|

The Week Ahead: Highlights

Europe Preview

Manufacturing Shows Resilience, but for How Long?

By Marco Babic, Econoday Economist

Last week's indicators in Europe showed the manufacturing

sector holding up reasonably well, although not enough to speak of green shoots

in the economy, particularly in light of signs of waning domestic demand and

inventories.

The seemingly daily drama surrounding tariffs is certainly

not helping as the battle has now moved to US courts. But whether through

necessity or lack of options, there are signs that global trade activity was

relatively unaffected in May.

In fact, the RWI/ISL Container Volume Index for April rose

to 137.3 in April from 136.2 in March. Chinese ports saw activity increase as

well, with the index for Chinese ports rising to 155.8 to 152.9, while the

North-range Index for European ports rose to 113.3 from 112.2 in March. Given

the roughly two weeks it takes for container ships originating in Chinese ports

to reach the west coast of the US, the full effects might not be seen until

May.

A clearer picture could develop in the week ahead as Germany

and France report their trade results for April, the first month in which

tariffs went fully into effect. In March, Germany's trade surplus increased to

21.1 billion Euros from 17.9 billion the month before as exports increase 1.1

percent and imports dropped 1.4 percent. The US also reports its trade results

for April next week, so it will instructive to compare to the European results.

Final May composite and manufacturing PMI reports for

Germany, France, the UK, and the Eurozone are generally expected to be close to

their preliminary readings. Still, they might provide some anecdotal

perspective from purchasing managers which could provide some insight into

expectations.

Preliminary reports supported less contraction in the

manufacturing sector, while services were more negative. These developments

were largely echoed in the official data as well. The services sector is one

weapon that the EU could deploy against the US if the tariff wars intensify,

since the US runs a surplus in services to the bloc.

Inventories are something to be closely watched, with those

particular tea-leaves perhaps providing some clarity on whether they are

building due to economic slowdown or growing in anticipation of tariffs.

Italy and Switzerland report retail sales for April next

week, and there few signs suggesting that consumers have abandoned their

cautionary stance in light of the current uncertainty.

What Does the ECB Have to Say?

On Thursday, the European Central Bank meets to discuss

policy and announces its decision on Thursday. With inflation largely within

the ECB's comfort zone, any policy response will come on expectations for a

slowing economy and the potential disruption from tariffs.

At its last meeting, the keepers of the euro cut the

Refinancing and Deposit rates by 25 basis points, and the Econoday consensus

looks for another 25 bp cut this week.

US Preview

What is Happening with Labor Market?

By Theresa Sheehan, Econoday Economist

In the June 2 week, the focus will be narrowly on conditions

in the labor market. In question is if job openings are fewer, hiring slower,

and layoffs more prevalent, or some combination of these? In other words, will

the FOMC find sufficient deterioration in the labor market to affect its

thinking regarding the maximum employment side of the dual mandate? This week's

series of reports are the last significant labor market numbers the FOMC will

have in hand when it meets next June 17-18.

The report on job openings and labor turnover (JOLTS)

at 10:00 ET on Tuesday is for April. These numbers will lag the other major

reports but still provide some insights. Will the level of job openings decline

for a third month in a row? If businesses are eliminating unfilled jobs and/or

reducing plans to hire, it will introduce a chill in the job market. However,

this does not necessarily mean that unemployment is going to rise. Businesses

may decide to hang on to their current staffing as potentially hard to replace

and more expensive to do so. Hiring may continue for some specialized areas

where the supply of workers with the right skills and experience is increasing,

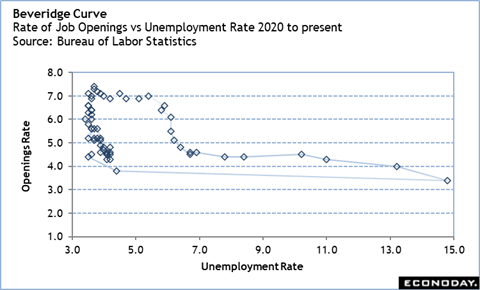

although overall labor demand is cooling. The Beveridge Curve (national

unemployment rate vs the job openings rate) indicates that the present labor

market is in good shape, something the FOMC will take into consideration.

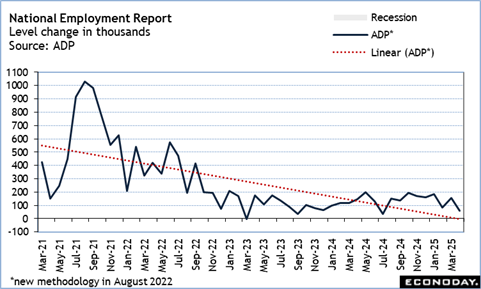

The ADP national employment report for May at 8:15 ET on

Wednesday will probably remain consistent with recent months where private

businesses of all sizes are hiring less. Ongoing restructuring in the

technology sector, closures in retail, and cutbacks in construction projects

should be offset by growth elsewhere. However, hiring will be cautious and

consistent with a less optimistic outlook for the economy.

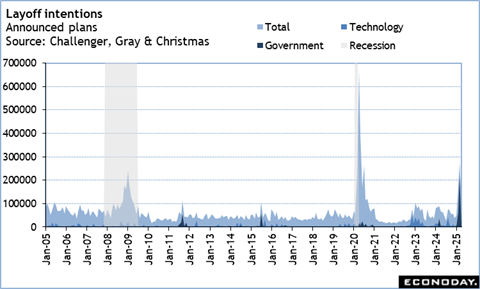

The Challenger report on layoff intentions in May at 7:30 ET

on Thursday could see a pullback of the frenetic job cut activity in the first

four months of the year, at least in government and technology. Other sectors

may be still shaping their responses to the uncertainty in the outlook for

trade and tariff policy which is rapidly changing and isn't done doing so.

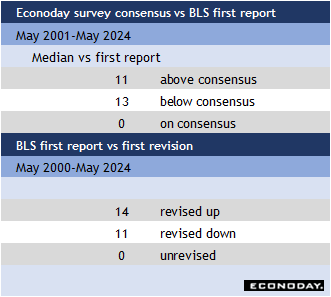

The monthly employment report at 8:30 ET on Friday is

expected to see somewhat slower job growth at the start of the second quarter

and perhaps a tick higher in the unemployment rate. May is when many college

graduates enter the job market, although some have been hired previously if

their expertise is in high demand. It is also a time when businesses in leisure

and hospitality bring on seasonal workers for the summer vacation period; the

early timing of Memorial Day may have brought this forward a bit. On the other

hand, school districts start to lay off staff in advance of the quieter months

of June, July, and August. This May could defy the former trends. Anecdotal

evidence suggests that college grads are not finding jobs as easily and the

travel industry is feeling the pinch of fewer foreign visitors.

Asia Preview

Purchasing Managers Reports in Focus

By Brian Jackson, Econoday Economist

The May round of PMI surveys will be the main focus the

Asia-Pacific data calendar in the week ahead. April surveys generally showed

weak conditions in most parts of the region, with respondents reporting that

the escalation of global trade tensions at the start of April had an immediate

impact. Next week's surveys will be closely watched to see if activity and

sentiment have improved over May.

The Reserve Bank of India's policy meeting will also be a

focus. At the previous meeting in early April, officials lowered the main

policy rate by 25 basis points from 6.25 percent to 6.00 percent. Officials

also announced that they would shift the policy stance from "neutral"

to "accommodative" and advised that they would monitor developments

closely to assess what further policy action may be required. Data released

since then have shown a further decline in headline inflation, mainly

reflecting smaller increase in food prices, with PMI surveys showing ongoing

strength in both the manufacturing and services sectors.

Australia will publish GDP data for the three months to

March and trade data for April. South Korea will publish GDP data for the three

months to March and inflation data for May.

The Week Ahead: Econoday Consensus Forecasts

Monday

France PMI Manufacturing Final for May (Mon 0950 CEST;

Mon 0750 GMT; Mon 0350 EDT)

Consensus Forecast, Index: 49.5

Consensus Range, Index: 49.5 to 49.5

No revision from the 49.5 flash is the call for PMI

manufacturing final.

Germany PMI Manufacturing Final for May (Mon 0955

CEST; Mon 0755 GMT; Mon 0355 EDT)

Consensus Forecast, Index: 48.8

Consensus Range, Index: 48.8 to 48.8

Forecasters look for no revision in the final report from

the flash at 48.8.

Eurozone PMI Manufacturing Final for May (Mon 1000

CEST; Mon 0800 GMT; Mon 0400 EDT)

Consensus Forecast, Index: 49.4

Consensus Range, Index: 49.4 to 49.4

The call is no revision for the final from the flash at

49.4.

United Kingdom PMI Manufacturing Final for May (Mon 0930

BST; Mon 0830 GMT; Mon 0430 EDT)

Consensus Forecast, Index: 45.1

Consensus Range, Index: 45.1 to 45.1

No revision from the 45.1 flash is the call for PMI

manufacturing final.

United States PMI Manufacturing Final for May (Mon 0945

EDT; Mon 1345 GMT)

Consensus Forecast, Index: 52.3

Consensus Range, Index: 52.3 to 52.3

No change from the flash at 52.3 is expected.

United States ISM Manufacturing Index for May (Mon 0945

EDT; Mon 1345 GMT)

Consensus Forecast, Index: 49.1

Consensus Range, Index: 47.7 to 51.5

Another mildly contractionary reading expected at 49.1 in

May after 48.7 in April and 49.0 in March.

United States Construction Spending for April (Mon 1000

EDT; Mon 1400 GMT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: -0.5% to 0.4%

The consensus looks for a rebound of 0.4 percent in April after

a 0.5 percent decrease in March.

Tuesday

South Korea CPI for May (Tue 0800 KST; Mon 2300 GMT; Mon

1900 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.1% to 2.2%

Seen up the same 0.1 percent on the month and 2.1 percent on

year for May versus increases of 0.1 percent and 2.1 percent in April.

China PMI Manufacturing for May (Tue 0945 CST; Tue 0145

GMT; Mon 2145 EDT)

Consensus Forecast, Index: 50.7

Consensus Range, Index: 49.5 to 50.8

Index expected to remain barely in expansion at 50.7 in May

versus 50.4 in April.

United States Motor Vehicle Sales for May (ANYTIME)

Consensus Forecast, Total Vehicle Sales - Annual Rate:

16.4 M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.8

M to16.5 M

Sales seen down to a routine 16.4 million unit rate from

strong 17.3 million in April.

Eurozone HICP Flash for May (Tue 1100 CEST; Tue 0900 GMT;

Tue 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 1.9% to 2.1%

Consensus Forecast, Narrow Core - Y/Y: 2.5%

Consensus Range, Narrow Core - Y/Y: 2.4% to 2.6%

Disinflation remains on track as forecasters see the HICP down

to the ECB target at 2.0 percent and 2.5 percent for narrow core in the May

flash versus 2.2 percent and 2.7 percent in the April final.

United States Factory Orders for April (Tue 1000 EDT;

Tue 1400 GMT)

Consensus Forecast, M/M: -3.0%

Consensus Range, M/M: -3.6% to -2.2%

After the big 6.3 percent drop in durable goods orders

already reported for April, largely due to falling aircraft orders, forecasters

see factory orders down 3.0 percent.

United States JOLTS for April (Tue 1000 EDT; Tue 1400

GMT)

Consensus Forecast, Job Openings Annual Rate, Millions:

7.100

Consensus Range, Job Openings Annual Rate, Millions: 7.000

to 7.120

Job openings seen at 7.100 million rate in April after

falling unexpectedly to 7.192 million in March from 7.480 million in February.

Wednesday

Australia GDP for First Quarter (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.4% to 0.5%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 1.5% to 1.7%

Q1 growth seen up 0.5 percent on the quarter and 1.5 percent

on year.

France PMI Composite Final for May (Wed 0950 CEST; Wed

0750 GMT; Wed 0350 EDT)

Consensus Forecast, Composite Index: 48.0

Consensus Range, Composite Index: 48.0 to 48.0

Consensus Forecast, Services Index: 47.4

Consensus Range, Services Index: 47.4 to 47.4

No change from the flash at 48.0 is the call for the May

composite final, down from 47.8 in the April final. No change is expected from

the flash at 47.4 for services, versus 47.3 in April final.

Germany PMI Composite Final for May (Wed 0955 CEST; Wed

0755 GMT; Wed 0355 EDT)

Consensus Forecast, Composite Index: 48.6

Consensus Range, Composite Index: 48.6 to 48.6

Consensus Forecast, Services Index: 47.2

Consensus Range, Services Index: 47.2 to 47.2

No change from the flash at 48.6 is the call for the May

composite final, down from 50.1 in April. No change is expected from the flash

at 47.2 for services, down from 49.0 in March.

Eurozone PMI Composite Final for May (Wed 1000 CEST; Wed

0800 GMT; Wed 0400 EDT)

Consensus Forecast, Composite Index: 49.5

Consensus Range, Composite Index: 49.5 to 49.5

Consensus Forecast, Services Index: 48.9

Consensus Range, Services Index: 48.9 to 48.9

No change from the flash at 49.5 is the call for the May

composite final, down from 50.4 in April. No change is expected from the flash

at 48.9 for services, down from 50.1 in April.

United Kingdom PMI Composite Final for May (Wed 0930

BST; Wed 0830 GMT; Wed 0430 EDT)

Consensus Forecast, Composite Index: 49.4

Consensus Range, Composite Index: 49.4 to 49.4

Consensus Forecast, Services Index: 50.2

Consensus Range, Services Index: 50.2 to 50.2

No change from the flash at 49.4 is the call for the May

composite final, up from 48.5 in March. No change is expected from the flash at

50.2 for services, up from 49.0 in April.

Eurozone Unemployment Rate for April (Wed 1100 CEST; Wed

0900 GMT; Wed 0500 EDT)

Consensus Forecast, Rate: 6.2%

Consensus Range, Rate: 6.2% to 6.3%

Rate expected flat at 6.2 percent.

United States ADP Employment Report for May (Wed 0815

EDT; Wed 1215 GMT)

Consensus Forecast, Private Payrolls - M/M: 110K

Consensus Range, Private Payrolls - M/M: 70K to 180K

Private payrolls up an uninspiring110K in May versus 62K in

April.

Canada Bank of Canada Announcement (Wed 0945 EDT; Wed

1345 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 2.75%

Consensus Range, Level: 2.50% to 2.75%

The consensus sees no rate cut this time after better than

expected GDP figures for the first quarter. Some forecasters still look for a

25 bp cut but it's a minority view.

United States PMI Composite Final for May (Wed 0945

EDT; Wed 1345 GMT)

Consensus Forecast, Composite Index: 52.1

Consensus Range, Composite Index: 52.1 to 52.1

Consensus Forecast, Services Index: 52.3

Consensus Range, Services Index: 52.3 to 52.3

No revision from 52.1 for the composite and 52.3 for

services is the call for the final.

United States ISM Services Index for May (Wed 1000

EDT; Wed 1400 GMT)

Consensus Forecast, Index: 52.0

Consensus Range, Index: 50.8 to 52.5

Services business has outperformed manufacturing and another

slightly expansionary 52.0 is the call for May services PMI versus 51.6 in

April.

Thursday

Australia International Trade in Goods for April (Thu

1130 AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$6.1 B

Consensus Range, Balance: A$4.5 B to A$7.6 B

The surplus is expected at A$6.1 billion versus A$6.9

billion in March as exports stay strong.

China PMI Composite for May (Thu 0945 CST; Thu 0145 GMT;

Wed 2145 EDT)

Consensus Forecast, Services Index: 51.1

Consensus Range, Services Index: 51.0 to 51.2

The services index is seen pretty stable at 51.1 versus 50.7

in April.

Germany Manufacturing Orders for April (Thu 0800 CEST;

Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, M/M: -1.8%

Consensus Range, M/M: -3.0% to -1.5%

Orders are seen retracing by 1.8 percent percent on the

month after a big 3.6 percent increase on the month in March.

Eurozone ECB Announcement (Thu 1415 CEST; Thu 1215

GMT; Thu 0815 EDT)

Consensus Forecast, Refi Rate Change: -25bp

Consensus Range, Refi Rate Change: -25 bp to

-25 bp

Consensus Forecast, Refi Rate Level: 2.15%

Consensus Range, Refi Rate Level: 2.15% to 2.15%

Consensus Forecast, Deposit Rate Change: -25 bp

Consensus Range, Deposit Rate Change: -25 bp to -25

Consensus Forecast, Deposit Rate Level: 2.0%

Consensus Range, Deposit Rate Level: 2.0% to 2.0%

After another batch of low inflation readings around the

Eurozone send a message of continued disinflation, forecasters see the ECB on

track for another 25 bp cut.

Canada Merchandise Trade for April (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Balance: -C$0.7 B

Consensus Range, Balance: -C$1.5 B to C$0.2 B

The trade account is expected to remain in deficit by C$0.7

billion after a trade gap of C$0.51 billion in March.

United States International Trade in Goods and Services

for April (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: -$118.1 B

Consensus Range, Balance: -$133.0 B to -$66.0 B

After the surprising drop in the merchandise trade gap

already reported in April, the deficit including services is expected at $118.1

billion, down from $140.5 billion in March. Imports were skewed higher by

tariff front-running in February and March and now that is seen reversing in

April.

United States Jobless Claims for Week 5/31 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 235K

Consensus Range, Initial Claims - Level: 230K to 243K

Claims seen down to 235K after rising a larger than expected

14K to a high 240K last week.

United States Productivity and Costs for First Quarter (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

-0.8%

Consensus Range, Nonfarm Productivity - Annual Rate: -0.8%

to -0.7%

Consensus Forecast, Unit Labor Costs - Annual Rate: 5.7%

Consensus Range, Unit Labor Costs - Annual Rate: 5.5%

to 5.7%

The consensus sees no revision in productivity growth at

minus 0.8 percent and ULC up 5.7 percent for Q1.

Friday

Japan Household Spending for April (Fri 0830 JST; Thu

2330 GMT; Thu 1930 EDT)

Consensus Forecast, M/M: -1.0%

Consensus Range, M/M: -2.7% to -0.4%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.4% to 5.0%

Japan's real household spending is forecast to slow down

sharply to a 0.9% rise on the year in April after posting an unexpected gain in

March, up a solid 2.1%, and slipping 0.5% in February (+1.8% if the boosting

impact of the Lunar New Year in February 2024 was excluded). Consumers remain

wary of spending beyond necessities amid elevated food and energy costs and

falling real wages. Demand for spring and summer clothing was dented during

most parts of the month until an unseasonal heat wave hit many regions in late

April while cosmetics sales were strong ahead of price hikes for some brands.

On the month, real average expenditures by households with

two or more people are expected to fall a seasonally adjusted 1.0% after rising

0.4% in March and unexpectedly soaring 3.5% in February following a 4.5% plunge

the previous month.

India Reserve Bank of India Announcement (Fri 1000

IST; Fri 0430 GMT; Fri 0030 EDT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 5.75%

Consensus Range, Level: 5.75% to 5.75%

Everyone looks for a 25 bp rate cut from the RBI.

Germany Industrial Production for April (Fri 0800

CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: -1.4%

Consensus Range, M/M: -2.3% to 2.0%

The consensus looks for output to fall back by 1.4 percent

after jumping 3.0 percent the month before.

Eurozone Retail Sales for April (Fri 1100 CEST; Fri

0900 GMT; Fri 0500 EDT)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -0.5% to 0.4%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 0.9% to 1.1%

Another weak month, expected down 0.3 percent from March and

only up 1.0 percent from a year ago.

Eurozone GDP for First Quarter (Fri 1100 CEST; Fri

0900 GMT; Fri 0500 EDT)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.3% to 0.4%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.2% to 1.4%

The final revision expected to show GDP at 0.4 percent on

quarter and 1.3 percent on year, marginally better than the last report at 0.3

percent and 1.2 percent, respectively.

Canada Labour Force Survey for May (Fri 0830 EDT; Fri

1230 GMT)

Consensus Forecast, Employment - M/M: 2K

Consensus Range, Employment - M/M: -15K to 5K

Consensus Forecast, Unemployment Rate: 7.0%

Consensus Range, Unemployment Rate: 6.9% to 7.0%

Employment seen up a marginal 2,000 with the jobless rate up

to 7.0 percent from 6.9 percent.

US Employment Situation for May (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 129K

Consensus Range, Nonfarm Payrolls - M/M: 100K to 190K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.1% to 4.3%

Consensus Forecast, Private Payrolls - M/M: 123K

Consensus Range, Private Payrolls - M/M: 98K to 140K

Consensus Forecast, Manufacturing Payrolls - M/M: 0

Consensus Range, Manufacturing Payrolls - M/M: -5K to

3K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.3%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.7%

Consensus Range, Average Hourly Earnings - Y/Y: 3.6%

to 3.7%

Consensus Forecast, Average Workweek: 34.3

Consensus Range, Average Workweek: 34.3 to 34.3

Payrolls expected up 129K in May after 177K in April. The

jobless rate expected flat at 4.2 percent. Given all the sturm and drang over

tariffs freezing investment and hiring, it's a pretty good showing.

United States Consumer Credit for April (Fri 0830 EDT;

Fri 1230 GMT)

Consensus Forecast, Employment - M/M: $10.2 B

Consensus Range, Employment - M/M: $9.0 B to $15.0 B

An identical, trend-like increase of $10.2 billion expected

in April after a gain of $10.2 billion in March.

|