|

The Week Ahead: Highlights

Asia-Pacific Preview

China Monthly Economic Data in Focus

By Brian Jackson, Econoday Economist

Monthly Chinese activity reports for October are the main

focus of the Asia-Pacific data calendar. PMI surveys have shown ongoing

stagnation in the manufacturing sector but some improvement in conditions in

the non-manufacturing sector in October. Trade data published this week showed

weaker growth in exports. Officials in recent months have generally expressed

satisfaction with incoming data, while cautioning about external risks to the

outlook, and this week's seem unlikely to prompt any shift in this assessment

or policy settings.

Australia and India also report key data in the week

ahead. In Australia, business and consumer confidence data will be watched for

the impact on sentiment of the recent pause in policy easing by the Reserve

Bank of Australia, with labour market data also scheduled for release. India

will report trade data and inflation data. Inflation in India has been lower in

recent months but mainly because of the impact of favourable rainfall

patterns and officials at the Reserve Bank of India will be focused on whether

any shifts in underlying price pressures are evident in the week's release.

Europe Preview

In Europe, All Eyes are on US Supreme Court

By Marco Babic, Econoday Economist

With the United States Supreme Court, SCOTUS, hearing oral

arguments about the legality of the Trump administration's tariffs, it's fair

to say Europeans are now SCOTUS watchers. The court is weighing whether to

uphold a lower court decision deeming many of the tariff's illegal. The

implications are profound.

In the back and forth between the justices, and lawyers for

the plaintiffs and the administration, the topic of 39 percent tariffs imposed

on Switzerland came up. Clearly the Swiss would like for tariffs to go away as

would all other countries subject to them.

Later this week, Italy and the EU report their trade

balances for September. Could these be the last reports of the tariff regime?

That is very much dependent on when the court announces its decision, but a

number of observers have said that based on the questions asked by the

justices, the court is skeptical of the administrations arguments for keeping

tariffs.

Should they be deemed illegal, how the collected tariffs are

refunded is an open question. A decision on lifting them will be a welcome

relief, and businesses can go back to planning. The question is if they are

lifted, will it be business as usual with the United States, or will its

trading partners seek to diversify trade elsewhere? Will the Canadians and

Europeans forgive and forget?

Over the past months, it seemed as if Europe took a deep

breath and tried to make the best of the situation, adopting what was a

wait-and-see approach to the SCOTUS decision. Well, here we are.

In August, the EUs trade surplus grew to 9.7 billion Euros

from 6.0 billion the month before as imports fell faster than exports in

September, down 2.4 and 0.8 percent, respectively, month on month. What does

the SCOTUS situation mean for trade in the coming months?

US importers might hold off on importing from European

countries in hopes that tariffs fall away, while European businesses might

start boosting production in anticipation of more US demand. Taken together, a

reasonable conclusion is that businesses on both sides of the Atlantic are

likely to be cautious while trying to read the SCOTUS tea leaves.

US Preview

NFIB Business Sentiment, Mortgage Applications Reports Ahead

By Theresa Sheehan, Econoday Economist

Once more the lack of government economic data reports will

elevate the numbers from private sources, independent agencies, and Fed

district banks.

There is a federal holiday on Tuesday, November 11 to observe

Veterans Day. This will be a full market close. Veterans Day is often used to

kickstart the holiday shopping period but this year it is just another

promotional opportunity. Retailers have already put winter holiday merchandise

prominently on shelves and are heavily advertising. Even the traditional "Black

Friday" banner has become disassociated from day after Thanksgiving discounts.

There are only two reports on the data calendar likely to

have any market impact In the November 10 week.

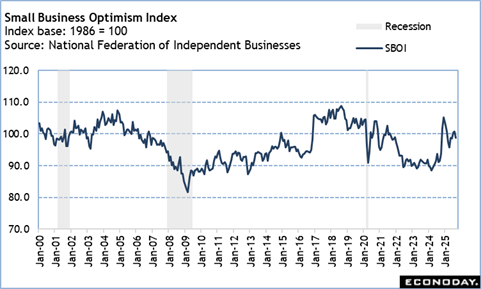

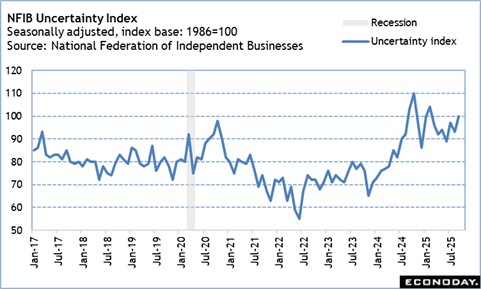

The NFIB business optimism index for October at 6:00 ET on

Tuesday could show a decline from the 98.8 reading in September. Another round

of chaotic declarations about tariff policy could diminish small business

confidence again. It could also heighten concerns about the economy. In

September, the NFIC uncertainty index rose 7 points to 100, its highest since

February.

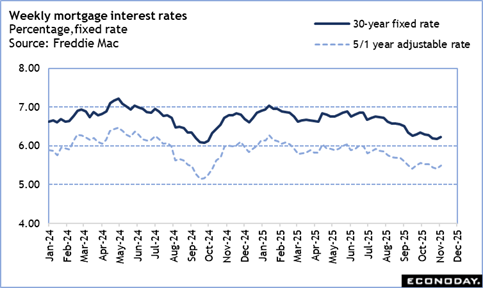

The weekly MBA index for mortgage applications is a

barometer for the health of the housing market. The next report for the week

ending November 7 is likely to react to the environment in which homebuyers and

mortgage refinancing remain extremely sensitive to changes in rates. Rates

remain relatively low compared to just a few months ago. However, those who

could refinance at more favorable rates have largely done so. Current mortgage

holders were clearly acting to reduce monthly housing costs. New homebuyers are

out there, but cautious and committing only when there is a good combination of

the right property at the right price at an affordable mortgage rate.

The Week Ahead: Econoday Consensus Forecasts

Monday

China CPI for October (Mon 0930 CST; Mon 0130 GMT; Sun

2030 EST)

Consensus Forecast, Y/Y: -0.2%

Consensus Range, Y/Y: -0.2% to 0.0%

The consensus sees CPI down 0.2 percent on year for October,

not quite as grim as the 0.3 percent decline in September.

China PPI for October (Mon 0930 CST; Mon 0130 GMT; Sun

2030 EST)

Consensus Forecast, Y/Y: -2.3%

Consensus Range, Y/Y: -2.3% to -2.2%

No change is expected in the rate of wholesale price deflation

at 2.3 percent.

Tuesday

UK Labour Market Report for October (Tue 0700 GMT;

Tue 0200 EST)

Consensus Forecast, ILO Unemployment Rate: 4.9%

Consensus Range, ILO Unemployment Rate: 4.7% to 4.9%

Consensus Forecast, Average Earnings including Bonus: 5.0%

Consensus Range, Average Earnings including Bonus: 4.9%

to 5.0%

The ILO jobless rate is seen up at 4.9 percent in October

versus 4.8 percent in September. Average earnings including bonus are expected

up 5.0 percent on year again versus 5.0 percent in September.

Germany ZEW Survey for November (Tue 1000 CET; Tue

0900 GMT; Tue 0400 EST)

Consensus Forecast, Current Conditions: -78

Consensus Range, Current Conditions: -80 to -78

Consensus Forecast, Economic Sentiment: 40.5

Consensus Range, Economic Sentiment: 35 to 43

Current conditions expected to recover a bit to minus 78 in

November from a dismal minus 80.0 in October. Economic sentiment is seen better

at 40.5 in October versus 39.3 in October.

United States NFIB Small Business Optimism Index for October

(Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 98.3

Consensus Range, Index: 98.0 to 99.5

The index is expected to continue eroding to 98.3 in October

from a soft 98.8 in September, 100.8 in August and 100.3 in July.

Brazil CPI for November (Tue 0900 BRT; Tue 1200 GMT; Tue

0700 EST)

Consensus Forecast, Y/Y: 4.75%

Consensus Range, Y/Y: 4.70% to 4.90%

The consensus sees CPI up 4.75 percent on year in October,

down from 5.17 percent in September.

Wednesday

Germany CPI for October (Wed 0800 CET; Wed 0700 GMT; Wed

0200 EST)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.3% to 0.3%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.3% to 2.3%

Consensus Forecast, HICP - M/M: 0.3%

Consensus Range, HICP - M/M: 0.3% to 0.3%

Consensus Forecast, HICP - Y/Y: 2.3%

Consensus Range, HICP - Y/Y: 2.3% to 2.3%

The consensus sees no revision in the October final from the

flash at gains of 0.3 percent and 2.3 percent.

Italy Industrial Production for September (Wed 1000

CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, M/M: 1.5%

Consensus Range, M/M: 1.1% to 1.7%

Consensus Forecast, Y/Y: -0.5%

Consensus Range, Y/Y: -0.5% to -0.5%

The consensus sees industrial production rebounding by 1.5

percent on the month in September but down 0.5 percent on the year. That

compares with August's 2.4 percent decrease on the month and a decline of 2.7

percent on year.

India CPI for October (Wed 1600 IST; Wed 1030 GMT; Wed

0530 EST)

Consensus Forecast, Y/Y: 0.44%

Consensus Range, Y/Y: 0.20% to 0.70%

Inflation continues to fade with the consensus looking for

0.44 percent on year in October, down again from 1.54 percent in September.

Thursday

Japan PPI for October (Thu 0830 JST; Wed 2330 GMT; Wed

1830 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 0.5%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 2.3% to 2.7%

Japan's corporate goods price index (CGPI), or producer

inflation, is expected to rise 2.6 percent in October from a year earlier,

following a 2.7 percent gain in September. Slower but still elevated rice

prices, along with higher commodity prices such as nonferrous metals, are

keeping producer inflation firm.

Average retail rice prices edged higher in October from the

previous month, though the year-on-year increase has moderated due to a higher

comparison base. Even so, rice prices remain high, and overall food costs

continue to exert upward pressure on prices.

Prices of nonferrous metals also climbed across a broad

range of items. Copper rose as global prices surged on supply concerns

following accidents at major mines, pushing domestic prices higher. Aluminum

and zinc prices posted similar gains. By contrast, prices of petroleum and

chemical products fell from the previous month amid weaker crude oil markets.

On a month-on-month basis, the CGPI is projected to rise 0.4

percent in October, marking a second straight increase after a 0.3% gain in

September and a 0.2% drop in August. The September gain was driven by higher

prices for agricultural products such as rice and eggs, nonferrous metals

including copper, gold bullion, and plastic-coated copper wire, as well as oil

and coal products such as gasoline, diesel oil, and kerosene.

Australia Labour Force Survey for October (Thu 1130

AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Employment - M/M: 20K

Consensus Range, Employment - M/M: 15K to 22K

Consensus Forecast, Unemployment Rate: 4.4%

Consensus Range, Unemployment Rate: 4.4% to 4.5%

Employment is expected up 20,000 on the month in October

versus a gain of 14,900 in September. The unemployment rate is seen at 4.4

percent versus 4.5 percent in September.

United Kingdom Monthly GDP for September (Thu 0700 GMT;

Thu 0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.2%

Growth seen at 0.1 percent on the month in September after the

same marginal 0.1 percent in August.

United Kingdom GDP for Third Quarter (Thu 0700 GMT; Thu

0200 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.3

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 1.3% to 1.5%

Growth expected at a slower 0.2 percent on quarter in Q3

after rising 0.3 percent in Q2. The first half of 2026 got a little support

from tariff frontloading.

United Kingdom Industrial Production for September (Thu

0700 GMT; Thu 0200 EST)

Consensus Forecast, Industrial Production - M/M: -0.2%

Consensus Range, Industrial Production - M/M: -0.2%

to -0.1

Consensus Forecast, Industrial Production - Y/Y: -0.9%

Consensus Range, Industrial Production - Y/Y: -1.4%

to -0.9%

Consensus Forecast, Manufacturing Output - M/M: -0.3%

Consensus Range, Manufacturing Output - M/M: -0.4% to

-0.2%

Consensus Forecast, Manufacturing Output - Y/Y: -1.4%

Consensus Range, Manufacturing Output - Y/Y: -1.5% to

-0.8%

Output is expected to fall back by 0.2 percent in September

on the month after rising 0.4 percent in August. Manufacturing is expected down

0.3 percent after rising 0.7 percent in August.

Eurozone Industrial Production for September (Thu

1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, M/M: 0.9%

Consensus Range, M/M: 0.5% to 1.0%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 1.4% to 2.4%

Output expected up 0.9 percent on month and 2.3 percent on

year in September after dropping 1.2 percent and rising 1.1 percent

respectively in August.

United States CPI for October (Thu 0830 EST; Thu 1330

GMT)

Consensus Forecast, CPI - M/M: 0.2%

Consensus Range, CPI - M/M: 0.1% to 0.3%

Consensus Forecast, CPI - Y/Y: 3.1%

Consensus Range, CPI - Y/Y: 3.0% to 3.1%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to

0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 3.0% to 3.1%

CPI is expected to show an increase of 0.2 percent for

October on the month and a 3.1 percent rise on year. The core is expected up 0.3

percent and up 3.0 percent on year.

United States Jobless Claims for Week 11/13 (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 230K

Consensus Range, Initial Claims - Level: 223K to 260K

Claims seen at 230K.

Friday

China Fixed Asset Investment for October (Fri 1000 CST;

Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Year to Date on Y/Y Basis: -0.8%

Consensus Range, Year to Date on Y/Y Basis: -0.8% to -0.8%

The consensus sees FAI down 0.8 percent on year in October,

even worse than the minus 0.5 percent in September, as FAI continues to falter.

China Industrial Production for October (Fri 1000 CST;

Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 5.55%

Consensus Range, Y/Y: 5.30% to 6.50%

Growth in industrial production is seen fading to 5.55

percent on year in October after perking up to 6.5 percent on year in

September.

China Retail Sales for October (Fri 1000 CST; Fri 0200

GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 2.7%

Consensus Range, Y/Y: 2.1% to 2.8%

The consensus sees sluggish sales growth at 2.7 percent in

October from a year ago versus 3.0 percent in September.

Eurozone GDP Flash for Third Quarter (Fri 1100 CET;

Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.1% to 1.3%

GDP growth expected unrevised at 0.2 percent on quarter and

1.3 percent on year for Q3.

United States PPI-Final Demand for October (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD - M/M: 0.0% to 0.4%

Consensus Forecast, PPI - Y/Y: 2.6%

Consensus Range, PPI - Y/Y: 2.4% to 2.7%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

The consensus sees PPI-FD up 0.3 percent on month in October

and up 2.6 percent on year.

United States Retail Sales for October (Fri 0830 EST;

Fri1330 GMT)

Consensus Forecast, Retail Sales - M/M: 0.2%

Consensus Range, Retail Sales - M/M: -0.2% to 0.4%

Sales are seen up 0.2 percent on the month.

Canada Manufacturing Sales for September (Fri 0830

EST; Fri1330 GMT)

Consensus Forecast, Manufacturing Sales - M/M: 1.3%

Consensus Range, Manufacturing Sales - M/M: 1.1% to

1.3%

Forecasters agree with the Stats Canada preliminary estimate

calling for a rebound of 1.3 percent in September after a drop of 1.0 percent

in August.

US Business Inventories for October (Fri 1000 EST; Fri1500

GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.3%

Inventories seen up 0.2 percent on the month.

|