|

The Week Ahead: Highlights

Europe Preview

What Will European Trade Data Show?

By Marco Babic, Econoday Economist

The week ahead brings July trade data for Italy and the

Eurozone, and August results for Switzerland. The Swiss data will be the most

interesting since it is the major country reporting full results for August

which is when the tariffs came into full effect. The EU has been dealing with a

15 percent tariff regime while Switzerland is under the weight of 39 percent

duties, with no clear end in sight.

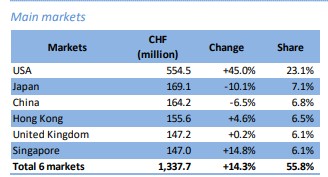

In July, Swiss wristwatch exports grew 7.5 percent, with a 45 percent increase

in those to the United States, in anticipation of the tariffs. Swiss trade data

is released on Friday, with the Federation of the Swiss Watch Industry

reporting August data on Thursday, which could give an insight into the effects

of the tariffs. While exports to the US will likely suffer, it will be of

interest to see if they expand into other markets.

The EU trade deal with the US is seen in Europe as widely unpopular, with many

observers saying the EU conceded far too much to the US. In Switzerland, there

has been no discernable progress in talks to lower the 39 percent tariffs. It

could be that both the EU and the Swiss government are taking a wait-and-see

approach in anticipation of the US Supreme Court ruling on the duties. An

appellate court upheld a trade court ruling that most of the tariffs are

illegal. A ruling by the Supreme Court could come in August.

Germany's ZEW reports investor sentiment for September on

Tuesday. In August both current conditions and economic sentiment eroded as the

view among investors that the trade deal with the US was unfavorable to the EU.

Current conditions slipped to minus 68.6 from minus 59.5 in July, while

economic sentiment fell to 34.7 from 52.7 in July. Since then, there have been

no substantial developments suggesting a major turnaround.

On the inflation front, Switzerland and Germany report PPI

data for August. In July, there was no evidence that pipeline inflation is

heading up, having fallen 0.2 percent month on month and 0.9 percent

year-on-year in Switzerland. In Germany, it fell by 0.1 percent from June and

1.5 percent from a year ago.

Italy and the Eurozone also report their final CPI figures for August, with

likely no change from preliminary readings.

Last week the ECB elected to keep interest rates unchanged, underscoring the

lack of immediate inflationary concerns. If anything, the risk is tilted

towards a slowing economy and with inflation within the ECB's comfort zone, it

makes its job easier to cut rates should the economy weaken.

US Preview

Fed Policy Decision in Focus; Markets See 25 BP Rate Cut

By Theresa Sheehan, Econoday Economist

Although there are some important economic data reports in

the September 15 week - notably August retail sales and on the housing market

for July and August - there will be little attention to spare for anything

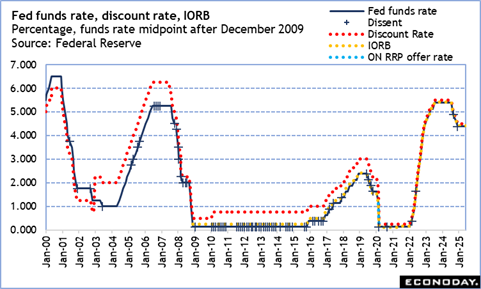

except the September 16-17 FOMC meeting. The majority of forecasters anticipate

a 25-basis point cut to the current fed funds target rate of 4.25-4.50 percent.

This would be the first cut since November 2024.

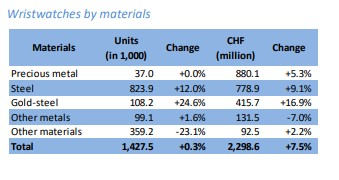

Since the release of the BLS annual benchmark revision for

March 2025 of minus 911,000, the FOMC has faced widespread criticism that they

are behind on rate cuts. However, that is hindsight on labor market conditions

and the FOMC determines policy based on the available data. The revision tells

us that there were significantly fewer gains in payrolls, not that payrolls did

not gain. Also, if there were fewer jobs added than previously thought, this

did not affect the unemployment rate which was delivering comfortable readings

in recent years and is only just now starting to move higher.

It should be noted that economic performance as measured by

GDP pointed to a resilient economy as the labor market supply and demand

rebalanced with little reason to think the labor market was not healthy. The

maximum employment side of the dual mandate is about supporting the economy

through setting interest rates which in turn encourages businesses to hire.

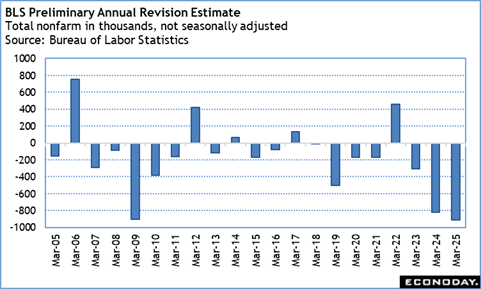

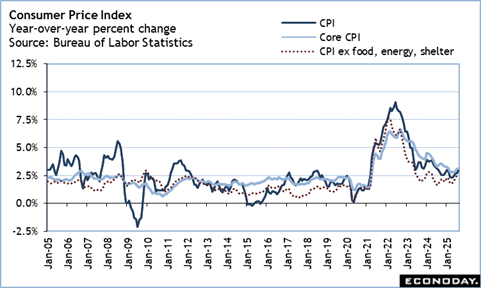

As to price stability, recent readings of the consumer price

index (CPI) point to year-over-year increases at levels the FOMC terms as

"elevated" and the progress in disinflation is at a standstill. It is widely

accepted that higher tariffs are adding significant costs along the supply

chain. The questions for the FOMC are how much cost, who is going to pay it -

sources, middlemen, or consumers - and will this be a short-term impact or lead

to more persistent price pressures?

The FOMC will release its post-meeting statement at 14:00 ET

on Wednesday. Accompanying it will be the quarterly update to the summary of

economic projections (SEP). The most likely policy decision will be a 25-basis

point cut, although a 50-basis point cut is not out of the question. If it is

25-basis points, it is probable that Governor Christopher Waller and Vice Chair

for Supervision Michelle Bowman will dissent again in favor of a 50-basis point

cut. The SEP could well feature some downward revisions in the outlook for

growth and upward revisions for the unemployment rate and PCE deflator. It

could also raise the possibility of a rate cut at both the remaining meetings

in 2025 - October 28-29 and December 9-10 - and the potential for more cuts

into 2026.

Fed Chair Jerome Powell can look forward to hard questioning

at his 14:30 ET press conference. He will doubtless receive a number of

questions on topics he will decline to address - about the Trump administration

and its hostility to the Fed, about fiscal policy and funding of the federal

government, about his plans for the future, and about the US dollar and trade.

What he can try to answer is those involving why the FOMC decided policy as it

has, what it makes of recent revised data reports, how it is balancing the dual

mandate, the contents of the SEP, and the potential for a recession.

Asia-Pacific Preview

China Industrial Production, Retail Sales Reports Ahead

By Brian Jackson, Econoday Economist

Monthly Chinese activity data for August is the main focus

of the Asia-Pacific data calendar in the week ahead. PMI surveys have shown

ongoing weakness in the manufacturing sector but some improvement in conditions

in the non-manufacturing sector in August, while trade data have shown weaker

growth in exports. This suggests that higher US tariffs on Chinese continue to

weigh on China's economy, though officials so far have shown little sign that

they believe a shift in policy settings is required.

The impact of global trade tensions will also be reflected in trade data

scheduled for release by Singapore, New Zealand and India. The Singapore data

will likely provide the best indication of regional trade flows after South

Korean data published earlier in the month showed weaker growth in both imports

and exports. In adoration, New Zealand will publish GDP data, while Australia

will labor market data.

In Taiwan, the Central Bank of China holds its quarterly policy meeting

mid-week. The bank's main policy rate has been on hold at 2.00 percent since

March 2004 and stable core inflation and strong growth in both exports and

industrial production suggest this policy stability will continue next week.

The Week Ahead: Econoday Consensus Forecasts

Monday

China Fixed Asset Investment for August (Mon 1000

CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 1.4%

Consensus Range, Year to Date on Y/Y Basis: 1.4% to 1.5%

Forecasters see FAI growth year on year even worse at 1.4

percent in August versus an already-low 1.6 percent in July.

China Industrial Production for August (Mon 1000 CST;

Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 5.6%

Consensus Range, Y/Y: 5.1% to 6.2%

Growth in industrial production is seen nearly flat at 5.6

percent on year in August versus 5.7 percent in July.

China Retail Sales for August (Mon 1000 CST; Mon 0200

GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.4% to 5.0%

The consensus sees continued muted sales growth (for China) from

a year ago at 3.8 percent in August versus 3.7 percent in July.

India Wholesale Price Index for August (Mon 1200 IST;

Mon 0630 GMT; Mon 0230 EDT)

Consensus Forecast, Y/Y: -0.3%

Consensus Range, Y/Y: -0.3% to 0.3%

WPI expected at minus 0.3 percent on year in August versus a

surprisingly low minus 0.58 percent in July.

Canada Manufacturing Sales for July (Mon 0830 EDT;

Mon 1230 GMT)

Consensus Forecast, M/M: 1.8%

Consensus Range, M/M: 1.7% to 1.8%

Forecasters agree with the Statistics Canada preliminary

estimate that sales jumped 1.8 percent in July after rising 0.3 percent in

June.

United States Empire State Manufacturing Index for

September (Mon 0830 EDT; Mon 1230 GMT)

Consensus Forecast, Index: 4.3

Consensus Range, Index: -6.0 to 8.0

The consensus sees the index fading to 4.3 in August from

11.9 in July.

Tuesday

United Kingdom Labour Market Report for August (Tue 0700

BST; Tue 0600 GMT; Tue 0200 EDT)

Consensus Forecast, ILO Unemployment Rate: 4.7%

Consensus Range, ILO Unemployment Rate: 4.7% to 4.7%

Consensus Forecast, Average Earnings - Y/Y: 4.6%

Consensus Range, Average Earnings - Y/Y: 4.5% to 4.7%

The ILO jobless rate is seen flat at 4.7 percent in August

versus 4.7 percent in July. Average earnings including bonus are also expected

unchanged with an increase of 4.6 percent on year versus 4.6 percent in July.

Italy CPI for August (Tue 1000 CEST; Tue 0800 GMT; Tue

0400 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.6% to 1.6%

Forecasters see the final CPI unrevised from the flash at

0.1 percent on month and 1.6 percent on year.

Eurozone Industrial Production for July (Tue 1100

CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: -1.3% to 0.7%

Consensus Forecast, Y/Y: 1.7%

Consensus Range, Y/Y: 0.9% to 3.7%

Output expected up 0.5 percent on month and 1.7 percent on

year in July after falling 1.3 percent and rising 0.2 percent respectively in

June.

Germany ZEW Survey for September (Tue 1100 CEST; Tue 0900

GMT; Tue 0500 EDT)

Consensus Forecast, Current Conditions: -74

Consensus Range, Current Conditions: -75 to -66

Consensus Forecast, Economic Sentiment: 25.7

Consensus Range, Economic Sentiment: 15 to 36

Current conditions expected even worse at minus 74 in

September versus an already dismal minus 68.6 in August. Economic sentiment is

seen at 25.7 in September versus 34.7 in August.

Canada Housing Starts for August (Tue 0815 EDT; Tue 1215

GMT)

Consensus Forecast, Annual Rate: 274K

Consensus Range, Annual Rate: 240K to 280K

Starts are expected to recede to 274K August from a

surprisingly strong 294K in July.

Canada CPI for August (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: 0.0%

Consensus Range, CPI - M/M: -0.1% to 0.2%

Consensus Forecast, CPI - Y/Y: 2.0%

Consensus Range, CPI - Y/Y: 1.8% to 2.1%

Forecasters see CPI unchanged on the month and up 2.0

percent on year in August versus increases of 0.3 percent and 1.7 percent in

July.

United States Retail Sales for August (Tue 0830 EDT; Tue

1230 GMT)

Consensus Forecast, Retail Sales - M/M: 0.3%

Consensus Range, Retail Sales - M/M: 0.1% to 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Range, Ex-Vehicles - M/M: 0.0% to 0.5%

The consensus looks for sales up a decent 0.3 percent in

August with sales ex-autos up 0.4 percent. That would follow increases of 0.5

percent and 0.3 percent, respectively, in July, which all suggests pretty

resilient consumer spending.

United States Import and Export Prices for August (Tue

0830 EDT; Tue 1230 GMT)

Consensus Forecast, Import Prices - M/M: -0.2%

Consensus Range, Import Prices - M/M: -0.3% to 0.2%

Consensus Forecast, Import Prices - Y/Y: 0.0%

Consensus Range, Import Prices - Y/Y: -0.2% to 0.2%

Consensus Forecast, Export Prices - M/M: -0.2%

Consensus Range, Export Prices - M/M: -0.3% to 0.2%

Import prices are expected down 0.2 percent on the month and

exports also down 0.2 percent on the month in August after rising 0.4 percent

and 0.1 percent in July.

United States Industrial Production for August (Tue 0915

EDT; Tue GMT)

Consensus Forecast, Industrial Production - M/M: 0.0%

Consensus Range, Industrial Production - M/M: -0.4%

to 0.3%

Consensus Forecast, Manufacturing Output - M/M: 0.1%

Consensus Range, Manufacturing Output - M/M: -0.4% to

0.4%

Consensus Forecast, Capacity Utilization Rate: 77.4%

Consensus Range, Capacity Utilization Rate: 77.1% to

77.8%

The consensus sees industrial output flat and manufacturing

up only 0.1 percent on the month with capacity utilization easing to 77.4 percent

from 77.5 percent in July. June saw a similar weak showing with industrial

production down 0.1 percent and manufacturing flat.

United States Business Inventories for July (Tue 1000

EDT; Tue 1600 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Business inventories are expected up 0.2 percent in July

from June.

United States Housing Market Index for September (Tue

1000 EDT; Tue 1400 GMT)

Consensus Forecast, Index: 33

Consensus Range, Index: 32 to 38

Builder sentiment is seen remaining depressed with the

housing market index at 33 in September after declining to 32 in August from 33

in July and 41 in September last year.

Wednesday

Japan Merchandise Trade for August (Wed 0850 JST; Tue

2350 GMT; Tue 1950 EDT)

Consensus Forecast, Balance: ¥-518.60 B

Consensus Range, Balance: ¥-648.40 B to ¥-247.60 B

Consensus Forecast, Imports - Y/Y: -5.5%

Consensus Range, Imports - Y/Y: -6.5% to -4.1%

Consensus Forecast, Exports - Y/Y: -2.9%

Consensus Range, Exports - Y/Y: -5.3% to -1.0%

Key forecast points:

Japanese export values are forecast to post their fourth

straight year-on-year drop in August, down 2.9%, after falling 2.6% in July,

hit by the protectionist U.S. trade policy focused on the auto and metals

industries as well as lingering sluggish demand from China. Toyota and other

Japanese carmakers have slashed the prices to defend their share in the

all-important U.S. market, pulling down overall export values.

Import values are expected to dip 5.5% for a second straight

drop following a 0.7% slip in July. The decrease is seen driven by continued

y/y declines in prices for crude oil and coal as well as in payback for recent

higher drug purchases. Imports of smartphones remain solid and those of

computers are also strong before Microsoft stops supporting its operating

system Windows 10 later this year.

Combining those factors, the trade balance is forecast to

post a deficit of ¥518.60 billion following a revised ¥118.44 deficit in July.

It would compare with a ¥711.44 billion deficit in August 2024.

United Kingdom CPI for August (Wed 0700 BST; Wed 0600

GMT; Tue 0200 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.3% to 0.4%

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.8% to 3.9%

UK annual inflation seen at a nasty 3.8 percent in August,

same as in July. Month on month, the consensus looks for an increase of 0.3

percent after rising 0.1 percent in July.

Eurozone HICP for August (Wed 1100 CEST; Wed 0900 GMT;

Wed 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.1%

Consensus Range, HICP - Y/Y: 2.1% to 2.1%

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.3% to 2.3%

Forecasters expect no revision in HICP from the flash at 2.1

percent and 2.3 percent for narrow core.

United States Housing Starts and Permits for August (Wed

0830 EDT; Wed 1230 GMT)

Consensus Forecast, Starts - Annual Rate: 1.370 M

Consensus Range, Starts - Annual Rate: 1.330 M to

1.400 M

Consensus Forecast, Permits - Annual Rate: 1.370 M

Consensus Range, Permits - Annual Rate: 1.355 M to

1.400 M

The call for August is for a sluggish 1.370 million unit

rate, down from 1.428 million in July. Permits also seen at 1.370 million in

August versus 1.354 million in July.

Canada Bank of Canada Announcement (Wed 0945 EDT; Wed

1345 GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 2.5%

Consensus Range, Level: 2.5% to 2.75%

This one could hinge on the outcome of the CPI report the

day before the governing council meets. Most forecasters see a 25 BP rate cut

but a staunch minority sees no change. The no change camp argues that inflation

will keep the Bank of Canada on hold even as the job market tanks.

United States FOMC Announcement (Wed 1400 EDT; Wed 1800

GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Federal Funds Rate - Target Range: 4.00%-4.25%

Consensus Range, Federal Funds Rate - Target Range: 4.00%-4.25%

to 4.00%-4.25%

The consensus sees a 25 basis point rate cut after a series

of job reports suggesting the economy is stalling.

Brazil Selic Rate (Wed 1830 BRT; Wed 2130 GMT; Wed

1730 EDT)

Consensus Forecast, Level: 15.0%

Consensus Range, Level: 15.0% to 15.0%

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

The Bank of Brazil has been on a tightening track but a

stalling economy suggests the bank will leave rates unchanged.

Thursday

New Zealand GDP for Second Quarter (Thu 1045 NZST; Wed

2245 GMT; Wed 1845 EDT)

Consensus Forecast, Q/Q: -0.4%

Consensus Range, Q/Q: -0.4% to -0.3%

Consensus Forecast, Y/Y: 0.0%

Consensus Range, Y/Y: 0.0% to 0.0%

The economy is expected to contract by 0.4 percent in Q2

from Q1 after gaining by 0.8 percent on quarter in Q1. On year, forecasts look

for 0.0 percent.

Japan Machinery Orders for July (Thu 0850 JST; Wed 2350

GMT; Wed 1950 EDT)

Consensus Forecast, M/M: -3.5%

Consensus Range, M/M: -5.5% to -0.5%

Consensus Forecast, Y/Y: 5.2%

Consensus Range, Y/Y: -1.5% to 7.4%

Key forecast points:

Japanese core machinery orders, the key leading indicator of

business investment in equipment and software, are forecast to post their first

drop in two months, down 3.5% on the month, following a stronger-than-expected

3.0% increase in June. Demand for computers remains strong in a move to

digitize operations amid widespread labor shortages.

Last month, the Cabinet Office forecast that core orders

would slip back 4.0% on quarter in the third quarter. It maintained its

assessment for the seventh consecutive month, saying, "Machinery orders are

showing signs of a pickup."

From a year earlier, core orders, which track the private

sector and exclude volatile orders from electric utilities and for ships, are

expected to mark their 10th consecutive gain, up 3.0%, following a solid 7.6%

rise the previous month.

Australia Labour Force Survey for August (Thu 1130 AEST;

Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Employment - M/M: 22K

Consensus Range, Employment - M/M: 10K to 32K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.2% to 4.3%

Employment is expected up 22,000 on the month in August

versus 25,000 in July. The unemployment rate is seen flat at 4.2 percent versus

4.2 percent in July.

Taiwan Central Bank of the Republic of China Third Quarter

(ANYTIME)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0bp

Consensus Forecast, Level: 2.0%

Consensus Range, Level: 2.0% to 2.0%

The consensus sees no change in rates as growth continues to

surprise and the Taiwan dollar has not been a concern.

United Kingdom BoE Announcement & Minutes (Thu

1200 BST; Thu 1100 GMT; Thu 0700 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 4.0%

Consensus Range, Level: 4.0% to 4.0%

Forecasters see one more rate cut this year but not at this

meeting. More likely in November as the economy remains in decent shape and

inflation remains high.

United States Jobless Claims for Week 9/13 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 246K

Consensus Range, Initial Claims - Level: 235K to 252K

Claims are expected to retreat to 246K after a surprising

27K leap to 263K in the latest week. The 4-week moving average rose to 241K

last week.

United States Philadelphia Fed Manufacturing Index for

September (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Index: 3.0

Consensus Range, Index: -3.0 to 8.0

The consensus sees the manufacturing index back to marginal

expansion at 3.0 in September from minus 0.3 in August.

United States Leading Indicators for August (Thu 1000

EDT; Thu 1600 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.4% to 0.0%

The index is seen down 0.1 percent in August after declining

by 0.1 percent in July.

Friday

Japan CPI for August (Fri 0830 JST; Thu 2330 GMT; Thu

1930 EDT)

Consensus Forecast, Y/Y: 2.8%

Consensus Range, Y/Y: 2.7% to 2.9%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.7%

Consensus Range, Ex-Fresh Food - Y/Y: 2.7% to 2.8%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.3%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 3.2%

to 3.4%

Consumer inflation in Japan is expected to continue slowing

in August to around 3% in two key measures, thanks to retail gasoline subsidies

which has offset the continued uptick in processed food costs.

The core reading (excluding fresh food) is forecast to post

a 2.7% rise on year in August after its annual rate decelerated to 3.1% in July

from 3.3% in June. The year-on-year rise in the total CPI is also seen at 2.8%,

easing further from 3.1%. The underlying inflation measured by the core-core

CPI (excluding fresh food and energy) is estimated at 3.3% vs. 3.4% in the

previous two months.

The yen's rise from last year's slump has also lowered

import costs, triggering a pullback in spending by visitors from overseas who

lost their currencies' competitive edge over the yen.

The impact of slowing overall energy price gains (gasoline

has been down) has been mitigated by elevated processed food prices despite

gradually easing domestic rice supply shortages (regular rice still costs

nearly double the price seen a year earlier) as well as higher mobile phone

charges.

Japan Bank of Japan Announcement (Fri 1130 JST; Fri 0800

GMT; Fri 0400 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0bp to 0bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.5% to 0.5%

At its Sept. 18-19 meeting, the Bank of Japan's nine-member

board is expected to decide to maintain the target for the overnight interest

rate at 0.5% for the fifth straight meeting after hiking it by 25 basis points

(0.25 percentage point) in January amid uncertainty over trade rows. A

majority, if not unanimous, vote is widely anticipated in light of Prime

Minister Shigeru Ishiba's decision to step down, taking the blame for crushing

defeats for his ruling Liberal Democratic Party in general elections, first in

the upper house last year and in the lower house in July.

The bank has repeated in its recent policy statements that

it will continue raising rates if growth and inflation evolve in line with its

medium-term outlook but it is still in the process of normalizing its monetary

policy stance from years of keeping short-term rates near zero percent.

United Kingdom Retail Sales for August (Fri 0700 BST;

Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.4% to 1.4%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 0.6% to 1.6%

Sales expected up a robust 0.5 percent in August from July

after rising 0.6 percent in July from June. On year, sales are seen up 1.5

percent in August after a yearly rise of 1.1 percent in July.

Germany PPI for August (Fri 0800 CEST; Fri 0600 GMT; Fri

0200 EDT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.2% to 0.2%

Consensus Forecast, Y/Y: -1.7%

Consensus Range, Y/Y: -1.7% to -1.5%

Wholesale prices are seen down 0.1 percent on the month and down

1.7 percent on year in August after slipping by 0.1 percent on the month in

July and declining 1.5 percent on year.

France Business Climate Indicator for September (Fri 0845

CEST; Fri 0645 GMT; Fri 0245 EDT)

Consensus Forecast, Index: 95

Consensus Range, Index: 95 to 96

The index expected to tick down to 95 in September from 96

in August.

Canada Retail Sales for July (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, M/M: -0.8%

Consensus Range, M/M: -0.9% to -0.5%

The consensus sees retail sales down 0.8 percent in July

from June, in line with the preliminary Stats Canada estimate.

|