|

The Week Ahead: Highlights

Europe Preview

ECB Expected to Keep Rates on Hold

By Marco Babic, Econoday Economist

After holding rates

steady at its last meeting, the ECB is likely to stay pat at its meeting next

Thursday, keeping the Refinancing Rate at 2.15 percent and the Deposit Rate at

2.0 percent. There wasn't much in the data since the last meeting to suggest a

change, with inflation well within the ECB's comfort zone. Moreover, PMI

reports in Europe have recovered, with those in some countries dipping a toe

into expansion.

That's not to say all of the data coming out of Europe has been rosy. Last

Friday, July manufacturing orders fell 2.9 percent month-on-month and 3.5

percent on the year. The usual caveats apply in that the series can be volatile

and in this case was affected by a drop in large orders. That sets the tone for

next week when Germany, France, and Italy report industrial production.

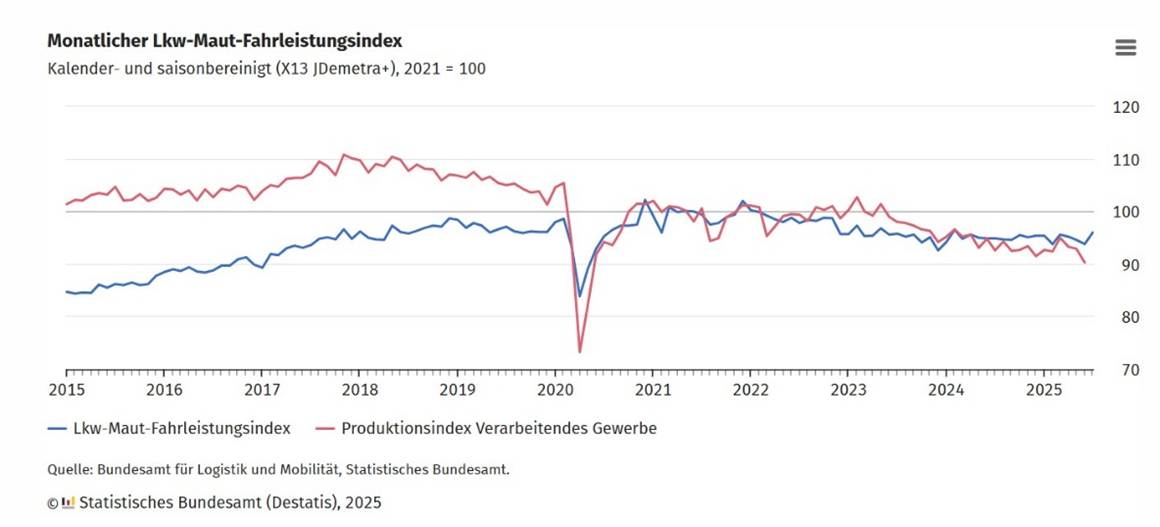

In June, industrial output in Germany fell 1.9 percent from May and 3.5 percent

from a year ago. One glimmer of hope for a rebound in production is Germany's

truck toll index which measures the activity of trucks with at least four axles

that are subject to tolls, and is designed to give insight into the direction

of industrial output. In July, the index was up 2.3 percent on the month and

1.1 percent year-on-year.

France reports industrial production for July on Tuesday, and observers will be

keen to see if it can match June's gains of 3.8 percent from May and 2.0

percent from a year ago. There are indications that businesses were pushing up

production ahead of the imposition of US tariffs. For Italy, production didn't

fare as well, falling 0.2 percent in June month-on-month, and gaining 0.9

percent from June of last year.

Germany also reports its

July trade results. In June, exports rose 0.8 percent from May and a tepid 0.1

percent year-on-year, with increased imports shrinking the surplus to 14.9

billion euros. US trade data released last week showed the US trade balance

with Germany widening to $6.27 billion in July from $3.76 billion in June. The

US exported less to and imported more from Germany in July than in June, with

imports of $12.73 billion versus $11.08 billion the month before. Exports

shrank to $6.55 billion from $7.23 billion.

Final CPI results for

Germany and France round out the week on Friday, with little to no change

expected from preliminary results which for Germany were a 0.1 percent monthly

gain and a 2.2 percent rise over a year ago. French inflation was a tamer 0.4 percent

month-on-month and 0.9 percent year on year. Either way, the ECB has the

preliminary data at its disposal which is certainly not going to be of present

concern.

US Preview

Market Eyes Inflation Reports as FOMC Weighs Rate Cuts

By Theresa Sheehan,

Econoday Economist

With the September 16-17

FOMC meeting on the near horizon, the focus will be on the August inflation

reports in the September 8 week. The reports released in the September 1 week

related to employment collectively signaled further weakening in the labor market.

This tips the balance of the FOMC's dual mandate more toward the need for some

support to achieving maximum employment. However, the FOMC will not ignore the

price stability side of the mandate.

Note that the BLS will

release its preliminary benchmark revision for March 2025 at 10:00 ET on

Tuesday. This won't change the tone of the recent data. It will affect how

markets anticipate the annual revisions to nonfarm payrolls that are issued in

February along with the January data.

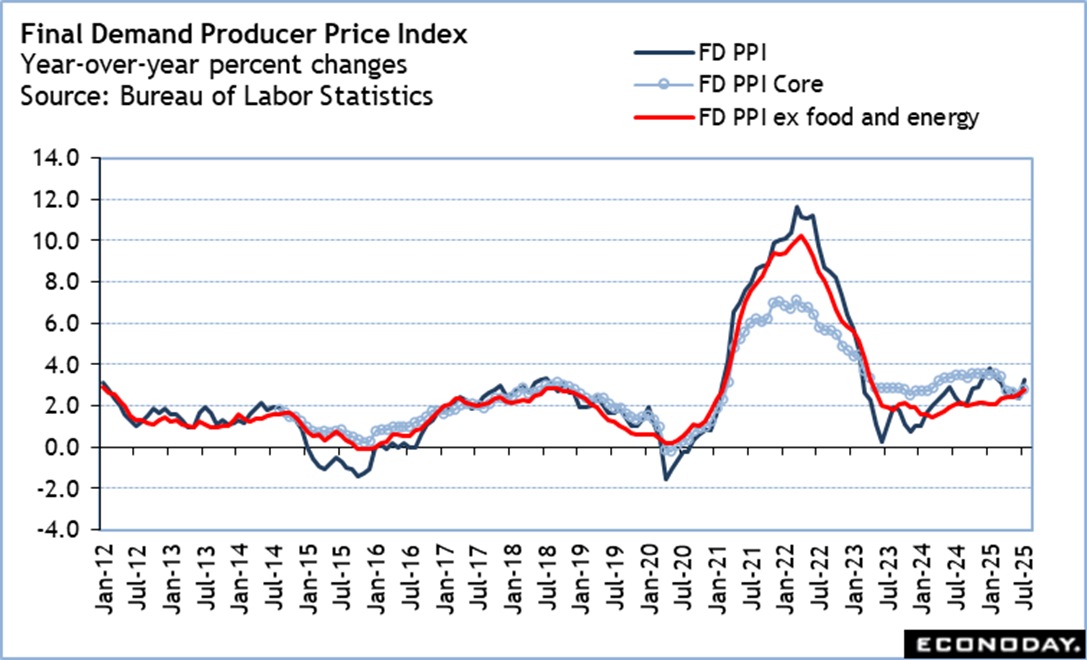

The August report on

final-demand PPI is set for release at 8:30 ET on Wednesday. The July report

pushed the year-over-year increase for the final demand index up to 3.3 percent

from 2.4 percent in June. The BLS core index - excluding food, energy, and trade

services - was up 2.8 percent year-over-year in July after up 2.5 percent in

June. If August presents evidence that producer price increases are

accelerating, it means that future CPI readings are also likely to accelerate.

The CPI for August at

8:30 ET on Thursday may show the influence of pass-through from the increased

costs in the producer level in the prior month. The year-over-year increase in

the all-items index of 2.7 percent in July was the same as in June. However,

the core CPI was up 3.1 percent year-over-year in July, up two-tenths from the

June reading. The July CPI was held down by weaker energy prices and no change

in food and beverages. If energy prices aren't much higher in August, food

prices are on the rise.

Evidence of weak

employment and rising inflation present a tricky combination for the FOMC to

resolve. Much will depend on if policymakers view the rises in prices as

short-term events or likely to lead to another cycle of price increases.

Asia-Pacific Preview

Inflation, Trade Reports in Focus

By Brian Jackson, Econoday

Economist

Inflation and trade data

will be the main focus of a light regional data calendar in the Asia-Pacific in

the week ahead. Chinese inflation data have shown weak price pressures all year

with consumer prices unchanged on the year in July and producer prices showing

ongoing deflation. Officials, however, have shown little indication that this

weakness warrants a big shift in policy settings. India inflation, meanwhile,

has remained heavily impacted by volatility in food prices in recent months,

broadly in line with the expectations of Reserve bank of India officials.

After South Korean trade data published this week showed weaker export growth

in August, China and Taiwan will report next week. Chinese exports grew at a

faster pace in July, but this likely reflects the re-routing of exports

ultimately destined for the United States as part of efforts to avoid the

impact of higher US tariffs. Despite global trade tensions, Taiwan's exports

have grown at a fast pace in recent months, reflecting very strong demand for

information, communication and audio-video products.

Australia will also report consumer and business confidence data next week.

Last month's cut in policy rates by the Reserve Bank of Australia has likely

provided some support to sentiment.

The Week Ahead: Econoday Consensus Forecasts

Monday

Japan GDP for Second

Quarter (Mon 0850 JST; Sun 2350 GMT; Sun 1950 EDT)

Consensus Forecast, Q/Q:

0.2%

Consensus Range, Q/Q:

0.2% to 0.5%

Consensus Forecast, Annual

Rate: 0.9%

Consensus Range, Annual

Rate: 0.7% to 1.9%

Consensus Forecast,

Y/Y: 1.3%

Consensus Range, Y/Y:

1.2% to 1.4%

The second reading of Japan's GDP data for the April-June quarter is expected

to confirm that the sluggish but somewhat resilient economy posted its fifth

straight quarter-on-quarter growth, up 0.2% on quarter (0.9% annualized),

little changed from the initial estimate of 0.3% (1.0% annualized). The

preliminary data released on Aug. 15 showed that the stronger-than-expected Q2

growth was supported by a rebound in net exports amid modest export gains and

weak imports. Domestic demand dipped amid elevated costs of living and falling

wages as well as uncertainty over global growth.

In the revised Q2 GDP data, domestic demand is forecast to have provided a

slightly positive 0.1 percentage point contribution to total domestic output

(revised up from -0.1 point). The decline in private sector inventories by -0.3

point (unrevised) overwhelmed a 1.2% rise q/q (no forecasts for contribution)

in business investment, revised down from +1.3% (+0.2 point). External demand

(exports minus imports) is believed to have pushed up the Q2 GDP by 0.3 point,

as reported last month.

China Merchandise

Trade for August (ANYTIME)

Consensus Forecast, Balance

of Trade: $97.8 B

Consensus Range,

Balance of Trade: $95 B to $115.9 B

Consensus Forecast, Imports

- Y/Y: 4.3%

Consensus Range, Imports

- Y/Y: -0.5% to 6.2%

Consensus Forecast, Exports

- Y/Y: 5.4%

Consensus Range, Exports

- Y/Y: 3.8% to 7.6%

The surplus is seen at $97.8

billion in August versus $98.24 billion in July. China trade stability reflects

the ongoing trade war truce between the US and China.

Germany Industrial

Production for July (Mon 0800 CEST; Mon 0600 GMT; Mon 0200 EDT)

Consensus Forecast, M/M:

1.2%

Consensus Range, M/M:

0.5% to 1.5%

Output is expected to

rebound by 1.2 percent on the month in July after falling 1.9 percent in June.

Germany Merchandise

Trade for July (Mon 0800 CEST; Mon 0600 GMT; Mon 0200 EDT)

Consensus Forecast, Balance:

E 15.5 B

Consensus Range, Balance:

E15.0 B to E21.4 B

The surplus is expected

to widen slightly to E15.5 billion in July from E14.9 billion in June.

United States Consumer

Credit for July (Mon 1500 EDT; Mon 1900 GMT)

Consensus Forecast, M/M:

$10.0 B

Consensus Range, M/M: $8.2

B to $17.7 B

The consensus sees

consumer credit rising by a more robust $10.0 billion in July after increasing

by $7.4 billion in June.

Tuesday

United States NFIB

Small Business Optimism Index for August (Tue 0600 EDT; Tue 1000 GMT)

Consensus Forecast, Index:

100.5

Consensus Range, Index:

99.5 to 101.0

The index is expected almost

flat at 100.5 in August from 100.3 in July as small business sentiment has

steadied after recovering from early-year lows as tariff fears have eased.

Wednesday

China CPI for August (Wed

0930 CST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast,

Y/Y: -0.2%

Consensus Range, Y/Y:

-0.3% to -0.1%

Flagging demand is seeing

inflation go negative again, not a desirable scenario for the PBOC.

The consensus looks for

CPI down 0.2 percent on year in August after a flat reading in July.

China PPI for August (Wed

0930 CST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast,

Y/Y: -2.9%

Consensus Range, Y/Y:

-3.0% to -2.8%

China's wholesale price

deflation problem worsened to show a minus 3.6 percent PPI figure in July as

weak domestic demand and the US trade war depressed prices. The consensus sees

a better showing in August, down 2.9 percent, as the government's

anti-involution efforts take hold.

Italy Industrial

Production for July (Wed 1000 CEST; Wed 0800 GMT; Wed 0400 EDT)

Consensus Forecast, M/M:

0.3%

Consensus Range, M/M:

0.0% to 0.5%

The consensus sees

industrial production up a moderate 0.3 percent on the month in July after

rising 0.2 percent in June.

United States PPI-Final

Demand for August (Wed 0830 EDT; Wed 1230 GMT)

Consensus Forecast,

PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD

- M/M: 0.2% to 0.6%

Consensus Forecast, PPI-FD

- Y/Y: 3.3%

Consensus Range, PPI-FD-

Y/Y: 3.3% to 3.3%

Consensus Forecast, Ex-Food

& Energy - M/M: 0.3%

Consensus Range, Ex-Food

& Energy - M/M: 0.2% to 0.4%

Consensus Forecast, Ex-Food

& Energy - Y/Y: 3.5%

Consensus Range, Ex-Food

& Energy - Y/Y: 3.4% to 3.7%

Consensus Forecast, Ex-Food,

Energy & Trade Services - M/M: 0.3%

Consensus Range, Ex-Food,

Energy & Trade Services - M/M: 0.3% to 0.3%

The consensus sees PPI-FD

up 0.3 percent on month in August and up 3.3 percent on year after an ugly

increase of 0.9 percent on month and 3.3 percent on year in July. The June

figure reflected a tariff jolt which should be more muted in August. Lower energy

prices should help too.

United States

Wholesale Inventories (Preliminary) for July (Wed 1000 EDT; Wed 1400 GMT)

Consensus Forecast,

M/M: 0.2%

Consensus Range, M/M:

-0.1% to 0.3%

Forecasters expect

inventories unrevised from the flash at an increase of 0.2 percent.

Thursday

Japan PPI for August (Thu

0850 JST; Wed 2350 GMT; Wed 1950 EDT)

Consensus Forecast, M/M:

-0.1%

Consensus Range, M/M:

-0.2% to 0.1%

Consensus Forecast,

Y/Y: 2.8%

Consensus Range, Y/Y:

2.5% to 2.9%

Producer inflation in

Japan is expected to pick up to 2.8% on year in August after easing to an

11-month low of 2.6% in July from 2.9% in June in light of summertime fuel

subsidies, slowly easing rice supply shortages and the import cost-cost cutting

effects of a firmer yen.

Higher demand for non-ferrous metals, first in anticipation for easing trade

conflicts, then in light of trade deals between Washington and its allies, have

provided some support to the corporate goods price index in the past couple of

months.

On the month, the CGPI is forecast to post its first drop in two months, down

0.1%, after rising 0.2% in July and slipping 0.2% in June. The increase in July

was led by higher costs for fuels (gasoline, diesel, heavy fuels), utilities

(electricity), farm produce (polished rice, pork, beef) and non-ferrous metals.

Eurozone ECB

Announcement (Thu 1415 CEST; Thu 1215 GMT; Thu 0815 EDT)

Consensus Forecast,

Refi Rate Change: 0 bp

Consensus Range, Refi

Rate Change: 0 bp to 0 bp

Consensus Forecast,

Refi Rate Level: 2.15%

Consensus Range, Refi

Rate Level: 2.15% to 2.15%

Consensus Forecast,

Deposit Rate Change: 0 bp

Consensus Range,

Deposit Rate Change: 0 bp to 0 bp

Consensus Forecast,

Deposit Rate Level: 2.00%

Consensus Range,

Deposit Rate Level: 2.00% to 2.00%

The consensus looks for

the ECB to remain on hold, based on the most recent comments from monetary

officials. Markets are watching closely how the ECB assesses the economic

outlook and inflation prospects in its latest projections, including the

prospect of more disinflation. Like the Fed, the ECB is likely to say policy

remains data-dependent. Some analysts say the ECB is done with rate cuts in the

current cycle.

United States CPI for

August (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, CPI

- M/M: 0.3%

Consensus Range, CPI -

M/M: 0.3% to 0.4%

Consensus Forecast, CPI

- Y/Y: 2.9%

Consensus Range, CPI -

Y/Y: 2.8% to 3.0%

Consensus Forecast, Ex-Food

& Energy - M/M: 0.3%

Consensus Range,

Ex-Food & Energy - M/M: 0.3% to 0.4%

Consensus Forecast, Ex-Food

& Energy - Y/Y: 3.1%

Consensus Range, Ex-Food

& Energy - Y/Y: 3.1% to 3.1%

Rising core goods prices

due to increasing tariff effects are giving us stiff monthly increases in CPI

even as core services inflation fades. The consensus sees CPI up 0.3 percent on

the month for total and core in August. The call for CPI on year is 2.9 percent

and 3.1 percent for core. The numbers is not likely to change the Fed's

trajectory of rate cuts starting in September given the slowdown in job growth.

United States Jobless

Claims for Week 9/06 (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial

Claims - Level: 234K

Consensus Range,

Initial Claims - Level: 225K to 247K

Claims seen down at 234K

after rising by a surprising 8K to 237K in the previous week. Notwithstanding

the weak payrolls figures, claims suggest a broadly stable employment market.

The 4-week moving average was last at 231K.

Friday

Germany CPI for August

(Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast,

M/M: 0.1%

Consensus Range, M/M:

0.1% to 0.2%

Consensus Forecast,

Y/Y: 2.2%

Consensus Range, Y/Y:

2.2% to 2.2%

Consensus Forecast, HICP

- M/M: 0.1%

Consensus Range, HICP

- M/M: 0.1% to 0.1%

Consensus Forecast, HICP

- Y/Y: 2.1%

Consensus Range, HICP

- Y/Y: 2.1% to 2.1%

The consensus looks for

no revision in the final report from the flash at ncreases of 0.1 percent on

month and 2.2 percent on year for August.

United Kingdom Monthly

GDP for July (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M:

0.1%

Consensus Range, M/M:

0.0% to 0.2%

Consensus Forecast, Q/Q:

0.2%

Consensus Range, Q/Q:

0.2% to 0.3%

Growth seen at a modest

0.1 percent on the month in July after a hefty 0.4 percent in June.

United Kingdom Merchandise

Trade for July (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Balance:

-£21.7 B

Consensus Range,

Balance: -£21.8 B to -£21.5 B

The trade gap is expected

nearly flat at Stg 21.7 billion in July versus Stg 22.16 in June

France CPI for August (Fri

0845 CEST; Fri 0645 GMT; Fri 0245 EDT)

Consensus Forecast,

M/M: 0.4%

Consensus Range, M/M:

0.4% to 0.5%

Consensus Forecast,

Y/Y: 0.9%

Consensus Range, Y/Y:

0.8% to 0.9%

Consensus Forecast, HICP

- M/M: 0.5%

Consensus Range, HICP

- M/M: 0.5% to 0.5%

Consensus Forecast, HICP

- Y/Y: 0.8%

Consensus Range, HICP

- Y/Y: 0.8% to 0.8%

The consensus looks for

no revision in the final report from the flash at increases of 0.4 percent on

month and 0.9 percent on year for August.

United States Consumer

Sentiment for August (Fri 1000 EDT; Fri 1400 GMT)

Consensus Forecast, Index:

58.0

Consensus Range, Index:

57.0 to 66.0

The first report for

September is expected to show sentiment failing to recover at 58.0 after

falling to 58.2 in August from 61.7 in July. Consumers are clearly still in a

bad mood as job worries are rising and inflation fears continue.

|