|

The Week Ahead: Highlights

Asia Pacific Preview

China GDP Report to Show Trade War Effects

By Brian Jackson, Econoday Economist

Chinese data will be the highlight of the Asia-Pacific data

calendar, with GDP data for the three months to June and monthly activity data

for June scheduled for release. The GDP data cover the period that began with

the escalation of global trade tensions and market volatility in early April

and will complement previously published monthly data that have shown the

initial impact of these developments. Next week's data may also likely be

accompanied by further commentary from officials referring to these

developments and may provide updated guidance on their policy response.

China will also publish trade data for June in the week ahead, as will

Singapore and India. South Korea and Taiwan have already published trade data

for June and both reported solid growth in exports though uncertainty about

future tariff increases remain a risk for trade flows in the region. Singapore

will publish GDP data ahead of a scheduled monetary policy meeting by the end

of July.

After the surprise decision by the Reserve Bank of Australia to leave policy

rates on hold at their meeting last week, Australian labour market data will be

monitored for evidence that labour market conditions remain tight. Officials at

that meeting cited uncertainty about near-term labour market conditions as a

key factor driving their decision to refrain from adjusting policy settings

this month.

Europe Preview

Is Europe Benefitting from US Trade Policy?

By Marco Babic, Econoday Economist

The coming week in Europe brings us the next round of trade

data for the Eurozone, Italy and Switzerland, following on the heels of German

trade data last week. A US imposed deadline for trade deals has been extended

from July 9 to August 1, leaving countries guessing once again on what the US

actually wants.

Last week, Germany recorded a trade surplus of 18.4 billion euros in May, an

improvement over a 15.8 billion surplus in April, although below the 22.3

billion in May of last year. Exports to the US declined 7.7 percent from the

previous month and were 13.8 percent below year-ago levels.

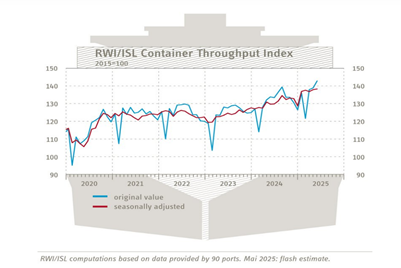

Interestingly, the RWI/ISL container throughput index rose in May, indicating

trade is still robust. The measure rose to a seasonally adjusted 138.3 in May

from 137.9 in April. US West Coast ports and Chinese container traffic was

lower in May. The port of Long Beach, California says total container volume

decline 8.2 percent from a year ago, but that doesn't tell the whole story.

Loaded inbound containers fell 13.4 percent while outbound volume fell 18.6

percent. So, what is happening?

The North Range Index which measures activity at ports in Northern Europe and

Germany rose to 117.4 in May from 115.9 in April. This suggests that while the

US and China are slugging it out, China is redirecting its exports to Europe to

avoid US tariffs.

The Eurozone and Italy report their trade data for May on Wednesday, with

Switzerland reporting June results on Thursday. In May, Switzerland's trade

surplus fell to 3.381 billion Swiss Francs from 6.325 billion in April. Swiss

chemical and pharmaceutical exports will provide further insight into how trade

could be faring more broadly.

Trade so far has shown a surprising resilience and trade reports could start to

show realignments with more activity between Europe and China in the coming

months.

US Preview

Heavy Data Week Ahead with Beige Book, Inflation, Retail

Sales

By Theresa Sheehan, Econoday Economist

There's plenty of important economic data on the calendar in

the July 14 week. However, the thing that may prove most interesting is the

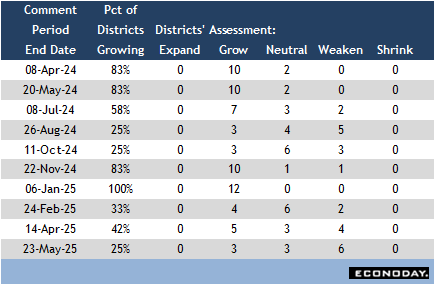

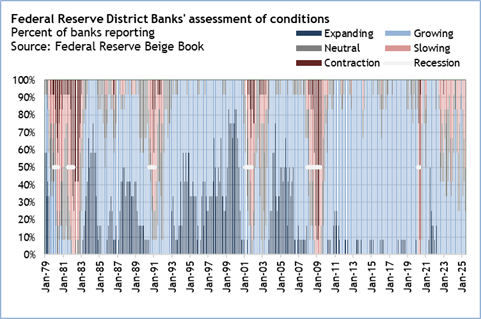

next issue of the Fed's Beige Book at 14:00 ET on Wednesday covering the period

for roughly late May through late June. The prior three Beige Books showed

broad-based weakness consistent with an incoming recession. The value of the

Beige Book is that it provides anecdotal evidence about current conditions

across the 12 Fed district banks. It is a qualitative assessment that is

usually backed up by the hard data. The Beige Book threw off some recession

signals back in 2022 and 2023. The hot labor market kept the US economy from

weakening while it recovered from supply chain disruptions and upward price

pressures related fiscal stimulus. This time around, the labor market has cut

back on hiring, and consumer and business spending has been exhausted by

front-loading purchases ahead of expected tariffs. Given the high levels of

uncertainty, that spending is not likely to be renewed in the near future.

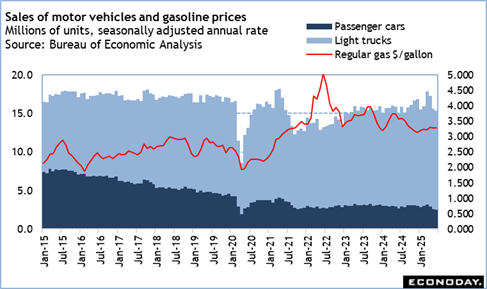

June data on retail and food services sales for June at 8:30

ET on Thursday will determine if spending rebounded from the declines seen in

May and April. In any case, retail spending in the second quarter 2025 is going

to be less due to demand being depleted from the first quarter. In particular,

spending on big ticket items like motor vehicles will keep the total dollar

value of sales down. And the early timing of the Memorial Day observance in May

could mean that some spending that normally would have reached into June will

be absent.

The focus on the consumer price index (CPI) report for June

at 8:30 ET Tuesday will be if the anticipated price increases from tariffs have

begun to reach the consumer level. The size and timing of the new tariff policy

was still unsettled in June, so it could well be another month of modest

increases. In particular, energy prices are lower for June and could restrain

inflation at the all-items level.

The Week Ahead: Econoday Consensus Forecasts

Monday

Japan Machinery Orders for May (Mon 0850 JST; Sun 2350

GMT; Sun 1950 EDT)

Consensus Forecast, M/M: -0.9%

Consensus Range, M/M: -4.2% to 3.0%

Consensus Forecast, Y/Y: 7.1%

Consensus Range, Y/Y: -3.0% to 10.0%

Key forecast points:

--Core machinery orders, the key indicator of business

investment, down 0.9% m/m (some expect a slight rebound) vs. -9.1% in April,

which was the first drop in three months; +7.1% y/y for an eighth straight rise

vs. +6.6% in April. The focus is on whether subcontractors of the auto, steel

and other industries that are directly hit by 25% Trump tariffs are reporting

slower orders.

--April-June orders may turn out to be firmer than the

official projection of -2.1% q/q vs. a solid +3.9% in Q1.

--The Bank of Japan's June quarter Tankan business survey

showed that both large and smaller firms revised up their capex plans more than

expected despite the uncertainty over global trade rows.

Singapore GDP for Second Quarter (Mon 0800 SGT; Mon 0000

GMT; Sun 2000 EDT)

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.0% to 3.6%

The consensus sees growth slowing to 3.5 percent on year in

Q2 versus 3.9 percent in Q1.

China Merchandise Trade for June (ANYTIME)

Consensus Forecast, Balance of Trade: $112.6 B

Consensus Range, Balance of Trade: $100.0 B to $117.0

B

Consensus Forecast, Imports - Y/Y: 2.5%

Consensus Range, Imports - Y/Y: 1.3% to 2.9%

Consensus Forecast, Exports - Y/Y: 5.5%

Consensus Range, Exports - Y/Y: 5.0% to 5.9%

The surplus is expected to widen to $112.6 billion in June

from $103.2 billion in May.

India Wholesale Price Index for June (Mon 1200 IST; Mon

0630 GMT; Mon 0230 EDT)

Consensus Forecast, Y/Y: 0.52%

Consensus Range, Y/Y: 0.50% to 0.90%

WPI expected to tick up but remain muted at 0.52 percent on

year for June from 0.39 percent in May.

India CPI for June (Mon 1600 IST; Mon 1030 GMT; Mon 0630

EDT)

Consensus Forecast, Y/Y: 2.40%

Consensus Range, Y/Y: 2.33% to 2.50%

Headline CPI expected lower at 2.40 percent on year in June

versus 2.82 percent in May.

Tuesday

China Fixed Asset Investment for June (Tue 1000 CST; Tue

0200 GMT; Mon 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 3.6%

Consensus Range, Year to Date on Y/Y Basis: 3.6% to 4.5%

Forecasters see FAI growth year on year down a tick at 3.6

percent in June versus 3.7 percent in May.

China GDP for Second Quarter (Tue 1000 CST; Tue 0200

GMT; Mon 2200 EDT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.1% to 1.1%

Consensus Forecast, Y/Y: 5.1%

Consensus Range, Y/Y: 4.4% to 5.3%

Showing only muted effects from the trade war. Slightly

slower growth seen at 0.9 percent on quarter in Q2 versus 1.2 percent in Q1.

The consensus sees year on year growth at 5.1 percent in Q2 compared with 5.4

percent in Q2.

China Industrial Production for June (Tue 1000 CST; Tue

0200 GMT; Mon 2200 EDT)

Consensus Forecast, Y/Y: 5.6%

Consensus Range, Y/Y: 5.5% to 5.8%

Growth in industrial production is seen declining to 5.6

percent on year in June from 5.8 percent in May.

China Retail Sales for June (Tue 1000 CST; Tue 0200

GMT; Mon 2200 EDT)

Consensus Forecast, Y/Y: 5.2%

Consensus Range, Y/Y: 4.7% to 6.1%

The consensus sees annual growth in sales down to 5.2 percent

in June versus 6.4 percent in May.

Eurozone Industrial Production for May (Tue 1100

CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: -1.3% to 1.7%

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 0.1% to 3.3%

Forecasters expect industrial output to rebound by 0.6 percent

on month in May after falling 2.4 percent on the month in April. The call for

the yearly change is an increase of 1.6 percent after 0.8 percent in April.

Germany ZEW Survey for July (Tue 1100 CEST; Tue 0900 GMT;

Tue 0500 EDT)

Consensus Forecast, Current Conditions: -66

Consensus Range, Current Conditions: -71.0 to -66.0

Consensus Forecast, Economic Sentiment: 50.2

Consensus Range, Economic Sentiment: 45.1 to 55.0

Germany's improving trend continues with current conditions

expected at minus 66 in July versus minus 72.0 in June. Economic sentiment is

seen up again at 50.2 in July versus an already surprisingly strong 47.5 in

June.

Canada Housing Starts for June (Tue 0815 EDT; Tue 1215

GMT)

Consensus Forecast, Annual Rate: 262.5K

Consensus Range, Annual Rate: 253K to 270K

Starts are expected to retreat to 262.5K in June from 280K

in May.

Canada CPI for June (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.1%

Consensus Range, CPI - M/M: -0.3% to 0.2%

Consensus Forecast, CPI - Y/Y: 1.9%

Consensus Range, CPI - Y/Y: 1.5% to 2.0%

Forecasters see Canada CPI up 0.1 percent on the month and

up 1.9 percent on year in June versus increases of 0.6 percent and 1.7 percent

in May.

United States CPI for June (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: -0.2% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.7%

Consensus Range, CPI - Y/Y: 2.5% to 2.7%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to

0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 2.9% to 3.0%

Headline inflation is expected at 0.3 percent on month and 2.7

percent on year in June versus a rise of 0.1 percent and 2.4 percent on year in

May. Core CPI is seen at 0.3 percent and 3.0 percent in June versus 0.1 percent

and 2.8 percent in May.

Canada Manufacturing Sales for May (Tue 0830 EDT; Tue

1230 GMT)

Consensus Forecast, M/M: -1.3%

Consensus Range, M/M: -1.3% to -1.3%

Forecasters agree with the Statistics Canada preliminary

estimate that sales fell 1.3 percent in May after dropping 2.8 percent in

April.

United States Empire State Manufacturing Index for July (Tue

0830 EDT; Tue 1230 GMT)

Consensus Forecast, Index: -10.0

Consensus Range, Index: -13.0 to -6.9

Forecasters see contraction continuing with the index at

minus 10.0 in July versus minus 16.0 in June.

Wednesday

United Kingdom CPI for June (Wed 0700 BST; Wed 0600

GMT; Tue 0200 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.0% to 0.4%

Consensus Forecast, Y/Y: 3.4%

Consensus Range, Y/Y: 3.2% to 3.5%

UK annual inflation seen unchanged at 3.4 percent in June

versus 3.4 percent in May. Month on month, the consensus looks for another

increase of 0.2 percent after rising 0.2 percent in May.

Italy CPI for June (Wed 1000 CET; Wed 0800 GMT; Wed 0400

EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.7%

Consensus Range, Y/Y: 1.7% to 1.7%

Consensus Forecast, HICP - M/M: 0.2%

Consensus Range, HICP - M/M: 0.2% to 0.2%

Consensus Forecast, HICP - Y/Y: 1.7%

Consensus Range, HICP - Y/Y: 1.7% to 1.7%

Forecasters expect no revision from the flash at 0.2 percent

on month and 1.7 percent on the year for June.

United States PPI-Final Demand for June (Wed 0830

EDT; Wed 1230 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.2% to 0.3%

Consensus Forecast, PPI - Y/Y: 2.5%

Consensus Range, PPI - Y/Y: 2.5% to 2.8%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 2.7%

Consensus Range, Ex-Food & Energy - Y/Y: 2.7% to 3.2%

The consensus sees PPI-FD up 0.2 percent on month in June

and up 2.5 percent on year after an increase of 0.1 percent on month and 2.6

percent on year in May.

United States Industrial Production for June (Wed 0915

EDT; Wed 1315 GMT)

Consensus Forecast, Industrial Production - M/M: 0.1%

Consensus Range, Industrial Production - M/M: -0.2%

to 0.3%

Consensus Forecast, Manufacturing Output - M/M: 0.1%

Consensus Range, Manufacturing Output - M/M: 0.0% to 0.2%

Consensus Forecast, Capacity Utilization Rate: 77.4%

Consensus Range, Capacity Utilization Rate: 77.2% to 77.5%

The consensus sees industrial output up 0.1 percent and

manufacturing up 0.1 percent on the month with capacity utilization flat at 77.4

percent versus 77.4 percent in May.

Thursday

Japan Merchandise Trade for June (Thu 0850 JST; Wed 2350

GMT; Wed 1950 EDT)

Consensus Forecast, Balance: ¥328.45 B

Consensus Range, Balance: ¥140.00 B to ¥440.10 B

Consensus Forecast, Imports - Y/Y: -1.5%

Consensus Range, Imports - Y/Y: -2.7% to 1.0%

Consensus Forecast, Exports - Y/Y: -0.3%

Consensus Range, Exports - Y/Y: -2.2% to 1.5%

Key forecast points:

--Japanese export values -0.3% on year in June vs. -1.7% in

May (the first drop in eight months but volumes were up for a second month in a

row), possibly led by autos, iron and steel and auto parts in the face of 25%

Trump tariffs. Japanese carmakers are reducing the prices for U.S. customers to

cover higher import costs, leading to lower overall export prices.

--Import values -1.5% for a third straight drop vs. -7.7% in

May (volumes were up for a third straight month) amid easing energy costs.

--The trade balance: a ¥328.45 billion trade surplus, the

black ink in three months vs. a revised ¥638.56 billion deficit in May and a

¥221.35 billion surplus in June 2024.

Australia Labour Force Survey for June (Thu 1130 AEST;

Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Employment - M/M: 23K

Consensus Range, Employment - M/M: 10K to 45K

Consensus Forecast, Unemployment Rate: 4.1%

Consensus Range, Unemployment Rate: 4.1% to 4.2%

Australia expected to show a 23K increase in employment on

the month in June. The jobless rate is expected steady at 4.1 percent from 4.1

percent in May.

United Kingdom Labour Market Report for June (Thu 0700

BST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, ILO Unemployment Rate: 4.6%

Consensus Range, ILO Unemployment Rate: 4.6% to 4.6%

ILO unemployment is expected unchanged at 4.6 percent in

June versus 4.6 percent in May.

Eurozone HICP for June (Thu 1100 CEST; Thu 0900 GMT; Thu

0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: % to %

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.3% to 2.4%

HICP expected unrevised from the flash at 2.0 percent on

year and 2.3 percent for narrow core.

United States Jobless Claims for Week 7/12 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 233K

Consensus Range, Initial Claims - Level: 230K to 235K

Claims are projected at 233K in the latest week after

declining more than expected to 5K to 227K in the previous week.

United States Retail Sales for June (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Retail Sales - M/M: 0.1%

Consensus Range, Retail Sales - M/M: -0.2% to 0.3%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: 0.1% to 0.5%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.1%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.1% to

0.2%

Retail sales have slowed as consumers remain wary. The consensus

looks for sales up 0.1 percent in June with sales ex-autos up 0.3 percent and

ex-autos and gas up 0.1 percent.

United States Philadelphia Fed Manufacturing Index for

July (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Index: -0.4

Consensus Range, Index: -5.0 to 6.7

The manufacturing barometer is expected at -0.4 in July

versus minus 4.0 in June.

United States Import and Export Prices for June (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, Import Prices - M/M: 0.2%

Consensus Range, Import Prices - M/M: -0.1% to 0.5%

Consensus Forecast, Import Prices - Y/Y: 0.2%

Consensus Range, Import Prices - Y/Y: -0.1% to 0.3%

Consensus Forecast, Export Prices - M/M: -0.1%

Consensus Range, Export Prices - M/M: -0.1% to 0.2%

The consensus sees import prices up 0.2 percent and export

prices down 0.1 percent on the month.

United States Business Inventories for May (Thu 1000

EDT; Thu 1600 GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.2% to 0.0%

Inventories expected flat on the month in May.

United States Housing Market Index for July (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Index: 33

Consensus Range, Index: 31 to 33

The index is expected to remain depressed at 33 in July

versus 32 in June and 41 in June 2024.

Friday

Japan CPI for June (Fri 0830 JST; Thu 2330 GMT; Thu 1930

EDT)

Consensus Forecast, Y/Y: 3.3%

Consensus Range, Y/Y: 3.3% to 3.4%

Consensus Forecast, Ex-Fresh Food -Y/Y: 3.4%

Consensus Range, Ex-Fresh Food - Y/Y: 3.3% to 3.4%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.4%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 3.2%

to 3.4%

Key forecast points:

--Consumer inflation in Japan is expected to ease in two of

the three key measures in June thanks to renewed subsidies to cap retail

gasoline and heating oil prices but still above 3% amid high processed food

prices, temporarily exceeding the Bank of Japan's long-run 2% price stability

target. The pace of deceleration is unlikely to be so drastic as in the Tokyo

CPI data released last month. The metropolitan area saw a plunge in water bills

due to the metropolitan government's free base charge for four months that

began in June.

--Core CPI (excluding fresh food) +3.4% y/y in June vs.

+3.7% in May; Upward pressure on processed food prices in the aftermath of rice

supply shortages is partly offset by slower gains in energy costs and the

year-long price-cutting effect of free high school education that began on

April 1; core-core CPI (excluding fresh food and energy) +3.4% vs. +3.3%; total

CPI +3.3% vs. +3.5% as fresh vegetable prices have stabilized after an earlier

spike.

Germany PPI for June (Fri 0800 CEST; Fri 0600 GMT; Fri

0200 EDT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.1%

Consensus Forecast, Y/Y: -1.3%

Consensus Range, Y/Y: -1.4% to -1.2%

The consensus sees no change on the month in June and a

decline of 1.3 percent on year.

United States Housing Starts and Permits for June (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Starts - Annual Rate: 1.300 M

Consensus Range, Starts - Annual Rate: 1.230 M to

1.350 M

Consensus Forecast, Permits - Annual Rate: 1.380 M

Consensus Range, Permits - Annual Rate: 1.300 M to

1.430 M

Starts expected to edge up to 1.300 million unit rate in

June from a sluggish 1.256 million in May.

United States Consumer Sentiment for July (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 61.4

Consensus Range, Index: 56.2 to 66.0

Sentiment expected up slightly to 61.4 in the first reading

for July from 60.7 in the June final.

|