|

The Week Ahead: Highlights

Asia Preview

Australia CPI Report Key for RBA Policy

By Brian Jackson, Econoday Economist

Australia's monthly CPI inflation data for May in the week

ahead will be closely watched ahead of the Reserve Bank of Australia's next

policy meeting early next month. RBA officials cut policy rates by 25 basis

points at their previous meeting mid-May, reflecting greater confidence that

that inflation will be around the midpoint of their target range of 2 percent

to 3 percent over the forecast period. The monthly measure of headline

inflation has now been stable at 2.4 percent for three consecutive months, and

another month of inflation around that level could strengthen the case for

another rate cut.

Singapore industrial production data for May next week

follows the publication of May trade data earlier this week which showed a

sharp slowdown in manufactured exports and in exports to the United States.

Singapore inflation data for May will also be published next week. If price

pressures remained subdued, any weakness in the industrial production data will

likely boost the chances that the Monetary Authority of Singapore will ease

policy at its quarterly policy meeting late-July.

Hong Kong and New Zealand will also publish trade data for

May next week. April trade data for both countries showed limited initial

impact from the escalation of global trade tensions at the start of April, but

May trade data from other countries in the region suggest that tariff increases

and uncertainty are weighing on external demand. Taiwan will also report

industrial production data for May next week.

Europe Preview

Europe Gets its First Look at June Data

By Marco Babic, Econoday Economist

Economic data released in Europe in the week ahead is heavy

on sentiment reports and will provide the first indications how the first two

months of official data are being digested. Following the imposition of tariffs

by the US in March, the data for April and May have shown some resilience,

although trade data show emerging cracks.

Swiss trade data sheds some light onto this. In March, the

country's exports to the US were 9.5 billion Swiss francs. Following two months

of export declines of more than 40 percent, the surplus was 3.2 billion francs

in May. To be sure, stockpiling took place in March in anticipation of the

tariffs but portend further headwinds there and in Europe more broadly.

On Monday Germany, France, and the Eurozone report June

composite PMI data. In May, the Eurozone composite indicator rose above 50,

marking expansion, but the readings for Germany and France, Europe's two

largest economies remained below 50. Companies have been working through order

backlogs, and there have been reports of price discounting to maintain market

share. The question is how long can that continue without sentiment declining

further?

Tuesday brings us to Germany's Ifo report which has been

surprisingly resilient, at least in terms of the economic outlook. Like other

related reports, current conditions are not being viewed as favorably as the

outlook, which will be the thing to watch for in the June Ifo data.

German consumers weigh in on Thursday on their view of the

economic situation with the release of the GfK consumer sentiment. Germans are

still reluctant to spend and even if they, like businesses, are more optimistic

about the future, the refusal to open their wallets presently is not an

economics vote of confidence.

Friday is a busy day with Italy reporting business and

consumer confidence which could show whether the Italian consumer is facing the

same challenges as in Germany. France also reports consumer spending on

manufactured goods, albeit for May, but may indicate whether they were more

inclined, or not, than consumers in other countries to purchase durable goods.

France and Italy are the first to report inflation data for

June, with the former providing results for CPI and PPI and Italy for PPI.

Presently inflation pressures are not evident in Europe generally, thanks in

large part to declining energy prices keeping things in check. With the current

situation in the Middle East, that could change, introducing some upward price

pressure.

US Preview

Fed's Powell Up Again on Capitol Hill

By Theresa Sheehan, Econoday Economist

With the June 16-18 FOMC meeting out of the way, attention

will turn to Fed Chair Jerome Powell's semi-annual monetary policy testimony at

10:00 ET on June 24 before the House Financial Services Committee and at 10:00

ET on June 25 before the Senate Banking Committee.

Powell is unlikely to say anything about monetary policy

that was not said in his June 18 press conference after the FOMC meeting unless

there is a significant exogenous event that alters the outlook. In recent

years, the monetary policy part of the chair's appearance usually gives way

quickly to questions about supervision and regulation which Powell will answer,

fiscal policy which Powell will address only in the broadest terms and avoiding

giving Congress advice, and politically tinged questions that he will decline

to answer altogether. He will defend the necessity of independence for the

central bank and speak about the importance of the five-year review of monetary

policy currently underway. He may get questions about how the geopolitical

situation affects FOMC decisions to which Powell will only say that the FOMC

pays attention to developments but makes it determination based on the data.

Among the economic data reports, the standouts should be the

NAR numbers on existing home sales in May at 10:00 ET on Monday and the Census

Bureau report on sales of new single-family homes in May at 10:00 ET on

Wednesday. Home sales have lost momentum as pessimistic consumers weigh the

risks of buying at a time of elevated uncertainty about the economy and job

security at a time when homes remain relatively expensive despite improved

inventories.

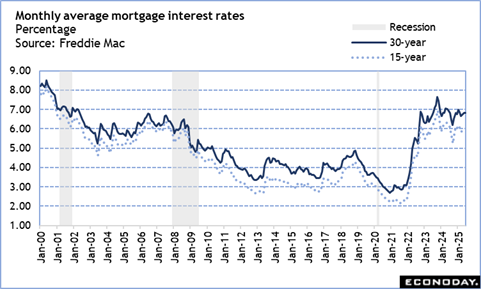

The spring buying season has felt the pinch of higher

mortgage rates which were on the rise in April into May. Existing home

purchases are for contracts closed and therefore made with mortgages taken out

mostly in April when the monthly average for a Freddie Mac 30-year fixed rate

mortgage was about 6.8 percent. New home sales are for contracts signed but not

yet closed. The monthly average rate for May is also about 6.8 percent. In some

cases, homebuyers are opting for adjustable rate mortgages to reduce initial

monthly payments and enable the purchase now, while hoping for a chance to

refinance at a lower rate later.

The Week Ahead: Econoday Consensus Forecasts

Monday

Singapore CPI for May (Mon 1300 SGT; Mon 0500 GMT;

Mon 0100 EDT)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.7% to 0.8%

Annual CPI inflation is expected to fade to 0.7 percent in

May from 0.9 percent in April.

Germany PMI Composite Flash for June (Mon 0930 CEST; Mon

0730 GMT; Mon 0330 EDT)

Consensus Forecast, Manufacturing Index: 49.0

Consensus Range, Manufacturing Index: 48.8 to 49.1

Consensus Forecast, Services Index: 47.8

Consensus Range, Services Index: 47.3 to 48.5

The consensus looks for the PMI manufacturing at 49.0 for the

June flash versus 48.3 in the May final. Forecasters expect the services index

at 47.8 in June versus 47.1 in in the May final.

Eurozone PMI Composite Flash for June (Mon 1000 CEST;

Mon 0800 GMT; Mon 0400 EDT)

Consensus Forecast, Composite Index: 50.5

Consensus Range, Composite Index: 50.5 to 50.5

Consensus Forecast, Manufacturing Index: 49.7

Consensus Range, Manufacturing Index: 49.5 to 50.0

Consensus Forecast, Services Index: 50.0

Consensus Range, Services Index: 50.0 to 50.1

The consensus looks for the PMI composite at 50.5 for the

June flash versus 50.2 in the May final. The PMI manufacturing is seen at 49.7

for June versus 49.4 in the May final. Forecasters expect the services index at

50.0 in June versus 49.7 in in the May final.

United States PMI Composite Flash for June (Mon 0945

EDT; Mon 1345 GMT)

Consensus Forecast, Manufacturing Index: 51.0

Consensus Range, Manufacturing Index: 51.0 to 52.0

Consensus Forecast, Services Index: 53.0

Consensus Range, Services Index: 52.9 to 54.0

Analysts believe growth slowed but remained positive in

June. The consensus looks for the PMI manufacturing at 51.0 for June versus

52.0 in the May final. Forecasters expect the services index at 53.0 in June

versus 53.7 in the May final.

United States Existing Home Sales for May (Mon 1000 EDT;

Mon 1400 GMT)

Consensus Forecast, Annual Rate: 3.95 M

Consensus Range, Annual Rate: 3.85 M to 4.10 M

Sales expected to remain in the doldrums at an annual 3.95

million unit rate in May versus 4.00 million in April and 4.02 million in

March. Home resales have been feeling the pinch of higher mortgage rates and

low consumer confidence.

Tuesday

Germany Ifo Survey for June (Tue 1000 CET; Tue 0800 GMT;

Tue 0400 EDT)

Consensus Forecast, Business Climate: 88.3

Consensus Range, Business Climate: 88.0 to 88.4

Consensus Forecast, Current Conditions: 86.5

Consensus Range, Current Conditions: 86.3 to 86.9

Consensus Forecast, Business Expectations: 89.8

Consensus Range, Business Expectations: 89.5 to 90.2

After a long period of weakness, sentiment has been rising

lately and expectations call for more of the same. Business climate is expected

at 88.3 versus 87.5 in the prior month. Current conditions seen at 86.5 versus

86.1 and expectations at 89.8 versus 88.9.

Canada CPI for May (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.5%

Consensus Range, CPI - M/M: -0.1% to 0.6

Consensus Forecast, CPI - Y/Y: 1.7%

Consensus Range, CPI - Y/Y: 1.5% to 1.8%

Forecasters see CPI up 0.5 percent on the month and 1.7

percent on year in May versus minus 0.1 percent and 1.7 percent in April.

United States Current Account for First Quarter (Tue 0830

EDT; Tue 1230 GMT)

Consensus Forecast, Balance: - $442.8 B

Consensus Range, Balance: -$463.8 B to -$430.0 B

The ballooning goods deficit is expected to lift the current

account gap to a record $442.8 billion in Q1 versus $303.9 billion in Q4 2024.

United States Case-Shiller Home Price Index for April (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, 20-City Unadjusted - Y/Y: 4.0%

Consensus Range, 20-City Unadjusted - Y/Y: 3.4% to 4.0%

Home prices seen up 4.0 percent on year in April versus 4.1

percent in March.

United States Consumer Confidence for June (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 99.0

Consensus Range, Index: 97.0 to 101.0

President Trump's pause in tariffs has helped stabilize the

economy and consumer sentiment. The consensus looks for confidence at 99.0

versus 98.0 in May and 85.7 in April.

Wednesday

Australia Monthly CPI for May (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.1% to 2.5%

The consensus sees CPI continuing to rise at a 2.4 percent

rate in May from 2.4 percent in April.

United States New Home Sales for May (Wed 1000 EDT; Wed

1400 GMT)

Consensus Forecast, Annual Rate: 694K

Consensus Range, Annual Rate: 650K to 722K

The consensus looks for a retreat to 694K in May from a

surprisingly strong 743K in April.

Thursday

Germany GfK Consumer Climate for July (Thu 0800 CEST;

Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Index: -18.9

Consensus Range, Index: -19.0 to -18.5

Sentiment in Germany has generally been trending higher and

consumer sentiment with it. The call is minus 18.9 for July versus minus 19.9

in June and minus 20.8 in May.

United States Durable Goods Orders for May (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, New Orders - M/M: 7.0%

Consensus Range, New Orders - M/M: 3.0% to 35.0%

Consensus Forecast, Ex-Transportation - M/M: 0.1%

Consensus Range, Ex-Transportation - M/M: -0.3% to

0.2%

Aircraft orders expected to rebound from April to power

overall durables orders to a 7.0 percent increase in May. Ex-transportation is

expected nearly flat at a gain of 0.1 percent.

United States GDP for First Quarter (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

-0.2%

Consensus Range, Quarter over Quarter - Annual Rate: -0.2%

to -0.1%

The final revision is expected to confirm GDP contracted a

marginal 0.2 percent in Q1.

United States International Trade in Goods (Advance) for

May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: -$90.7 B

Consensus Range, Balance: -$93.0 B to -$70.0 B

The trade gap is expected at $90.7 billion versus $87.6

billion in April.

United States Jobless Claims Week 6/21 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 245K

Consensus Range, Initial Claims - Level: 240K to 248K

Claims expected stable at the same 245K in the latest week

from last week.

United States Pending Home Sales Index for May (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.0% to 0.9%

After dropping 6.3 percent in April, pending home sales are

expected pretty to stabilize with a gain of 0.5 percent in May.

Friday

Japan Tokyo CPI for June (Fri 0830 JST; Thu 2330 GMT;

Thu 1930 EDT)

Consensus Forecast, CPI - Y/Y: 3.3%

Consensus Range, CPI - Y/Y: 3.2% to 3.4%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.4%

Consensus Range, Ex-Fresh Food - Y/Y: 3.2% to 3.7%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.3%

Consensus Range, Ex-Fresh Food & Energy - Y/Y:

3.1% to 3.5%

Key forecasts: Consumer inflation in Tokyo, the leading

indicator of the national average, is expected to have stayed above 3% in June

but easing slightly from its annual rates in May in two key measures thanks to

renewed retail gasoline subsidies and lower utility costs reflecting an earlier

slump in crude oil prices. It is partially offset by elevated processed food

prices amid lingering domestic rice supply shortages.

--Core CPI (excluding fresh food) +3.4% y/y in June vs. a

28-month high of 3.6% in May.

--Total CPI +3.3% y/y vs. +3.4% in the previous two months;

fresh food prices have eased after a recent spike.

--Core-core CPI (ex-fresh food, energy) +3.3% y/y vs. +3.3%

in May.

Japan Unemployment Rate for May (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.4% to 2.6%

Key forecast: The seasonally adjusted

unemployment rate in Japan 2.5% in May vs. 2.5% the previous two months, 2.4%

in February. Payrolls seen up on year for the 34th straight month amid

widespread labor shortages. Other data show real wages are down amid high costs

of living.

Japan Retail Sales for May (Fri 0850 JST; Thu 2350 GMT;

Thu 1950 EDT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.4% to -0.1%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 0.5% to 2.3%

Key forecasts: Japanese retail sales slowed

down in May, hit by sluggish department store sales, falling fuel prices and a

pullback in vehicle sales after a recent recovery. Many department store chains

report inbound spending continued falling from a year earlier when the yen was

much weaker at around Y156 (vs. Y145 last month) that had boosted purchasing

power of visitors from other countries.

--Retail sales +2.2% y/y vs. +3.5% (revised

from +3.3%) in April; -0.2% m/m vs. +0.7% from +0.5%).

Eurozone EC Consumer Sentiment for June (Fri 1100

CEST; Fri 1300 GMT; Fri 0900 EDT)

Consensus Forecast, Economic Sentiment: 95.5

Consensus Range, Economic Sentiment: 95.1 to 95.5

Consensus Forecast, Industry Sentiment: -9.6

Consensus Range, Industry Sentiment: -10.0 to -9.5

Economic sentiment expected to tick up to. 95.5 in June from

94.8 in May. Industry sentiment also expected better at minus 9.6 versus minus

10.3 in May.

Canada Monthly GDP for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.1%

Growth stalled in April after surging on front-running

tariffs in Q1. The consensus agrees with the Stats Canada estimate of up 0.1

percent in April. Sectors exposed to US tariffs got whacked in April.

United States Personal Income and Outlays for May (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.3%

Consensus Range, Personal Income - M/M: 0.0% to 0.8%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.2%

Consensus Range, Personal Consumption Expenditures - M/M:

-0.2% to 0.4%

Consensus Forecast, PCE Price Index - M/M: 0.1%

Consensus Range, PCE Price Index - M/M: 0.1% to 0.1%

Consensus Forecast, PCE Price Index - Y/Y: 2.3%

Consensus Range, PCE Price Index - Y/Y: 2.2% to 2.5%

Consensus Forecast, Core PCE Price Index - M/M: 0.1%

Consensus Range, Core PCE Price Index - M/M: 0.1% to 0.1%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.6%

Consensus Range, Core PCE Price Index - Y/Y: 2.6% to

2.6%

Income shows moderate growth while spending softens as

pre-tariff durable goods spending corrects lower. The consensus sees personal income

up 0.3 percent and spending up 0.2 percent on the month. The price indexes are

well behaved with PCE prices up only 0.1 percent on the month for total and

core. The year-on-year figures are seen at 2.3 percent and 2.6 percent core.

United States Consumer Sentiment for June (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 60.5

Consensus Range, Index: 60.0 to 62.0

Sentiment expected unrevised at 60.5 in the final June

report from the preliminary, way up from a low low 52.2 in May.

|