|

The Week Ahead: Highlights

US Preview

CPI in Focus as Fed Weighs Tariffs and Inflation

By Theresa Sheehan, Econoday Economist

The economic data in the August 11 week is inextricably

entwined with the outlook for Federal Reserve monetary policy and the debate

over price stability.

The highlights of the week are the July consumer price index

(CPI) data at 8:30 ET on Tuesday and retail sales at 8:30 ET on Friday.

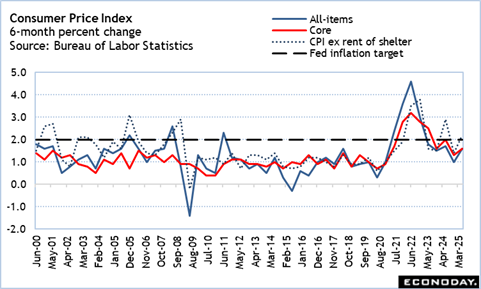

In question about the CPI is whether there is more evidence

of costs from tariffs being passed through to consumers and if so, by how

much? The June report suggests that the process has begun with annual

increases up three-tenths to 2.7 percent for all-items CPI and up one-tenth to

2.9 percent for the CPI excluding food and energy. More upward price pressures

are likely in July. How sustained these will be is unknown. Interestingly, the

uptick in the CPI occurs at the start of the third quarter. It is possible that

the timing of recent price increases will boost the third quarter CPI-W which

is used to calculate the annual cost-of-living-adjustment (COLA) for social

security benefits applied in the following January.

In any case, rising consumer prices complicate decisions

about monetary policy. The "tension" in the dual mandate cited by Fed Chair

Jerome Powell between maximum employment and price stability is getting more

polarized. The July monthly employment report points to weakening in the labor

market at a time when prices are on the rise. Opinions on the FOMC have

diverged about whether inflation conditions still need restrictive monetary

policy to prevent them from becoming entrenched versus falling hiring, signs of

contraction in the labor force, and more aggressive layoff plans by businesses.

The FOMC will have the August reports for the monthly

employment situation and CPI in hand when it next meets on September 16-17. As

such, Fed policymakers will have a more complete picture of the US economy by

then. However, there are also concerns that the reports out of the BLS - of

which these are two of the most important - will no longer be free of political

influence. The ability of the FOMC to set policy based on reliable data could

be compromised.

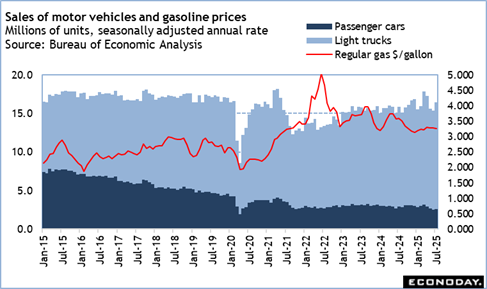

The data on retail and food services sales in July will get

support from an uptick in motor vehicle sales, the presence of Amazon's 4-day

sales event, and a scattering of state sales tax holidays at the start of local

school years. Unit sales of motor vehicles were up to 16.4 million in July from

15.3 million in June and concentrated in the pricier light trucks category.

Dealers may have offered less discounts in July due to somewhat depleted

inventories. Amazon's Prime Day sale reached a new record but only compared to

prior 2-day events. Consumers in states that offered a sales tax holiday on

back-to-school items probably took advantage of the chance to stock up.

Gasoline prices were a bit lower in July which in turn may have helped boost

travel and travel-related spending. The pickup in consumer spending may not be

sustained into August, but it should start the third quarter off on a positive

note for the GDP component of personal consumption expenditures.

Europe Preview

Europe Gets Second Quarter Scorecard

By Marco Babic, Econoday Economist

Europe receives its report card for the second quarter in

the form of final GDP on Thursday. Preliminary figures showed a gain of 0.1

percent for the quarter and 1.4 percent year-on-year. The final report will

provide more details, and it will be of particular interest to see what

inventories have done. French GDP was up 0.3 percent on the quarter after

gaining 0.1 percent in the first quarter, with much of the improvement coming

from inventories. Switzerland will report flash second quarter GDP on Friday.

While the EU reached a framework agreement for 15 percent US tariffs, it was

viewed as the ugly stepchild by some European governments, and it is still

unclear what the final version will look like. The EU fared better than

Switzerland which was unable to secure a deal with the Trump administration,

resulting in a 39 percent levy taking coming into force August 7.

This is clearly a difficult situation for Switzerland, which is not part of the

EU, and it raises the question whether the Swiss will perhaps funnel goods

through the EU to the United States.

Trade continues to remain the big story, and Italy will report its trade

figures for June on Monday. There has been evidence to businesses stockpiling

which is evident in some of the other time series which have been reported.

Still, the full effects of tariffs won't really be known until the trade

reports for August and September are released. Meanwhile, container volume data

which is more up to date could shed some light on this, and we will be looking more

closely at that.

Some further hints could come from Germany's ZEW investor August sentiment

survey for Germany. This showed a surprising improvement in July to 52.7 from

50.2 in June. The institute also helpfully provides an index for the Euro area

economies, which improved to 36.1 in July from 35.3 in June.

Final inflation figures are coming next week for Italy, Germany, and France and

are not showing any indications that prices are accelerating among the three

biggest EU economies. Neither the European Central Bank nor the Swiss National

Bank will be having any headaches about inflation. Also, with the Euro and

Swiss Franc relatively stronger against the dollar, imported inflation isn't a

problem for the foreseeable future.

Asia-Pacific Preview

Market Sees RBA Rate Cut as Inflation Ebbs

By Brian Jackson, Econoday Economist

The Reserve Bank of Australia's policy meeting will be the

main event on the Asia-Pacific calendar in the week ahead. At the previous RBA

meeting last month, officials unexpectedly left policy rates hold at 3.85

percent but the statement accompanying the decision also, for the first time,

advised how many members on the board voted in favour of the decision. Only six

of the nine members voted for no change and the statement also said that

"the decision today was about timing rather than direction." Since then,

inflation data have shown a further moderation in price pressures, suggesting a

rate cut next week is likely. Australian labor market data are also scheduled

fo release later in the week.

The other big focus will be monthly Chinese business activity data for July.

Data released so far have provided contrasting information about the strength

of the Chinese economy. Purchasing managers' surveys have shown further

contraction in the manufacturing sector and subdued conditions in the

non-manufacturing sector in August, suggesting that higher tariffs imposed on

China by the Trump administration are weighing on activity. Trade data

published this week, however, showed export growth picked up, with stronger

demand from other trading partners outweighing a decline in exports to the

United States.

The Week Ahead: Econoday Consensus Forecasts

Monday

Italy CPI for July (Mon 1000 CET; Mon 0800 GMT; Mon 0400

EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.4%

Consensus Forecast, Y/Y: 1.7%

Consensus Range, Y/Y: 1.7% to 1.7%

CPI expected at 0.4 percent on month and 1.7 percent on year

in the July final, unrevised from the flash, showing inflation remains very

restrained.

Tuesday

Australia RBA Announcement (Tue 1430 AEST; Tue 0430 GMT;

Tue 0030 EDT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 3.60%

Consensus Range, Level: 3.60% to 3.60%

The 25 basis point rate cut to 3.60 percent that forecasters

were expecting last time will finally appear at this meeting as inflation

continues to cool.

United Kingdom Labour Market Report for July (Tue 0700

BST; Tue 0600 GMT; Tue 0200 EDT)

Consensus Forecast, ILO Unemployment Rate: 4.7%

Consensus Range, ILO Unemployment Rate: 4.7% to 4.8%

Consensus Forecast, Average Earnings Including Bonus:

5.0%

Consensus Range, Average Earnings Including Bonus: 4.8%

to 5.0%

The ILO jobless rate is seen flat at 4.7 percent in July

versus 4.7 percent in June. Earnings expected up 5.0 percent on year,

unchanged from the June rate.

Germany ZEW Survey for August (Tue 1100 CEST; Tue 0900

GMT; Tue 0500 EDT)

Consensus Forecast, Current Conditions: -63

Consensus Range, Current Conditions: -68 to -60

Consensus Forecast, Economic Sentiment: 40

Consensus Range, Economic Sentiment: 30 to 45

After a nice rebound through July, sentiment is expected to

retreat to 40 in August from 52.7 in July. Current conditions are expected down

to minus 63.0 from minus 59.5.

United States NFIB Small Business Optimism Index for July

(Tue 0600 EDT; Tue 1000 GMT)

Consensus Forecast, Index: 98.9

Consensus Range, Index: 98.0 to 103.0

The index is expected pretty flat at 98.9 in July from 98.6

in June as business sentiment remains dampened by uncertainty over tariffs and

other government policies.

India CPI for July (Tue 1600 IST; Tue 1030 GMT; Tue

0630 EDT)

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.3% to 1.76%

Inflation remains muted with the consensus looking for 1.6

percent in July, down from 2.10 percent in June.

United States CPI for July (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.2%

Consensus Range, CPI - M/M: 0.1% to 0.3%

Consensus Forecast, CPI - Y/Y: 2.8%

Consensus Range, CPI - Y/Y: 2.7% to 2.9%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 3.0% to 3.1%

The consensus looks for headline inflation up 0.2 percent on

month and 2.8 percent on year in July after 0.3 percent and 2.7 percent on year

in June. Core CPI is seen at 0.3 percent and 3.0 percent in July, up from 0.2

percent and 2.9 percent in June. Watch for more signs of tariffs boosting goods

prices. In June core goods ex-autos rose by a scary 0.6 percent and analysts

expect a similar rise in July. Autos are seen as another source of inflation trouble.

Fortunately, services and housing are exerting disinflationary pressure to keep

a lid on things.

Wednesday

Japan PPI for July (Wed 0850 JST; Tue 2350 GMT; Tue

1950 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.5%

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.4% to 2.8%

Producer inflation in Japan is expected to decelerate

further to a 14-month low of 2.5% on year in July after sliding to a 10-month

low of 2.9% in June from 3.3% in May, thanks to fuel subsidies, easing rice

supply shortages and the import cost-cost cutting effects of a firmer yen

( ¥146.71 to the dollar in July's Tokyo interbank average vs. ¥158.06 a year

earlier).

Higher demand for non-ferrous metals in light of a string of

trade deals struck last month between Washington and its allies appears to have

provided some support to the corporate goods price index.

On the month, the CGPI is forecast to post its first

increase in three months, up 0.2%, after slipping 0.2% in June, when lower

costs for fuels, utilities and metal products were partly offset by higher

prices for non-ferrous metals and farm produce. The summertime electricity

surcharge levied by Japan's 10 major power companies likely added a slight

upward pressure to the index last month.

Australia Wage Price Index for Second Quarter (Wed 1130

AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.8% to 1.0%

Consensus Forecast, Y/Y: 3.3%

Consensus Range, Y/Y: 3.3% to 3.3%

WPI expected up 0.8 percent on quarter in Q2 after running

slightly hotter at 0.9 percent in Q1. On year, the consensus sees WPI up 3.3

percent versus 3.4 percent in Q1.

Germany CPI for July (Wed 0800 CEST; Wed 0600 GMT; Wed

0200 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.3% to 0.3%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 2.0% to 2.0%

Consensus Forecast, HICP - M/M: 0.4%

Consensus Range, HICP - M/M: 0.4% to 0.4%

Consensus Forecast, HICP - Y/Y: 1.8%

Consensus Range, HICP - Y/Y: 1.8% to 1.8%

No change expected in the final July reading from the flash

with CPI up 0.3 percent on the month in July and up 2.0 percent on year.

Thursday

Australia Labour Force Survey for July (Thu 1130 AEST;

Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Employment - M/M: 25K

Consensus Range, Employment - M/M: 13K to 50K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.2% to 4.5%

After flatlining for two months, employment is expected to

improve slightly in July. The picture remains troubling and provides the RBA another

reason to cut. Employment is expected up 25,000 on the month in July versus

2,000 in June. The unemployment rate is seen at 4.2 percent versus 4.3 percent

in June.

United Kingdom Monthly GDP for June (Thu 0700 BST; Thu

0600 GMT; Thu 0200 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.2%

GDP predicted up 0.2 percent on the month in June after

declining 0.1 percent in May.

United Kingdom GDP for Second Quarter (Thu 0700 BST; Thu

0600 GMT; Thu 0200 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.1% to 0.3%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.7% to 1.0%

Growth expected at a weaker 0.1 percent on quarter in the

first report for Q2 after rising 0.7 percent in Q1.

United Kingdom Industrial Production for June (Thu 0700

BST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Industrial Production - M/M: 0.5%

Consensus Range, Industrial Production - M/M: 0.3% to

0.5%

Output is expected to rebound by 0.5 percent in June after

dropping 0.9 percent in May.

France CPI for July (Thu 0845 CEST; Thu 0645 GMT; Thu

0245 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 1.0% to 1.0%

Consensus Forecast, HICP - M/M: 0.3%

Consensus Range, HICP - M/M: 0.3% to 0.3%

Consensus Forecast, HICP - Y/Y: 0.9%

Consensus Range, HICP - Y/Y: 0.9% to 0.9%

No change expected in the final July reading from the flash

with CPI up 0.2 percent on the month in July and up 1.0 percent on year.

Eurozone GDP Flash for Second Quarter (Thu 1100 CEST;

Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.1% to 0.1

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 1.4% to 1.4%

The consensus sees no change in the second print for

Eurozone GDP from a gain of 0.1 percent and 1.4 percent year on year in the

first report for Q2. Growth has fallen back to earth in Q2 after an unusual

boost from exports in Q1 when GDP rose 0.6 percent on the quarter.

Eurozone Industrial Production for June (Thu 1100

CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -1.0% to 0.7%

Consensus Forecast, Y/Y: 2.7%

Consensus Range, Y/Y: 2.5% to 3.7%

Output expected down 0.5 percent on quarter and up 2.7

percent on year in June after rising 1.7 percent and 3.7. percent respectively

in May.

United States Jobless Claims for Week 8/9 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 230K

Consensus Range, Initial Claims - Level: 220K to 233K

After the nasty monthly employment report, the consensus

looks for claims to continue rising to 230K after an already worrisome 7K

increase to 226K last week.

United States PPI-Final Demand for July (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.1% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.5% to 2.6%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: 0.1% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 2.7% to 3.0%

The consensus sees PPI-FD up 0.2 percent on month in July

and up 2.6 percent on year after no change on month in June and a 2.3 percent increase

on year.

Friday

Japan GDP for Second Quarter (Fri 0850 JST; Thu 2350

GMT; Thu 1950 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: -0.1% to 0.4%

Consensus Forecast, Annual Rate: 0.4%

Consensus Range, Annual Rate: -0.5% to 1.5%

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.6% to 1.2%

Japan's gross domestic product for the April-June quarter is

forecast to be nearly flat, up just 0.1% on quarter, or an annualized 0.4%, as

stiff Trump tariffs on autos and metals forced Japanese carmakers to slash the

prices for their U.S. customers to protect their market share while 3%

inflation sparked by protracted domestic rice supply shortages hurt consumer

spending.

The sluggish Q2 growth would follow the economy's first

contraction in four quarters in January-March with a slight 0.04% dip

(officially -0.0%), or an annualized -0.2%, which was in payback for a

technical jump in net exports in the previous quarter. It was also due to flat

consumption amid high costs of living and the uncertainty over global growth

and inflation triggered by the protectionist U.S. trade policy.

Domestic demand is expected to provide a positive 0.1

percentage point contribution to total domestic output in Q2 after boosting Q1

GDP by 0.8 point. External demand (exports minus imports) is also estimated to

have raised the Q2 GDP by 0.1 point after pushing down the total output by 0.8

point the previous quarter.

Consensus forecasts for key components in percentage change

on quarter except for private inventories and net exports, whose contributions

are in percentage points. Figures in the previous quarter are in parentheses:

GDP q/q: +0.1% (-0.04%); 1st rise in 2 qtrs

GDP annualized: +0.4% (-0.2%); 1st rise in 2 qtrs

GDP y/y: +0.8% (+1.7%); 4th straight rise

Domestic demand: +0.1 point (+0.8 point); 2nd straight rise

Private consumption: +0.1% (+0.1%); 5th straight rise

Business investment: +0.8% (+1.1%); 5th straight rise

Public investment: +1.1% (-0.6%); 1st rise in 4 qtrs

Private inventories: -0.3 point (+0.6 point); 1st drop in 2

qtrs

Net exports (external demand): +0.1 point (-0.8 point), 1st

rise in 2 qtrs

China Fixed Asset Investment for July (Fri 1000 CST; Fri

0200 GMT; Thu 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 2.8%

Consensus Range, Year to Date on Y/Y Basis: 2.6% to 3.1%

Forecasters see FAI growth year on year at a sluggish 2.8

percent, year to date, flat from June, and well down from 4.0 percent in the

first part of the year.

China Industrial Production for July (Fri 1000 CST; Fri

0200 GMT; Thu 2200 EDT)

Consensus Forecast, Y/Y: 5.9%

Consensus Range, Y/Y: 5.6% to 6.4%

Growth in industrial production is seen declining to 5.9

percent on year in May versus 6.8 percent in June.

China Retail Sales for July (Fri 1000 CST; Fri 0200

GMT; Thu 2200 EDT)

Consensus Forecast, Y/Y: 4.6%

Consensus Range, Y/Y: 4.3% to 5.0%

The consensus sees sales growth from a year ago at 4.6

percent in July versus 4.8 percent in June.

United States Retail Sales for July (Fri 0830 EDT; Fri

1230 GMT)

Consensus Forecast, Retail Sales - M/M: 0.5%

Consensus Range, Retail Sales - M/M: 0.1% to 1.0%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: -0.1% to 0.6%

Retail sales are seen up 0.5 percent in July on the month

and up 0.3 percent ex-autos. Autos bounced back in July to lead overall sales.

Forecasters expect consumer spending to fade as the year goes on as employment

slackens and price increases bite.

Canada Manufacturing Sales for June (Fri 0830 EDT; Fri

1230 GMT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.7%

The consensus agrees with the Statistics Canada preliminary

estimate: up 0.4 percent.

United States Empire State Manufacturing Index for August

(Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Index: 0.5

Consensus Range, Index: -10.0 to 10.0

The Empire index is expected to slip to 0.5 in August from

5.5 in July.

United States Import and Export Prices for July (Fri 0830

EDT; Fri 1230 GMT)

Consensus Forecast, Import Prices - M/M: 0.1%

Consensus Range, Import Prices - M/M: 0.0% to 0.3%

Consensus Forecast, Import Prices - Y/Y: -0.2%

Consensus Range, Import Prices - Y/Y: -0.4% to 0.0%

Consensus Forecast, Export Prices - M/M: 0.1%

Consensus Range, Export Prices - M/M: 0.0% to 0.6%

Import prices expected up 0.1 percent on the month and down

0.2 percent on year. Export prices seen up 0.1 percent on the month too.

United States Industrial Production for July (Fri 0915

EDT; Fri GMT)

Consensus Forecast, Industrial Production - M/M: 0.0%

Consensus Range, Industrial Production - M/M: -0.3%

to 0.3%

Consensus Forecast, Manufacturing Output - M/M: 0.1%

Consensus Range, Manufacturing Output - M/M: -0.1% to

0.1%

Consensus Forecast, Capacity Utilization Rate: 77.6%

Consensus Range, Capacity Utilization Rate: 77.3% to 77.8%

Another muted showing for industrial production with output

flat and capacity utilization unchanged at 77.6 percent.

United States Business Inventories for June (Fri 1000

EDT; Fri 1600 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.1% to 0.2%

Business inventories expected up 0.2 percent on the month.

United States Consumer Sentiment for August (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 62.1

Consensus Range, Index: 60.0 to 63.5

Another modest improvement is expected at 62.1 in the

preliminary August report versus 61.7 in July and 60.7 in June. The view of

current conditions have improved even as expectations remain gloomy.

|