|

The Week Ahead: Highlights

Europe Preview

Europe's Consumers Are Front and Center

By Marco Babic, Econoday Economist

The coming week's indicators for Europe provides a gauge of

the continent's consumer spending with May retail sales being reported for

Germany, Switzerland, and Italy. Consumer price reports are also on the docket

for Italy, Germany, the Eurozone, and Switzerland.

Last Friday, France set the stage for CPI with flash HICP

reported up 0.4 percent in June after a 0.2 percent decline in May, on higher

prices for services and petroleum products. Year-on-year prices were 0.8

percent higher than June of last year.

Prices for services have been ticking higher, but subdued

energy prices have been acting as a counterweight to prices, but that could be

changing with the developments in the Middle East. Should price developments

for Germany, Italy, and the Eurozone mirror those in France, Eurozone

year-on-year inflation could move about 2 percent. In May, the bloc's inflation

rate was 1.9 percent, with the narrow core up 2.3 percent. Germany is already above

that threshold at 2.1 percent while Italy is a more moderate 1.7 percent.

Switzerland is an outlier with a rate of minus 0.1 percent in April.

Retail sales results for May are coming for Germany,

Switzerland, and Italy. For the former two countries, retail sales fell 1.1

percent and 0.3 percent in April although rising 2.3 percent and 1.3 percent

year-on-year respectively. This suggests consumer caution in the face of

geopolitical and economic uncertainty. Italian consumers were less shy,

spending 0.7 percent more in April than they did in March, and 3.7 percent more

than a year ago. It remains to be seen if this will be sustained or if there is

broader belt tightening. French consumers spent 0.3 percent less of

manufactured goods in May than they did in April, with spending on durable

goods down 0.6 percent.

The industrial sector comes into focus on Friday with May

industrial production reported for France and May Manufacturing orders for

Germany. In April, France's industry produced 1.4 percent less than it did in

March, and 2.1 percent less than April of last year. Germany's manufacturing

orders, generally volatile, were up 0.6 percent on a monthly and 4.9 percent on

a yearly basis. PMI data for France, Germany and the Eurozone show the sector

in contraction, and final figures for June coming on Tuesday will unlikely

reverse that. It's worth noting that while currently the industrial sector is

in a slump, the outlook for the next twelve months is quite optimistic. Last

week at the NATO conference, many European countries announced they will

increase military spending.

Germany has pledged to increase its military spend to 5

percent of GDP. Whether that becomes a reality is an open question. Taken at

face value, however, that is a positive sign for the industrial sector. To be

sure, such spending would take time to be seen in actual orders and subsequent

production, but it could certainly be a driver of sentiment and lead companies

to plan for ramped up production.

US Preview

Watching for Weakening Labor Market

By Theresa Sheehan, Econoday Economist

The Independence Day celebration on Friday, July means some

changes to the data release calendar. Most notable is that the monthly

employment report for June will be released one day sooner than usual on

Thursday at 8:30 ET. The Challenger report is also pushed forward by a day to

Wednesday at 7:30 ET rather than the normal Thursday release.

Amid signs of slowing growth, the lookout is on for

concurrent weakening in the labor market. While overall the labor market has

been good, there are signs of slower hiring and rising layoffs. The pace is not

yet alarming but unemployment rates in the low 4's that have dominated the past

year are likely going start moving higher.

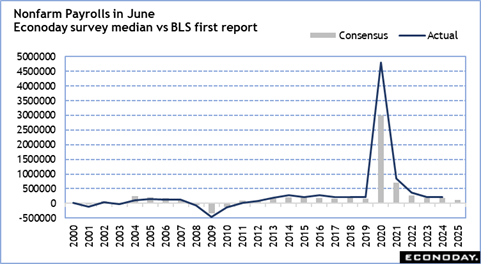

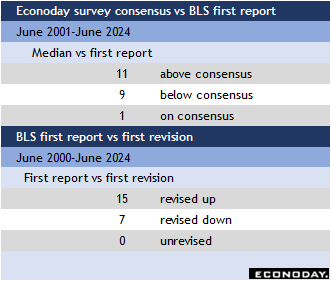

The June employment report is expected to add jobs somewhere

near 125,000. The early timing of the Memorial Day weekend may mean that some

hiring related to the summer vacation months that would have taken place in

June was moved up to May. There is ongoing restructuring in retail and

technology that could mean hiring was softer in June. And some service

businesses may be feeling the pinch of the loss of federal government contracts

and not building payrolls as a consequence. Weakness in the housing sector -

especially for new residential construction - could mean construction hiring is

off as well. If there is a surprise in the June data, it may well be to the

downside.

Asia-Pacific Preview

Purchasing Managers Reports to Give Early Look at June

Business

By Brian Jackson, Econoday Economist

The June round of PMI surveys will be the main focus for the

Asia-Pacific data calendar in the week ahead. May surveys showed a contraction

in activity in much of the region, with respondents citing the impact of global

trade tensions. Next week's surveys will be closely watched for an early

indication of activity and sentiment over June and whether there has been any

immediate impact from the escalation of conflict in the Middle East.

South Korea will report June trade data after both the April and May data

showed weakness in exports growth. Industrial production, retail sales and

inflation data for South Korea will also be published. Australian trade data

are less timely, with data for May scheduled for release next week. Australia

will also report data on household spending. With monthly CPI data published

this week showing a fall in both headline and underlying inflation in May, any

signs of weakness in the consumer sector will likely strengthen the case for

the Reserve Bank of Australia to cut rates again at its next policy meeting the

following week.

The Week Ahead: Econoday Consensus Forecasts

Monday

South Korea Industrial Production for May (Mon 0800

KST; Sun 2300 GMT; Sun 1900 EDT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: -0.2% to 0.7%

South Korea industrial output expected to rebound by 0.6

percent in May after dropping 0.9 percent in April.

Japan Industrial Production for May (Mon 0850 JST; Sun

2350 GMT; Sun 1950 EDT)

Consensus Forecast, M/M: 3.3%

Consensus Range, M/M: 0.5% to 4.0%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: -1.8% to 4.2%

Key forecast points:

--Japan's industrial production is seen rebounding 3.3% on

the month May (vs. METI's projection +5.2%) after posting its first drop in

three months in April (-1.1%) amid some optimism that the global trade war may

be resolved through negotiations, although the protectionist U.S. trade policy

remains unpredictable and geopolitical risks have been heightened. Output is

seen up 1.1% y/y vs. +0.5% in April for a fourth straight gain.

--The Ministry of Economy, Trade and Industry is expected to

maintain its assessment (the last change was an upgrade in July 2024), saying

industrial output is "taking one step forward and one step back."

China CFLP Composite PMI for Jun (Mon 0930 CST; Mon 0130

GMT; Sun 2130 EDT)

Consensus Forecast, Manufacturing Index: 49.7

Consensus Range, Manufacturing Index: 49.6 to 50.1

Consensus Forecast, Non-Manufacturing Index: 50.3

Consensus Range, Non-Manufacturing Index: 49.5 to 50.5

Not much change in business conditions is the call with PMI manufacturing

expected at 49.7 in June versus 49.5 in May and services unchanged at 50.3 from

May.

Germany Retail Sales for May (Mon 0800 CEST; Mon 0600

GMT; Mon 0200 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.4% to 1.0%

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.4% to 2.5%

Sales expected to recover by 0.5 percent on the month after

dropping 1.1 percent in April. Sales seen up 2.5 percent on year compared with

2.3 percent in April.

United Kingdom GDP for First Quarter (Mon 0700 BST; Mon

0600 GMT; Mon 0200 EDT)

Consensus Forecast, Q/Q: 0.7%

Consensus Range, Q/Q: 0.7% to 0.7%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.3%

No revision expected in the final look at Q1 with growth of

0.7 percent on the quarter and 1.3 percent on year.

Switzerland KOF Swiss Leading Indicator for June (Mon

0900 CEST; Mon 0700 GMT; Mon 0300 EDT)

Consensus Forecast, Index: 99.0

Consensus Range, Index: 99.0 to 99.3

Slight improvement to 99.0 is the call for June from 98.5 in

May.

Eurozone M3 Money Supply for May (Mon 1000 CEST; Mon 0800

GMT; Mon 0400 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 4.0%

Consensus Range, Y/Y - 3-Month Moving Average: 4.0%

to 4.1%

Slightly faster growth rate of 4.0 percent expected for

money supply, up from 3.8 percent in April.

India Industrial Production for May (Mon 1600 IST;

Mon 1030 GMT; Mon 0630 EDT)

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.3% to 2.5%

Weaker output growth is expected at 2.4 percent in May from

a year ago versus 2.7 percent in April.

Germany CPI for June (Mon 1400 CET; Mon 1200 GMT; Mon

0800 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.2%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.0% to 2.2%

Consensus Forecast, HICP - M/M: 0.3%

Consensus Range, HICP - M/M: 0.3% to 0.3%

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.1% to 2.3%

CPI expected to show increases of 0.2 percent on month and 2.1

percent on year in June versus 0.1 percent and 2.1 percent in May.

United States Chicago PMI for June (Mon 0945 EDT; Mon

1345 GMT)

Consensus Forecast, Index: 43.0

Consensus Range, Index: 41.6 to 46.3

The consensus looks for an uptick to 43.0 in June from 40.5

in May as another sub-50 reading shows business activity continuing to

contract.

Tuesday

Japan Tankan for Second Quarter (Tue 0850 JST; Mon

2350 GMT; Mon 1950 EDT)

Consensus Forecast, Large Manufacturer Sentiment Index:

10

Consensus Range, Large Manufacturer Sentiment

Index: 8 to 14

Consensus Forecast, Large Non-Manufacturer Sentiment

Index: 35

Consensus Range, Large Non-Manufacturer Sentiment Index:

32 to 37

Consensus Forecast, Small Manufacturer Sentiment Index:

-1

Consensus Range, Small Manufacturer Sentiment

Index: -3 to 2

Consensus Forecast, Small Non-Manufacturer Sentiment

Index: 15

Consensus Range, Small Non-Manufacturer Sentiment Index:

12 to 17

FY Current, 2025

Consensus Forecast, Large Firms Capital Expenditure Plans:

8.4%

Consensus Range, Large Firms Capital Expenditure Plans:

4.0% to 10.6%

Consensus Forecast, Small Firms Capital Expenditure Plans:

-7.9%

Consensus Range, Small Firms Capital Expenditure Plans:

-12.1% to -4.1%

Key forecasts:

--The Bank of Japan's quarterly Tankan business survey is

forecast to show confidence was flat or deteriorated in most categories in the

June quarter, hit by Trump tariffs on vehicles, metals and other goods, with

automakers lowering export prices to pay for higher import costs for U.S.

customers. High costs of living are keeping households wary, hurting retailers,

while construction and transport firms are saddled with labor shortages.

Looking ahead, firms tend to be cautious about three months ahead but they may

be more optimistic over trade talks with Washington.

The diffusion index on business conditions (the percentage

of firms reporting improvement minus that of firms reporting deterioration)

--Large manufacturers: 10 vs. 12 in Mar, 14 in Dec, 13 in

Sept, 13 in June 2024 (the second straight drop)

--Large non-manufacturers: 35 vs. 35 in Mar, 33 in Dec, 34

in Sept, 33 in June 2024, 30 in Dec 2023 (flat after the first drop in 2 qtrs)

--Smaller manufacturers: -1 vs. 2 in Mar, 1 in Dec, 0 in

Sept, -1 in June, -1 in Mar, 1 in Dec 2023 (the first drop in 5 qtrs)

--Smaller non-manufacturers: 15 vs. 16 in Mar, 16 in Dec, 14

in Sept, 12 in June (the first fall in 4 qtrs)

--Major firms are expected to project their plans for

business investment in equipment and software would rise a combined 8.4% on the

year in fiscal 2025 ending in March 2026, up from +3.1% (the first estimate) in

the March. Capex plans are generally supported by demand for automation amid

labor shortages as well as government-led digital transformation and emission

control.

--Smaller firms are also likely to revise up their combined

capital spending plans to a 7.9% decrease from -10.0 (the first estimate) about

three months earlier. Small and medium firms tend to have conservative plans at

the start of each fiscal year and revise them up later.

South Korea External Trade for June (Tue 0900 KST;

Tue 0000 GMT; Mon 2000 EDT)

Consensus Forecast, Balance: $8.4 B

Consensus Range, Balance: $8.3 B to $9.1 B

The export powerhouse is seen in surplus by $8.4 billion in

June versus $6.9 billion in May.

China PMI Manufacturing for June (Tue 0945 CST; Tue 0145

GMT; Mon 2345 EDT)

Consensus Forecast, Index: 49.0

Consensus Range, Index: 49.0 to 49.6

The Caixin manufacturing index is expected up slightly at

49.0 from 48.3 in May.

India PMI Manufacturing Final for June (Tue 1030 IST;

Tue 0500 GMT; Tue 0100 EDT)

Consensus Forecast, Level: 58.4

Consensus Range, Level: 58.4 to 58.4

The consensus looks for no change from 58.4 in May.

Germany PMI Manufacturing Final for June (Tue 0955

CEST; Tue 0755 GMT; Tue 0355 EDT)

Consensus Forecast, Index: 49.0

Consensus Range, Index: 48.3 to 49.0

Forecasters look for no revision in the final report from

the flash at 49.0.

Germany Unemployment Rate for June (Tue 0955 CEST; Tue

0755 GMT; Tue 0355 EDT)

Consensus Forecast, Rate: 6.4%

Consensus Range, Rate: 6.3% to 6.4%

The consensus looks for unemployment to tick up to 6.4

percent in June from 6.3 percent in May.

Eurozone PMI Manufacturing Final for June (Tue 1000

CEST; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Index: 49.4

Consensus Range, Index: 49.4 to 49.4

The call is no revision for the final from the flash at

49.4.

United Kingdom PMI Manufacturing Final for June (Tue 0930

BST; Tue 0830 GMT; Tue 0430 EDT)

Consensus Forecast, Index: 47.7

Consensus Range, Index: 47.7 to 47.7

No revision from the 47.7 flash is the call for PMI

manufacturing final.

Eurozone HICP Flash for June (Tue 1100 CEST; Tue 0900

GMT; Tue 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 1.9% to 2.1%

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.0% to 2.5%

Forecasters see the HICP at a benign 2.0 percent and 2.3

percent for narrow core in the June flash versus 1.9 percent and 2.3 percent in

the May final.

United States PMI Manufacturing Final for June (Tue 0945

EDT; Tue 1345 GMT)

Consensus Forecast, Index: 52.0

Consensus Range, Index: 50.0 to 52.0

No change from the flash at 52.0 is expected.

United States ISM Manufacturing Index for June (Tue 0945

EDT; Tue 1345 GMT)

Consensus Forecast, Index: 48.8

Consensus Range, Index: 48.1 to 49.5

Another sub-50 reading expected at 48.8 in June after 48.5

in June, 48.7 in April and 49.0 in March, showing slow contraction.

United States Construction Spending for May (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.2% to 0.3%

The consensus looks for an increase of 0.1 percent in May after

a 0.4 percent decrease in April.

United States JOLTS for May (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Job Openings: 7.300 M

Consensus Range, Job Openings: 7.100 M to 7.350 M

Job openings seen at 7.300 million rate in May versus 7.391

million in April and 7.200 million in March.

Wednesday

South Korea CPI for June (Wed 0800 KST; Tue 2300 GMT;

Tue 1900 EDT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.1

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.0% to 2.2%

CPI expected to show no change on month and an increase of

2.1 percent on year versus minus 0.1 percent and up 1.9 percent in May.

Australia Monthly Retail Sales for May (Wed 1130 AET;

Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: -0.7% to 0.9%

Sales are expected up by 0.4 percent after declining 0.1

percent in April.

United States Motor Vehicle Sales for June (ANYTIME)

Consensus Forecast, Total Vehicle Sales - Annual Rate:

15.5 M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.2

M to 15.9 M

Sales are seen fading to a 15.5 million rate in June from

15.6 in May and 17.3 million in April as consumer spending fizzled in Q2.

Eurozone Unemployment Rate for May (Wed 1100 CEST; Wed

0900 GMT; Wed 0500 EDT)

Consensus Forecast, Rate: 6.2%

Consensus Range, Rate: 6.2% to 6.2%

The jobless rate is seen flat at 6.2 percent in May from

April.

United States ADP Employment Report for June (Wed 0815

EDT; Wed 1215 GMT)

Consensus Forecast, Private Payrolls - M/M: 103K

Consensus Range, Private Payrolls - M/M: 50K to 125K

Private payrolls expected up 103K after rising only 37K in

May.

Thursday

Australia International Trade in Goods for May (Thu 1130

AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$ 5.046 B

Consensus Range, Balance: A$4.70 B to A$6.5 B

The surplus is expected at A$5.046 billion in May after

A$5.413 billion in April.

France PMI Composite Final for June (Thu 0950 CEST; Thu

0750 GMT; Thu 0350 EDT)

Consensus Forecast, Composite Index: 48.5

Consensus Range, Composite Index: 48.5 to 48.5

Consensus Forecast, Services Index: 48.7

Consensus Range, Services Index: 48.7 to 48.7

No change from the flash at 48.5 is the call for the June

composite final, down from 49.3 in the May final. No change is expected from

the flash at 48.7 for services versus 48.9 in the May final.

Germany PMI Composite Final for June (Thu 0955 CEST; Thu

0755 GMT; Thu 0355 EDT)

Consensus Forecast, Composite Index: 50.4

Consensus Range, Composite Index: 50.4 to 50.4

Consensus Forecast, Services Index: 49.4

Consensus Range, Services Index: 47.1 to 49.4

No change from the flash at 50.4 is the call for the June

composite final, up from 48.5 in May. No change is expected from the flash at

49.4 for services, up from 47.1 in May.

Eurozone PMI Composite Final for June (Thu 1000 CEST;

Thu 0800 GMT; Thu 0400 EDT)

Consensus Forecast, Composite Index: 50.2

Consensus Range, Composite Index: 50.2 to 50.2

Consensus Forecast, Services Index: 50.0

Consensus Range, Services Index: 50.0 to 50.0

No change from the flash at 50.2 is the call for the June

composite final, flat from 50.2 in May. No change is expected from the flash at

50.0 for services, up from 49.7 in May.

United Kingdom PMI Composite Final for June (Thu 0930

BST; Thu 0830 GMT; Thu 0430 EDT)

Consensus Forecast, Composite Index: 50.7

Consensus Range, Composite Index: 50.7 to 50.7

Consensus Forecast, Services Index: 51.3

Consensus Range, Services Index: 51.3 to 51.3

No change from the flash at 50.7 is the call for the June

composite final, up from 50.3 in May. No change is expected from the flash at

51.3 for services, up from 50.9 in May.

Canada Merchandise Trade for May (Thu 0830 EDT; Thu 1230

GMT)

Consensus Forecast, Balance: -C$5.9 B

Consensus Range, Balance: -C$8.0 B to -C$4.0 B

Forecasters expect the trade balance in deficit again at C$5.9

billion in May after a surprisingly large shortfall of C$7.1 billion in April.

US Employment Situation for June (Thu 0830 EDT; Thu 1230

GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 110K

Consensus Range, Nonfarm Payrolls - M/M: 70K to 130K

Consensus Forecast, Unemployment Rate: 4.3%

Consensus Range, Unemployment Rate: 4.2% to 4.4%

Consensus Forecast, Private Payrolls - M/M: 100K

Consensus Range, Private Payrolls - M/M: 75K to 125K

Consensus Forecast, Manufacturing Payrolls - M/M: -2K

Consensus Range, Manufacturing Payrolls - M/M: -4K to

15K

Consensus Forecast, Participation Rate - 62.5%

Consensus Range, Participation Rate - 62.3% to

62.5%

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.3%

Consensus Forecast, Average Workweek: 34.3 hours

Consensus Range, Average Workweek: 34.3 to

34.3

Nonfarm jobs expected up 110K and the jobless rate at 4.3

percent for June versus 139K and 4.2 percent in May. Slowdown alert.

United States International Trade in Goods and Services

for May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: - $70.8 B

Consensus Range, Balance: -$72.5 B to -$67.2 B

The trade gap is expected at $70.8 billion after dropping to

$61.6 billion in April as tariffs continue to add volatility.

United States Jobless Claims for Week 6/28 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 240 K

Consensus Range, Initial Claims - Level: 237 K to 245

K

Claims seen at 240 K versus 236 K in the previous week.

United States PMI Composite Final for June (Thu 0945

EDT; Thu 1345 GMT)

Consensus Forecast, Services Index: 53.1

Consensus Range, Services Index: 51.8 to 53.1

No revision expected from the flash at 53.1 in services.

United States Factory Orders for May (Thu 1000 EDT; Thu

1400 GMT)

Consensus Forecast, M/M: 8.1%

Consensus Range, M/M: 0.0% to 9.5%

With durable goods already reported up 16.4 percent, another

huge aircraft-driven rise expected at 8.1 percent on the month.

United States ISM Services Index for June (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Index: 50.5

Consensus Range, Index: 49.7 to 52.0

Slight recovery to 50.5 expected from 49.9 in May.

Friday

Japan Household Spending for May (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: -0.4% to 0.6%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: -0.3% to 3.1%

Key forecast points:

--Japan's real average expenditures by households with two

or more people remains sluggish in May, hit by an above-3% consumer inflation

rate and a 2% drop in real wages. Spending on foodstuffs (including eating out)

is showing a gradual recovery after a recent spike in fresh vegetable prices

caused by last year's bad weather has waned.

--Household spending is seen up a modest 1.1% y/y vs. -0.1%

in April, +2.8% in March, with a few economists projecting a slight drop.

The eighth y/y decline in 12 months in April was caused by

consumer preference to simplified lower-cost funerals and by lower spending on

non-core factors such as gift money and funds sent to children studying away

from home.

--Seasonally adjusted spending +0.3% m/m vs. -1.8% in April,

+0.4% in March.

Australia Household Spending for May (Fri 1130 AET; Fri

0130 GMT; Thu 2130 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.1% to 0.8%

Spending expected up 0.5 percent for May.

Germany Manufacturing Orders for May (Fri 0800 CEST; Fri

0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -2.0% to 0.6%

Consensus Forecast, Y/Y: 5.5%

Consensus Range, Y/Y: 4.9% to 6.4%

Orders expected at minus 0.1 percent on the month after

rising 0.6 percent in May. On year, sales expected up 5.5 percent, better than

the 4.9 percent in April.

|