imports ahead of stiff Trump tariffs.

Domestic demand is expected to provide a positive 0.4

percentage point contribution to total domestic output in Q1 after trimming Q4

GDP by 0.2 point and boosting it by 0.5 point in Q3. External demand (exports

minus imports) is estimated to have lowered the Q1 GDP by 0.6 point after

adding 0.7 point to the growth in the previous quarter.

United States Housing Starts and Permits for April (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Starts - Annual Rate: 1.362 M

Consensus Range, Starts - Annual Rate: 1.310 M to 1.414

M

Consensus Forecast, Permits - Annual Rate: 1.45 M

Consensus Range, Permits - Annual Rate: 1.43 M to 1.47

M

Starts are expected marginally better at 1.362 million units

in April versus 1.324 million in March.

United States Import and Export Prices for April (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Import Prices - M/M: -0.3%

Consensus Range, Import Prices - M/M: -0.5% to 0.3%

Consensus Forecast, Export Prices - M/M: -0.3%

Consensus Range, Export Prices - M/M: -0.6% to 0.2%

Imports and exports both expected down 0.3 percent on the

month.

United States Consumer Sentiment for May (Fri 1000 EDT;

Fri 1400 GMT)

Consensus Forecast, Index: 53.0

Consensus Range, Index: 52.0 to 54.8

Consensus Forecast, Year-ahead Inflation Expectations: 6.6%

Consensus Range, Year-ahead Inflation Expectations: 6.5%

to 6.7%

After dropping another 8 percent in April, the index is

expected to steady at its low levels, 53.0 for confidence. Inflation

expectations are seen rising again to a remarkable 6.6% from 6.5% in April and

3.3 percent in May 2024.

|