|

The Week Ahead: Highlights

Asia Preview

Trade Talks in Focus in Light Data Week

By Brian Jackson, Econoday Economist

The Asia-Pacific data calendar is light in the week ahead.

South Korea reports GDP for the three months to June, providing more

comprehensive information about the impact of global trade tensions over that

period, while New Zealand will report trade data for June. Singapore and Taiwan

industrial production data will also be watched for evidence of the impact of

trade tensions, while inflation data will likely show price pressures remain

subdued in Singapore and Hong Kong Hong.

The main focus instead will be on any reports on the progress on trade

negotiations. The 90-day pause on tariff increases announced by the Trump

Administration in April are set to expire at the start of August, and officials

across the Asia-Pacific region have been working hard to avoid the higher

tariffs taking effect. To date, however, there has been little indication that

the pause will be extended.

Europe Preview

Sentiment Indicators to the Fore

By Marco Babic, Econoday Economist

The week ahead is thin on official data in Europe, so

sentiment indicators will be the center of attention. On Tuesday, France

reports its Business Climate Index for July which has been below its long-term

average for the previous two months. Inventory buildup has been a concern has

had deteriorating order books. July is not likely to see a significant

improvement as tariff uncertainty continues.

Consumer Confidence for the Eurozone is scheduled for Wednesday with

preliminary results for July. For the most part, consumers have been wary and

putting off large purchases. There is no reason to think there will be an

upswing in current sentiment. Interestingly, consumers have been more

optimistic for future developments, but cautious on current conditions. In any

event, if consumers aren't opening up their wallets, that isn't going to help

business confidence either.

Private Sector sentiment in the form of Composite PMI indexes is scheduled for

Thursday release for France, Germany, the Eurozone, and UK. The latter three

composite readings are all above 50 meaning an expanding private sector. France

remained below 50 in June at 49.2. What has been supporting the expansionary

results has been the services sector while manufacturing has been a drag.

Inventories and orders will be the main interest among the components and

whether order books are improving and warehouses filling up with goods. Part of

the inventory equation is also whether there was opportunistic stockpiling as

the July 9 trade deal agreement with the US was pushed to August 1.

Germany's Ifo Institute reports its Business Climate Index for July after a

surprising pickup in June to 88.4 from 87.5. However, the main contributor to

that was the expectations component which rose to 90.7 from 88.9 in May. The

sense is that such increases are based more on hopes that trade deals are

reached rather than anything concrete. Lost in all of this is the fact that

even if a trade deal is struck, some of the tariffs already in place will

remain there.

Will the ECB Focus on Trade?

At its previous meeting in June, the European Central Bank cut its main policy

rates by 25 basis points and that it was satisfied with the current level of

inflation which is around the ECB's 2.0 percent target. With inflation

presently not posing a threat, observers will be listening to what it has to

say about trade tensions.

In June, the ECB said that if trade tensions continue in coming months, growth

and inflation would be below baseline expectations. Well, here we are. To be

sure, we are only six weeks away from the previous meeting, but uncertainties

still abound. The EU was blindsided by the US when additional tariffs were

threatened after EU negotiators felt they were dealing in good faith. Moreover,

the July 9 deadline to reach a deal was moved to August 1.

Whether a deal is reached or the goalposts moved again, uncertainty prevails.

With a trade deal and tariffs, businesses will face uncertainty on how that

will affect them. If the deadline is extended again, that's more uncertainty by

a different name.

US Preview

Fed Watching for Signs of Revival in Manufacturing

By Theresa Sheehan, Econoday Economist

During the communications blackout period around the July

29-30 FOMC meeting (midnight, Saturday, July 26 through midnight, Thursday,

July 31) the only Fed speaker on monetary policy will be Chair Jerome Powell at

his press briefing on Wednesday, July 30 at 14:30 ET. The economic data in the

July 21 week will probably take a backseat to speculation about the potential

for a rate cut at the upcoming meeting (still relatively low) and just how much

FOMC participants are going to disagree in interpreting the economic data.

The data on the calendar isn't likely to sway the FOMC

deliberations one way or another absent a convincing surprise.

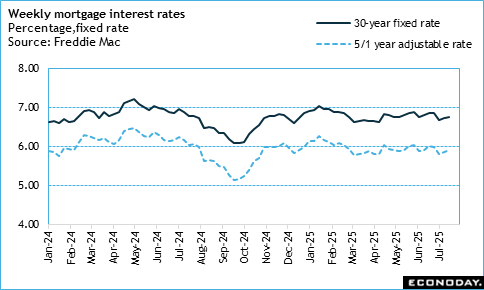

The present housing market is subject to the vagaries of

mortgage rates which have been unsettled. New residential construction has been

curtailed, so if there is any strength in sales, it will be in the existing

home market where buyers have more negotiating power and sellers can give a

little on prices after substantial gains in equity in recent years. The NAR

data on existing home sales for June is set for 10:00 ET on Wednesday and will

reflect mortgages locked in in May and early June.

Homebuyers have exhibited extreme sensitivity to even a few

basis points difference in their loan rates as affecting affordability. The

Freddie Mac rate for a 30-year fixed rate mortgage was on the rise in May and

peaked at 6.89 percent in the May 29 week. The first week in June saw a dip to

6.76 percent which brought buyers back into the market. However, rates rose

thereafter and ended at 6.85 percent in the June 26 week. Nonetheless, the

rates dip again in the first weeks of July and may offer a boost to future

sales.

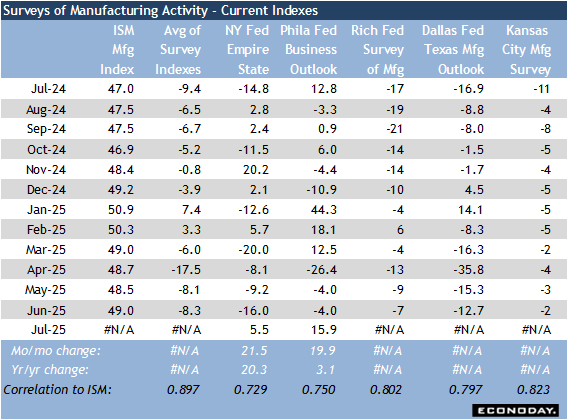

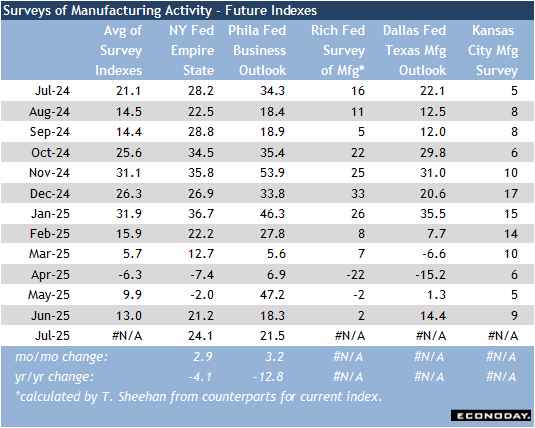

What may prove interesting to the FOMC is if activity is

picking up in manufacturing. The July surveys of manufacturing for the New York

and Philadelphia Fed districts both show a jump in general business conditions

and return to positive territory. Moreover, future conditions look more stable

and consistent with moderate expansion. Could the Richmond Fed's manufacturing

composite index for July at 10:00 ET on Tuesday and Kansas City manufacturing

index for July at 11:00 ET on Thursday show a similar move? If so, a modest

rebound in the factory sector could help persuade Fed policymakers that the

economy and labor market are in less need of support than inflation is in need

of continued restrictive monetary policy to ensure it does not become

entrenched.

The Week Ahead: Econoday Consensus Forecasts

Monday

New Zealand CPI for Second Quarter (Mon 1045 NZST; Sun

2245 GMT; Sun 1845 EDT)

Consensus Forecast, Q/Q: 0.6%

Consensus Range, Q/Q: 0.5% to 0.6%

Consensus Forecast, Y/Y: 2.8%

Consensus Range, Y/Y: 2.8% to 2.8%

CPI seen up 0.6 percent on quarter and 2.8 percent on year

in Q2 versus 0.9 percent and 2.5 percent in Q1, still within the 1-3 percent

RBNZ comfort range.

United States Leading Indicators for June (Mon 1000 EDT;

Mon 1600 GMT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.3% to -0.1%

The consensus forecast looks for another modest decline 0f

0.2 percent in June after a 0.1 percent dip in May.

Tuesday

China Loan Prime Rate for July (Tue 0900 CST; Mon 0100

GMT; Mon 2100 EDT)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.0%

Consensus Range, 1-Year Rate - Level: 3.0% to 3.0%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.5%

Consensus Range, 5-Year Rate - Level: 3.5% to 3.5%

The consensus looks for no change this time on both 1-year

and 5-year LPR.

France Business Climate Indicator for July (Tue 0845

CEST; Tue 0645 GMT; Tue 0245 EDT)

Consensus Forecast, Index: 97

Consensus Range, Index: 95 to 97

Forecasters expect the index to improve slightly to 97 in

July from 96 in June.

Wednesday

United States Existing Home Sales for June (Wed 1000 EDT;

Wed 1400 GMT)

Consensus Forecast, Annual Rate: 4.00 M

Consensus Range, Annual Rate: 3.90 M to 4.10 M

Expected down to an annual 4.00 million unit rate in June from

4.03 million in May. Home resales continue to suffer from poor affordability

and consumer uncertainty. National Association of Home Builders reported last week

that buyer traffic is extremely weak, worst since the pandemic when things

really shut down.

Eurozone EC Consumer Confidence Flash for July (Wed

1600 CEST; Wed 1400 GMT; Wed 1000 EDT)

Consensus Forecast, Index: -14.5

Consensus Range, Index: -15.5 to -14.0

The index is expected up a bit to minus 14.5 in July from

minus 15.3 in June.

Thursday

South Korea GDP for Second Quarter (Thu 0800 KST; Wed

2300 GMT; Wed 1900 EDT)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.3% to 0.6%

Growth seen up 0.4 percent on the quarter after a decline of

0.2 percent in Q1.

France PMI Composite Flash for July (Thu 0915 CEST; Thu

0715 GMT; Thu 0315 EDT)

Consensus Forecast, Manufacturing Index: 48.8

Consensus Range, Manufacturing Index: 48.5 to 49.1

Consensus Forecast, Services Index: 50.0

Consensus Range, Services Index: 49.9 to 50.0

The consensus looks for the PMI manufacturing at 48.8 for

July versus 48.1 in the June final.

Forecasters expect the services index at 50.0 in July versus

49.6 in in the June final.

Germany PMI Composite Flash for July (Thu 0930 CEST; Thu

0730 GMT; Thu 0330 EDT)

Consensus Forecast, Composite Index: 50.7

Consensus Range, Composite Index: 49.1 to 51.0

Consensus Forecast, Manufacturing Index: 49.5

Consensus Range, Manufacturing Index: 48.8 to 49.5

Consensus Forecast, Services Index: 50.1

Consensus Range, Services Index: 49.2 to 50.5

The consensus looks for the PMI composite at 50.7 for July

versus 50.4 in the June final.

PMI manufacturing is seen at 49.5 for July versus 49.0 in

the June final. Forecasters expect services at 50.1 in July versus 49.7 in in

the June final.

Eurozone PMI Composite Flash for July (Thu 1000 CEST;

Thu 0800 GMT; Thu 0400 EDT)

Consensus Forecast, Composite Index: 50.9

Consensus Range, Composite Index: 50.2 to 51.0

Consensus Forecast, Manufacturing Index: 49.8

Consensus Range, Manufacturing Index: 49.4 to 50.0

Consensus Forecast, Services Index: 50.8

Consensus Range, Services Index: 50.2 to 51.0

The consensus looks for the PMI composite at 50.9 for July

versus 50.6 in the June final. PMI manufacturing is expected at 49.8 for July

versus 49.5 in the June final. Forecasters expect the services index at 50.8 in

July versus 50.5 in in the June final.

United Kingdom PMI Composite Flash for July (Thu 0930

BST; Thu 0830 GMT; Thu 0430 EDT)

Consensus Forecast, Composite Index: 51.7

Consensus Range, Composite Index: 51.3 to 51.8

Consensus Forecast, Manufacturing Index: 48.0

Consensus Range, Manufacturing Index: 47.5 to 48.5

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 52.0 to 52.6

The consensus looks for the PMI composite at 51.7 for July

versus 52.0 in the June final. PMI manufacturing expected at 48.0 for July

versus 47.7 in the June final. Forecasters expect the services index at 52.5 in

July versus 52.8 in the June final.

Germany Gfk Consumer Sentiment for August (Thu

0800 CEST: 2:00 EDT)

Consensus Forecast, Index: -19.0

Consensus Range, Index: -20.0 to -19.1

Sentiment expected better at minus 19.0 in August from minus

20.3 in July.

European Central Bank Policy Announcement (Thu 0815

EDT; Thu 1215 GMT)

Consensus Forecast, Refi Rate - Change: 0 bp

Consensus Range, Refi Rate - Change: 0 bp to 0 bp

Consensus Forecast, Refi Rate - Level: 2.15%

Consensus Range, Refi Rate - Level: 2.15% to 2.15%

Consensus Forecast, Depo Rate - Change: 0 bp

Consensus Range, Depo Rate - Change: 0 bp to 0 bp

Consensus Forecast Depo Rate - Level: 2.0%

Consensus Range, Depo Rate - Level: 2.0% to 2.0%

With rates at neutral, no change is expected as

policy-makers wait for the Aug. 1 US tariff deadline to see what the EU faces.

Canada Retail Sales for May (Thu 0830 EDT; Thu 1230

GMT)

Consensus Forecast, M/M: -1.1%

Consensus Range, M/M: -0.1% to -0.9%

Forecasters agree with Stats Canada's advance estimate that

sales dropped 1.1 percent in May after gaining 0.3 percent in April. The

culprit is falling auto sales on payback from strong gains lately. Sales

ex-autos remain decent as consumer spending is holding up surprisingly well.

United States Jobless Claims for Week 7/19 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 225 K

Consensus Range, Initial Claims - Level: 210 K to 230

K

Claims are seen rising to 225K in the latest week after an

unexpected drop to 221K last week.

United States PMI Composite Flash for July (Thu 0945

EDT; Thu 1345 GMT)

Consensus Forecast, Composite Index: 52.3

Consensus Range, Composite Index: 52.0 to 52.9

Consensus Forecast, Manufacturing Index: 52.7

Consensus Range, Manufacturing Index: 52.0 to 53.2

Consensus Forecast, Services Index: 52.7

Consensus Range, Services Index: 52.4 to 53.1

The consensus looks for the PMI composite at 52.3 for July

versus 52.9 in the June final. Manufacturing seen at 52.7 for July versus 52.9

in the June final. Forecasters also see services at 52.7 in July versus 52.9 in

in the June final.

United States New Home Sales for June (Thu 1000 EDT; Thu

1400 GMT)

Consensus Forecast, Annual Rate: 650 K

Consensus Range, Annual Rate: 630 K to 690 K

Sales expected to recover somewhat but remain soft at 650K

in June after an unexpectedly large 14 percent drop to 623K in May.

Friday

Japan Tokyo CPI for July (Fri 0830 JST; Thu 2330 GMT;

Thu 1930 EDT)

Consensus Forecast, CPI - Y/Y: 3.0%

Consensus Range, CPI - Y/Y: 2.9% to 3.3%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.0%

Consensus Range, Ex-Fresh Food - Y/Y: 2.8% to 3.1%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.1%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 3.0%

to 3.3%

Key forecast points:

--Consumer inflation in Tokyo, the leading indicator of the

national average, is expected to have stayed around 3% in July but easing

further in light of renewed nationwide retail gasoline subsidies and a plunge

in water bills thanks to the city's free base charge for four months that began

in June. Lower inbound spending due to a firmer yen and stricter duty-free

shopping rules has also led to lower inflation.

--Slower energy price gains (gasoline is now down) are

partially offset by rising processed food prices in the aftermath of protracted

domestic rice supply shortages as well as higher mobile phone charges.

--Core CPI (excluding fresh food) +3.0% y/y in July vs.

+3.1% in June, +3.6% in May.

--Total CPI +3.0% y/y vs. +3.1% in June, +3.4% in the

previous two months; fresh food prices have eased after a recent spike caused

by last year's bad weather.

--Core-core CPI (ex-fresh food, energy) +3.1% y/y vs. +3.1%

in June, +3.3% in May.

United Kingdom Retail Sales for June (Fri 0700 BST; Fri

0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 1.4%

Consensus Range, M/M: 0.7% to 2.0%

Consensus Forecast, Y/Y: 1.8%

Consensus Range, Y/Y: 1.4% to 3.5%

Sales expected to rebound by 1.4 percent on the month in

June after dropping 2.7 percent in May. Year on year sales seen up 1.8 percent

after declining by 1.3 percent in May.

Germany Ifo Survey for July (Fri 1000 CEST; Fri 0800 GMT;

Fri 0400 EDT)

Consensus Forecast, Business Climate: 89.2

Consensus Range, Business Climate: 88.5 to 89.5

Consensus Forecast, Current Conditions: 87.5

Consensus Range, Current Conditions: 86.4 to 91.5

Consensus Forecast, Business Expectations: 91.4

Consensus Range, Business Expectations: 87.0 to 91.5

As things continue to look up in Germany, the Ifo business

climate index is seen up at 89.2 in July from 88.4 in June.

Eurozone M3 Money Supply for June (Fri 1000 CEST; Fri

0800 GMT; Fri 0400 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 3.7%

Consensus Range, Y/Y - 3-Month Moving Average: 3.7%

to 3.7%

Money supply is expected to show a marginally softer 3.7

percent annual growth rate in June versus 3.8 percent in May.

Italy business and Consumer Confidence for July (Fri 1000

CEST; Fri 0800 GMT; Fri 0400 EDT)

Consensus Forecast, Consumer Confidence: 96.1

Consensus Range, Consumer Confidence: 95.8 to 96.5

Confidence seen flat at 96.1 in July from June.

United States Durable Goods Orders for June (Fri 0830

EDT; Fri 1230 GMT)

Consensus Forecast, New Orders - M/M: -11.0%

Consensus Range, New Orders - M/M: -13.0% to -8.6%

Consensus Forecast, Ex-Transportation - M/M: 0.1%

Consensus Range, Ex-Transportation - M/M: -0.6% to

0.2%

Consensus Forecast, Core Capital Goods - M/M: 0.2%

Consensus Range, Core Capital Goods - M/M: 0.1% to

0.2%

After soaring in May, aircraft orders are down in June, which

is expected to leave total durable goods orders down 11.0 percent. Ex-aircraft

is seen up 0.1 percent and core capital goods up 0.2 percent, not a bad

showing.

|