|

The Week Ahead: Highlights

Europe Preview

Europe Looks Back at Third Quarter GDP While Awaiting

Clarity From the US

By Marco Babic, Econoday Economist

The coming week will provide a look at how the major

European economies fared in the third quarter, with Germany, France, and Italy

reporting gross domestic product for the three months ending in September.

Eurozone GDP is also scheduled for release next week.

Both the German and Italian economies contracted in the

second quarter, by 0.3 percent and 0.1 percent respectively, while France eked

out a 0.3 percent increase. While there have been some cautiously positive

developments in the data over the third quarter, nothing has really stood out

that would lead one to the conclusion that the economies performed any better.

Overall, the Eurozone economy eked out a 0.1 percent gain in the second

quarter, corresponding to 1.5 percent annual growth.

Preliminary GDP data is generally thin on details, so it

will be difficult to judge what the effects of the US tariffs were on the

European economies in the third quarter. Even with a trade agreement between

the US and EU, of which EU countries are decidedly not thrilled with, there is

still an element of uncertainty. The US Supreme Court is expected to issue a

ruling on the legality of the tariffs this month or next. Even if they are

ruled illegal, there is some evidence that trade flows are being realigned.

The other highlight of the week is the Germany's October Ifo

report. In September, the overall index fell, as businesses judged current

conditions and expectations less favorably. There could be a positive surprise

to the upside for the October results given the jump in the Composite PMI index

for Germany reaching its highest level in two years last week to 53.8. While

manufacturing was slightly contractionary with a reading of 49.6, the services

index rose to 54.5 from 51.5.

Also in Germany, October consumer confidence is scheduled

for Tuesday. After improving modestly in September, it remains to be seen if

that improves in tandem with business sector sentiment.

Preliminary inflation data for October is also scheduled for

Germany, France, Italy and the Eurozone. For the countries sharing the Euro,

inflation was 2.2 percent year-on-year in September, with the narrow core at

2.4 percent. In isolation, this isn't a level that is likely to concern the

European Central Bank, but should it start to tick higher, it will become part

of the policy discussion once again. For now, the more urgent question is

economic growth.

US Preview

FOMC Rate Cut Expected Despite Data Blackout

By Theresa Sheehan, Econoday Economist

The federal government shutdown drags on into the October 27

week with no reports coming out of the major statistical agencies, although

some of the independent government agencies continue to publish their data.

Reports that rely on government numbers - from both private and government

sources - are feeling the effects of the dearth of official data. Some are

using data proxies to continue publication, while others are delaying until the

official numbers become available.

The big news of the coming week is the FOMC meeting on

October 28-29. The FOMC deliberations will face challenges in the absence of

some vital pieces of information. Nonetheless, in recent remarks Fed Chair

Jerome Powell indicated that the committee has sufficient information - numbers

and anecdotal - to decide current monetary policy.

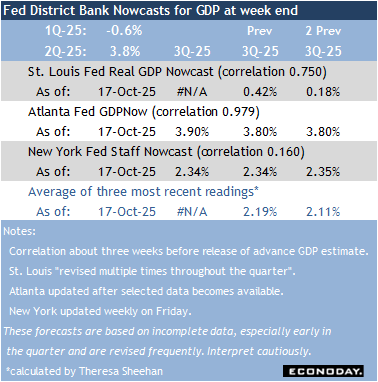

If the labor market has slowed significantly, the US economy

continues to grow moderately through the third quarter. This does not suggest a

rapid increase in unemployment even though hiring is weak. The government

shutdown may pose a greater risk to the outlook for the fourth quarter that has

to be taken into account. Consumers and businesses are increasingly losing

confidence and behaving with caution. Fourth quarter growth will feel the

effects. Without spending and investment, growth will start to falter as the

year closes. This would counsel a rate cut.

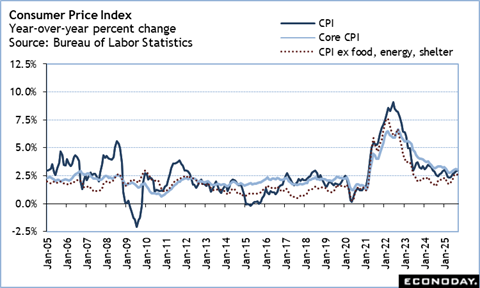

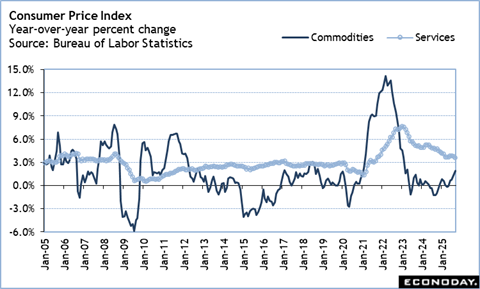

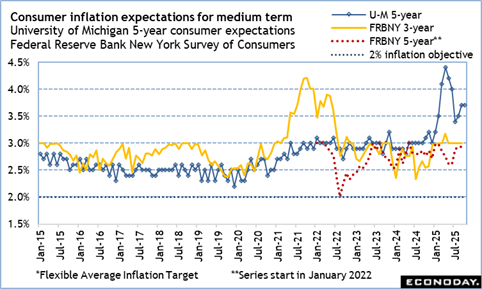

If the inflation from tariffs is of limited duration, it is

still being felt now and with enough force to push inflation expectations

higher. Importantly, the price increases are in some of the most visible in

goods costs and adversely affecting household spending. These price increases

are not temporary even if the upward pressure is. This will contribute to

perceptions that inflation is going to be higher going forward. The FOMC cannot

ignore that inflation and inflation expectations are not improving and need to

be addressed. This would counsel no cut in rates at this time.

Powell has reiterated that there is no "risk-free path" for

the FOMC to set policy as it balances the needs of maximum employment and price

stability. He also warned that monetary policy is not "predetermined" before

any meeting. A few Fed officials are publicly stating their preferences, but it

will be the majority of voters that prevail.

Given that most Fed policymakers are taking a cautious

approach to setting rates, the meeting is likely to end with at least one

dissent in the vote. If a rate cut is made, it will probably be for a modest 25

basis points. Newly installed Governor Stephan Miran has advocated for a

50-basis point rate cut, but that probably does not have wide support among

FOMC participants.

The FOMC will release its statement at 14:00 ET on

Wednesday. There will be no update to the summary of economic projections until

the December 9-10 meeting. Powell's press briefing will take place half an hour

later. He is likely to receive more than a few questions that he will refuse to

answer related to government fiscal policy, the effects of the government

shutdown, his relationship with the Trump administration, and his plans for

after the end of his term as Chair in May 2026. His message regarding the economic

outlook and monetary policy will be one of caution in uncertain times.

Asia-Pacific Preview

Australia Inflation Reports Key for Upcoming RBA Rate

Decision

By Brian Jackson, Econoday Economist

Australian inflation data will be the key focus in the week

ahead, with quarterly consumer and producer price data and monthly consumer

price data scheduled for release. These could determine the outcome of the

Reserve Bank of Australia meeting that will take place the following week. At

their previous meeting, held last month, RBA offcials kept rates on hold but

argued that they are well placed to "respond decisively" if data indicate

a move is warranted.

South Korea will publish GDP, industrial production, retail

sales and trade data, with the latter one of the first October releases across

the region. The Bank of Korea left policy rates on hold at its meeting last week,

partly reflecting concerns about property prices. The official Chinese PMI

survey for October will also be published late in the week; Hong Kong will

publish GDP and trade data, and India will publish industrial production data.

The Week Ahead: Econoday Consensus Forecasts

Monday

Germany Ifo Survey for October (Mon 1000 CEST; Mon 0900

GMT; Mon 0500 EDT)

Consensus Forecast, Business Climate: 87.9

Consensus Range, Business Climate: 87.0 to 90.5

Consensus Forecast, Current Conditions: 85.5

Consensus Range, Current Conditions: 85.0 to 86.0

Consensus Forecast, Business Expectations: 89.4

Consensus Range, Business Expectations: 89.0 to 90.1

No significant recovery expected in sentiment after last

month's drop. Business climate is expected nearly unchanged at 87.9 in October versus

87.7 in September and 89.0 in August. Current conditions seen at 85.5 versus

85.7 and expectations seen softening to 89.4 from 89.7.

Eurozone M3 Money Supply for September (Mon 1000 CEST;

Mon 0900 GMT; Mon 0500 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 2.7%

Consensus Range, Y/Y - 3-Month Moving Average: 2.5%

to 3.0%

Money supply growth expected to slow to 2.7 percent in

September from 3.2 percent in August.

United States Durable Goods Orders for September (Mon

0830 EDT; Mon 1230 GMT)

Consensus Forecast, New Orders - M/M: 0.1%

Consensus Range, New Orders - M/M: -1.5% to 0.6%

Consensus Forecast, Ex-Transportation - M/M: 0.0%

Consensus Range, Ex-Transportation - M/M: -0.5% to 0.3%

Durable goods orders expected almost flat with a modest

increase of 0.1 percent on the month in September and no change in orders ex-transportation.

That would follow a big 2.9 percent rise in total orders in August with a gain

of 0.4 percent ex-transportation, i.e., excluding volatile aircraft orders.

Tuesday

South Korea GDP for Third Quarter (Tue 0800 KST; Mon 2300

GMT; Mon 1900 EDT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.9% to 1.0%

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 0.9% to 1.5%

Growth seen improving somewhat to 0.9 percent on the quarter

and a still-sluggish 1.4 percent on year in Q3 after rising by 0.7 percent on

quarter and 0.6 percent on the year in Q2.

Germany GfK Consumer Climate for November (Tue 0800 CEST;

Tue 0700 GMT; Tue 0300 EDT)

Consensus Forecast, Index: -21.8

Consensus Range, Index: -22.5 to -21.5

The consensus looks for a slight improvement in the consumer

sentiment index to minus 21.8 in November from minus 22.3 in October.

India Industrial Production for September (Tue 1600

IST; Tue 1030 GMT; Tue 0630 EDT)

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.1% to 3.0%

Output growth is expected to slow to at 2.2 percent in

September from a year ago versus 4.0 percent in August as India's economy

continues to struggle.

United States Case-Shiller Home Price Index for August (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, 20-City Adjusted - M/M: -0.1%

Consensus Range, 20-City Adjusted - M/M: -0.1% to 0.0%

Consensus Forecast, 20-City Unadjusted - Y/Y: 1.6%

Consensus Range, 20-City Unadjusted - Y/Y: 1.2% to 2.1%

Case Shiller index is seen up a modest 1.6 percent on year

in August versus 1.8 percent in July. These numbers were close to 5 percent at

the beginning of the year and have slowed steadily since then. That reflects

the slowdown in housing prices that has helped keep US inflation at bay.

United States Consumer Confidence for October (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 93.4

Consensus Range, Index: 92.0 to 95.0

The consensus looks for 93.4 in October versus 94.2 in

September and 97.8 in August as consumers are gloomy about current conditions

and the outlook.

Wednesday

Australia Monthly CPI for September (Wed 1130 AET; Wed

0030 GMT; Tue 2030 EDT)

Consensus Forecast, CPI - Y/Y: 3.1%

Consensus Range, CPI - Y/Y: 3.0% to 3.2%

CPI expected at 3.1 percent on year in September versus 3.0

percent in August.

Australia CPI for Third Quarter (Wed 1130 AET; Wed 0030

GMT; Tue 2030 EDT)

Consensus Forecast, CPI - Q/Q: 1.0%

Consensus Range, CPI - Q/Q: 0.7% to 1.2%

Consensus Forecast, CPI - Y/Y: 3.0%

Consensus Range, CPI - Y/Y: 2.7% to 3.0%

CPI expected up 1.0 percent on quarter and 3.0 percent on

year in Q3 versus 0.7 percent on quarter and 2.1 percent on year in Q2.

United States International Trade in Goods (Advance) for

September (Wed 0830 EDT; Wed 1230 GMT)

Consensus Forecast, Balance: -$90.0 B

Consensus Range, Balance: -$96.0 B to -$87.0 B

The consensus sees the goods trade gap up at $90.0 billion

in September versus $85.5 billion in August.

United States Wholesale Inventories (Advance) for September

(Wed 0830 EDT; Wed 1230 GMT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.3% to 0.1%

The consensus sees inventories down 0.2 percent in

September.

Canada Bank of Canada Announcement (Wed 0945 EDT; Wed

1345 GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 2.25%

Consensus Range, Level: 2.25% to 2.50%

Slow growth, bleak results in the bank's latest Business

Outlook Survey, and dovish comments from Governor Tiff Macklem point to another

25 basis point rate cut from the Bank of Canada.

United States Pending Home Sales Index for September (Wed

0830 EDT; Wed 1230 GMT)

Consensus Forecast, M/M: 1.0%

Consensus Range, M/M: 0.5% to 1.3%

Sales have been improving lately with falling mortgage

rates. The consensus sees sales up another 1.0 percent in September after a 4.0

percent jump in October.

United States FOMC Announcement (Wed 1400 EDT; Wed 1800

GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Federal Funds Rate - Target Range:

3.75% to 4.00%

Consensus Range, Federal Funds Rate - Target Range:

3.75%- 4.00% to 3.75%- 4.00%

A 25 basis point rate cut is considered baked in the cake at

this meeting and again in December. The delayed September CPI report bolstered

the expectation.

Thursday

Japan Bank of Japan Announcement (Thu 1130 JST; Thu 0230

GMT; Thu 2230 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.5% to 0.5%

At its Oct. 29-30 meeting, the Bank of Japan's nine-member

board is expected to maintain the target for the overnight interest rate at

0.5% for the sixth straight meeting after hiking it by 25 basis points (0.25

percentage point) in January amid uncertainty over the emerging effects of the

protectionist U.S. trade policy, geopolitical risks and financial markets. The

government is also trying to put together an economic revival package under

Prime Minister Sanae Takaichi who took office on Oct. 21.

France GDP Flash for Third Quarter (Thu 0745 CEST;

Thu 0645 GMT; Thu 0245 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.2%

The consensus sees GDP up 0.2 percent in Q3 from Q2 after a

0.3 percent rise in Q2.

Germany Unemployment Rate for October (Thu 0955 CEST;

Thu 0855 GMT; Thu 0455 EDT)

Consensus Forecast, Rate 6.3%

Consensus Range, Rate: 6.2% to 6.4%

The jobless rate is expected flat at 6.3 percent.

Germany GDP Flash for Third Quarter (Thu 1000 CEST;

Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: -0.1% to 0.2%

Consensus Forecast, Y/Y: 0.3%

Consensus Range, Y/Y: 0.1% to 0.4%

The consensus sees GDP flat in Q3 from Q2 and up 0.3

percent on year.

Italy GDP Flash for Third Quarter (Thu 1000 CEST; Thu

0900 GMT; Thu 0500 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.0% to 0.1%

Consensus Forecast, Y/Y: 0.5%

Consensus Range, Y/Y: 0.5% to 0.6%

The consensus sees GDP up 0.1 percent in Q3 from Q2 and up

0.5 percent on year in Q3.

Eurozone EC Consumer Sentiment for October (Thu 1100

CEST; Thu 1000 GMT; Thu 0600 EDT)

Consensus Forecast, Economic Sentiment: 95.7

Consensus Range, Economic Sentiment: 95.1 to 96.2

Consensus Forecast, Industry Sentiment: -10.1

Consensus Range, Industry Sentiment: -11.0 to -9.0

Consensus Forecast, Consumer Sentiment: -14.2

Consensus Range, Consumer Sentiment: -14.2 to -14.2

Economic sentiment expected at 95.7 for October versus 95.5

in the previous report. Industry sentiment seen at minus 10.1 versus minus

10.3. Consumer sentiment seen slightly better at minus 14.2 versus minus 14.9.

Eurozone GDP Flash for Third Quarter (Thu 1100 CEST;

Thu 1000 GMT; Thu 0600 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.0% to 0.1%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.1% to 1.2%

The consensus sees GDP up 0.1 percent in Q3 from Q2 and up

1.2 percent on year in Q3.

Eurozone Unemployment Rate for September (Thu 1100

CEST; Thu 1000 GMT; Thu 0600 EDT)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.3%

No change expected at 6.3 percent.

United States GDP for Third Quarter (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

3.0%

Consensus Range, Quarter over Quarter - Annual Rate: 1.7%

to 3.8%

Growth expected at 3.0 percent rate in the first look at Q3

after rising at a 3.8 percent rate in Q2.

United States Jobless Claims for Week 10/30 (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 235K

Consensus Range, Initial Claims - Level: 230K to 235K

Claims seen at 235K, pretty steady from where they've been

lately.

Germany CPI for October (Thu 1400 CEST; Tue 1300 GMT;

Tue 0900 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.2% to 2.3%

Consensus Forecast, HICP - M/M: 0.2%

Consensus Range, HICP - M/M: 0.2% to 0.2%

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.1% to 2.2%

CPI expected up 0.2 percent on the month in October versus

an increase of 0.2 percent in September On year, expectations call for an

increase of 2.2 percent versus 2.4 percent in September.

Eurozone ECB Announcement (Thu 1415 CEST; Thu 1315

GMT; Thu 0915 EDT)

Consensus Forecast, Refi Rate Change: 0 bp

Consensus Range, Refi Rate Change: 0 bp to 0

bp

Consensus Forecast, Refi Rate Level: 2.15%

Consensus Range, Refi Rate Level: 2.15% to 2.15%

Consensus Forecast, Deposit Rate Change: 0 bp

Consensus Range, Deposit Rate Change: 0 bp to 0 bp

Consensus Forecast, Deposit Rate Level: 2.00%

Consensus Range, Deposit Rate Level: 2.00% to 2.00%

The consensus looks for the ECB to stand pat given the

economy's resilience and inflation holding around the 2 percent target. ECB

President Lagarde is expected again to stress policy outlook is data-dependent.

That puts the focus on the December meeting when new projections on the economy

and inflation are due.

Friday

South Korea Industrial Production

for September (Fri 0800 KST; Thu 2300 GMT; Thu 1900 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.2% to 1.2%

Consensus Forecast, Y/Y: 3.1%

Consensus Range, Y/Y: 2.6% to 11.7%

Output seen up 0.1 percent on month and 3.1 percent on year.

Japan Tokyo CPI for October (Fri 0830 JST; Thu 2330 GMT;

Thu 1930 EDT)

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.2% to 2.7%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.4%

Consensus Range, Ex-Fresh Food - Y/Y: 2.3% to 2.7%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.4%

Consensus Range, Ex-Fresh Food & Energy - Y/Y:

2.2% to 2.7%

Consumer inflation in Tokyo, the leading indicator of the

national average, is forecast to have decelerated slightly in all three key

measures in October as the upward pressures from processed food (mostly rice)

prices continue to ease, offsetting a possible uptick in energy costs caused by

the phasing out of the peak season national subsides for electricity and

natural gas.

The core measure (excluding fresh food) is expected to post

a 2.4% increase on the year in October after stabilizing at 2.5% in September

and easing to the level in August from 2.9% in July. Nationwide rice supply

shortages have been largely resolved, thanks to release of official reserves of

older rice and emergence of fresh crops.

The year-on-year rise in the total CPI is also seen slowing

to 2.4% from 2.5% in the previous two months and 2.9% in July. The annual rate

for the core-core CPI (excluding fresh food and energy), which is little

affected by fluctuations in gasoline and heating oil prices, is estimated to be

at 2.4% vs. 2.5% previously.

Japan Unemployment Rate for September (Fri 0830 JST; Thu

2330 GMT; Thu 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.5% to 2.6%

Japanese payrolls are expected to post their 38th straight

rise on year in September amid lingering shortages of construction workers,

truck drivers and system engineers among many other categories.

The seasonally adjusted unemployment rate is forecast to

remain low and stable at 2.5% after what is deemed to be a temporary surge in

job cuts and retirements pushed it up to 2.6% in August and hitting a more than

five-year low of 2.3% in July. The jobless rate moved in a tight 2.4% to 2.5%

range in the previous six months. The 2.3% rate in July is the lowest since

2.2% recorded in December 2019 in the early phase of the pandemic.

Japan Industrial Production for September (Fri 0850

JST; Thu 2350 GMT; Thu 1950 EDT)

Consensus Forecast, M/M: 1.4%

Consensus Range, M/M: 1.0% to 2.4%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 0.8% to 3.8%

Japan's industrial production is forecast to post its first

rise in three months, up 1.4% on the month in September, following a 1.5% drop

(revised down from -1.2%), as real exports rebounded in the month thanks to

recovering demand from Europe and despite the dampening effects of stiff U.S.

tariffs on autos and metals. Trade data showed last week that Japan's exports

rose in September for the first time in five months, driven by robust shipments

of computer chips to China and other Asian countries.

Japan Retail Sales for September (Fri 0850 JST; Thu

2350 GMT; Thu 1950 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.1% to 2.5%

Consensus Forecast, Y/Y: 0.6%

Consensus Range, Y/Y: 0.4% to 2.7%

China CFLP Composite PMI for October (Fri 0930 CST; Fri

0130 GMT; Thu 2130 EDT)

Consensus Forecast, Manufacturing Index: 49.6

Consensus Range, Manufacturing Index: 49.5 to 49.7

Consensus Forecast, Non-Manufacturing Index: 50.3

Consensus Range, Non-Manufacturing Index: 50.1 to

50.4

Manufacturing expected at 49.6 versus 49.8 a month ago and

services at 50.3 versus 50.0.

Eurozone HICP Flash for October (Fri 1100 CEST; Fri 0900

GMT; Fri 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.0% to 2.3%

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.3% to 2.4%

Headline inflation expected at 2.2 percent and narrow core

at 2.3 percent.

Italy CPI for October (Fri 1100 CEST; Fri 1000 GMT; Fri

0600 EDT)

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.5% to 1.7%

CPI expected up 1.7 percent on year versus 1.6 percent in

September.

Canada Monthly GDP for August (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.1%

No growth expected in August, the kind of number that

supports BOC rate cuts.

United States Personal Income and Outlays for September (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.4%

Consensus Range, Personal Income - M/M: 0.3% to 0.5%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.4%

Consensus Range, Personal Consumption Expenditures - M/M:

0.3% to 0.5%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.3% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.8%

Consensus Range, PCE Price Index - Y/Y: 2.8% to 2.8%

Consensus Forecast, Core PCE Price Index - M/M: 0.3%

Consensus Range, Core PCE Price Index - M/M: 0.2% to

0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.9%

Consensus Range, Core PCE Price Index - Y/Y: 2.9% to

3.0%

Income and spending both expected up a robust 0.4 percent on

the month. PCE prices seen up 0.3 percent on the month for total and core.

United States Employment Cost Index for Third Quarter (Fri

0830 EST; Fri 1230 GMT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.8% to 0.9%

Consensus Forecast, Y/Y: 3.7%

Consensus Range, Y/Y: 3.7% to 3.7%

ECI expected up 0.9 percent on the quarter and 3.7 percent

on year.

United States Chicago PMI for October (Fri 0945 EDT; Fri

1345 GMT)

Consensus Forecast, Index: 42.0

Consensus Range, Index: 41.5 to 45.0

Another grim month of contraction in a long-running trend.

South Korea External Trade for October (Fri 0900 KST;

Fri 0000 GMT; Fri 2000 EDT)

Consensus Forecast, Balance: $1.93 B

Consensus Range, Balance: $0.6 B to $4.9 B

The surplus is expected to shrink to $1.93 billion in

October from $9.6 billion in September.

|