|

The Week Ahead: Highlights

Asia-Pacific Preview

RBNZ, BOK Interest Rate Decisions Ahead

By Brian Jackson, Econoday Economist

Policy decisions by the Reserve Bank of New Zealand and the

Bank of Korea will be the main focus. The RBNZ cut rates by 50 basis points at

their previous meeting early October and said then that they were "open" to

further reductions. Subsequent CPI data showed higher inflation in the three

months to September, but this was largely driven by higher food prices. Other

data showing weaker growth and labour market conditions are expected to be

enough to prompt further policy easing. New Zealand will also report quarterly

retail trade data next week.

The BoK left rates on hold for the fourth consecutive

meeting last month, with officials again expressing concerns about house price

growth in the Seoul area and higher household debt. Higher core

inflation in October likely will reinforce the case to keep rates on hold again

next week, with monthly industrial and retail sales data scheduled for release

after the policy meeting.

Australia monthly CPI data for October will also be closely

watched after September data showed a sharp increase in headline inflation and

increases in underlying measures of inflation. Quarterly investment data for

Australia will also be published next week. In addition, Singapore inflation

and industrial production data, Hong Kong trade data, and Indian GDP and

industrial production data are also scheduled for release.

Europe Preview

A Fuller Economic Picture to Emerge in Europe

By Marco Babic, Econoday Economist

Europe's biggest economies are reporting final third-quarter

GDP figures in the week ahead, painting a fuller picture of how they fared in

the quarter when US tariffs were fully implemented.

Preliminary figures showed the French economy expanding 0.5

percent during the third quarter and 0.9 percent year-on-year. Meanwhile,

Germany and Italy both reported no economic growth in the third quarter while

posting modest grown of 0.3 percent and 0.4 percent, respectively compared to a

year ago.

Other indicators have been highlighting inventories and

hesitant investment plans, with the GDP figures likely to confirm that. Of

course, the net contribution from trade will be of interest insofar as Europe

has been grappling with the impact of the US tariffs.

Switzerland also reports final GDP, having contracted 0.5

percent quarter-on-quarter, with the watch, pharma, and chemical industries

particularly hard hit. The US and Swiss governments have reached an

agreement-in-principle to reduce tariffs from 39 percent to 15 percent,

bringing the alpine nation in-line with the those imposed on the European

Union. The watch industry will be particularly relieved about that.

In addition to its scorecard on the economy, Germany also

reports the Ifo Business Climate Index and consumer confidence this week. The

widely analyzed Ifo report improved in October amid a brighter outlook, while

the assessment of current conditions was subdued. The question is will this

continue?

German consumers on the other hand were more negative in

their views, as the GfK Consumer Confidence Index slipped to minus 24.1 from

minus 22.5. There isn't much, if any, current evidence that purse strings will

be loosened and spending increased, leading one to conclude consumers aren't

poised to add to the economy. Retail sales scheduled for Friday will likely

reflect that. In September, sales grew 0.2 percent on a monthly and

year-on-year comparison.

Preliminary CPI reports are also coming out this week for

France and Italy and unlikely to show a surge in prices, with both remaining

well within the comfort and target range of the European Central Bank. The

central bank is releasing the Minutes of its most recent meeting and could

provide some anecdotal guidance on the economy.

US Preview

Rescheduled PPI-PD, Retail Sales Reports in Focus

By Theresa Sheehan, Econoday Economist

In the November 24 week, US statistical agencies will

continue to update data release schedules, and prepare and release more of the

delayed reports. It may be a few more days before all the missed reports are

rescheduled. A challenging circumstance is that the Thanksgiving holiday falls

on Thursday. While the federal government is technically open on Friday, the

data calendar will be limited. Stock and bond markets are closed on Thursday

and will close early on the unofficial holiday on Friday. With effectively only

three working days in the week, the data calendar will be crammed, particularly

on Tuesday and Wednesday.

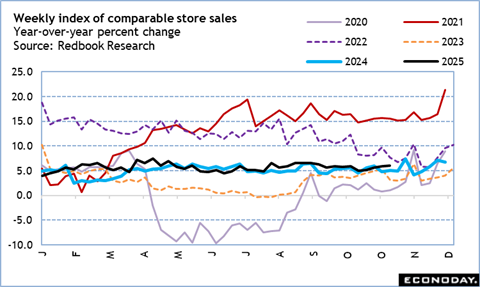

The September numbers for retail sales are rescheduled to

8:30 ET on Tuesday. This will complete the first look at consumer spending for

the third quarter 2025. There may have been some pick up in the pace of retail

sales in the third quarter as consumers worried about the availability of goods

and/or higher before the holiday season. If consumers were shopping early, it

may mean a weaker winter retail season than previously expected.

The final-demand producer price index for September is also

at 8:30 ET on Tuesday. Although changes in producer prices do not always pass

through to the consumer level, any evidence of upward price pressures for

producers - mostly from the cost of tariffs on the supply chain - will be a

signal that inflation at the consumer levels remains elevated and is not yet

done.

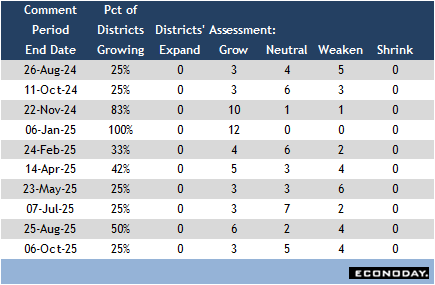

The Beige Book set for release at 14:00 ET on Wednesday will

present anecdotal evidence about the US economy for roughly the period of early

October through mid-November. This coincides with most of the shutdown of the

Federal government from October 1 through November 12. The assessment of

economic conditions across the 12 districts is likely to be gloomy, although it

will be more so for some districts than others. Nevertheless, the broad tone of

the report is expected to remain consistent with little or no growth in the

majority of districts and outright weakening in the remainder. Despite what is

likely to be moderate growth for the third quarter, there is little upward

momentum going into the fourth quarter.

The second estimate of third quarter GDP and the September

data on personal income and outlays were originally set for release on

Wednesday. These are going to be rescheduled.

The Week Ahead: Econoday Consensus Forecasts

Monday

Singapore CPI for October (Mon 1300 CST; Mon 0500

GMT; Mon 0000 EST)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.2% to -0.1%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 1.1%

The consensus sees CPI off 0.1 percent on month and up 0.9

percent on year in October after increases of 0.4 percent and 0.7 percent in

September.

Germany Ifo Survey for November (Mon 1000 CET; Mon

0900 GMT; Mon 0400 EST)

Consensus Forecast, Business Climate: 88.3

Consensus Range, Business Climate: 88.0 to 88.7

Consensus Forecast, Current Conditions: 85.4

Consensus Range, Current Conditions: 84.9 to 85.5

Consensus Forecast, Business Expectations: 91.3

Consensus Range, Business Expectations: 91.0 to 92.0

Business climate expected almost unchanged at 88.3 versus

88.4 in the prior month. Current conditions seen at 85.4 versus 85.3 and

expectations at 91.3 versus 91.6.

Tuesday

Germany GDP for Third Quarter (Tue 0800 CET; Tue 0700

GMT; Tue 0200 EST)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: 0.0% to 0.0%

Consensus Forecast, Y/Y: 0.3%

Consensus Range, Y/Y: 0.3% to 0.3%

Forecasters see no change from the flash at 0.0 percent on

quarter and 0.3 percent on year for Q3.

US PPI-Final Demand for September

(Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD - M/M: 0.2% to 0.5%

Consensus Forecast, PPI - Y/Y: 2.6%

Consensus Range, PPI - Y/Y: 2.5% to 2.7%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 2.7%

Consensus Range, Ex-Food & Energy - Y/Y: 2.7% to

2.9%

PPI-FD seen at 0.3 percent on month and 2.6 percent on year.

US Retail Sales for September (Tue 0830 EST; Tue 1330

GMT)

Consensus Forecast, Retail Sales - M/M: 0.4%

Consensus Range, Retail Sales - M/M: -0.1% to 0.6%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: -0.1% to 0.6%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.3%

Consensus Range, Ex-Vehicles & Gas - M/M: -0.5%

to 0.4%

Sales seen up 0.4 percent in nominal terms, which means flat

in real terms as spending cools. Auto sales expected to provide a lift due to

consumers front-running expiring EV sales incentives.

US Case-Shiller Home Price Index for September (Tue

0900 EST; Tue 1400 GMT)

Consensus Forecast, 20-City Adjusted - M/M: 0.1%

Consensus Range, 20-City Adjusted - M/M: -0.1% to 0.2%

Consensus Forecast, 20-City Unadjusted - Y/Y: 1.4%

Consensus Range, 20-City Unadjusted - Y/Y: 1.3% to 1.6%

Prices seen up 0.1 percent on month, seasonally adjusted,

and up a modest 1.4 percent on year, (versus 1.6 percent in August), as housing

price inflation continues to recede.

US FHFA House Price Index for September (Tue 0900

EST; Tue 1400 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.2%

Like its cousin, the Case-Shiller index, the FHFA is

expected to show a marginal 0.1 percent rise on the month.

US Consumer Confidence for November (Tue 1000 EST;

Tue 1500 GMT)

Consensus Forecast, Index: 93.3

Consensus Range, Index: 92.5 to 94.9

Confidence seen down again at 93.3 in November from 94.6 in

October and 95.6 in September. Consumers remain in a funk over high prices and

job worries, plus the University of Michigan survey finds the high income

segment is not happy about the tech stock selloff in the second half of

November.

US Business Inventories for August (Tue 1000 EST; Tue

1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.0% to 0.2%

The consensus looks for a small 0.2 percent increase on the

month.

Wednesday

Australia Monthly CPI for October (Wed 1130 AET; Wed

0030 GMT; Tue 1930 EST)

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.3% to 3.9%

CPI seen up 3.5 percent on year again in October after 3.5

percent in September.

New Zealand RBNZ Announcement (Wed 1400 NZDT; Wed

0100 GMT; Tue 2000 EST)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 2.25%

Consensus Range, Level: 2.25% to 2.25%

Forecasters expect and markets have priced in a 25 basis

point rate cut from the RBNZ to follow up the 50 bp cut last time.

Singapore Industrial Production for October (Wed 1300

CST; Wed 0500 GMT; Wed 0000 EST)

Consensus Forecast, Y/Y: 6.7%

Consensus Range, Y/Y: 6.4% to 14.0%

The consensus sees industrial production up 6.7 percent on

year in October versus a remarkable 16.1 percent on year in September.

US Durable Goods Orders for September (Wed 0830 EST;

Wed 1330 GMT)

Consensus Forecast, New Order - M/M: 0.1%

Consensus Range, New Order - M/M: -1.5% to 1.4%

Consensus Forecast, Ex-Transportation - M/M: 0.0%

Consensus Range, Ex-Transportation - M/M: -0.5% to 0.5%

Durable goods orders expected almost flat with a modest

increase of 0.1 percent on the month in September and no change in orders

ex-transportation. That would follow a big 2.9 percent rise in total orders in

August with a gain of 0.4 percent ex-transportation, i.e., excluding volatile

aircraft orders.

US Jobless Claims Week 11/22 (Wed 0830 GMT; Wed 1330

EST)

Consensus Forecast, Initial Claims - Level: 225K

Consensus Range, Initial Claims - Level: 224K to 235K

Claims expected back up to 225K after dipping below 4-week

moving average of 224K to 220K last week.

US Pending Home Sales for October (Wed 1000 EST; Wed

1500 GMT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M -2.0% to 0.0%

Forecasters see sales down 0.4 percent on the month in

October after no change in September.

US Chicago PMI for November (Wed 0945 EST; Wed 1445

GMT)

Consensus Forecast, Index: 44.3

Consensus Range, Index: 42.8 to 46.0

The index is expected to show another month of contraction

at 44.3.

Thursday

Australia Capital Expenditures for Third Quarter (Thu

1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.5% to 1.0%

Australia capex expected up 0.8 percent versus a sluggish

0.2 percent in Q2.

South Korea Bank of Korea Announcement (Thu 1000 KST;

Thu 0100 GMT; Wed 2000 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.50%

Consensus Range, Level: 2.50% to 2.50%

Forecasters uniformly expect the bank to keep rates steady

in the face of a strong won and as it worries about financial stability.

Germany GfK Consumer Climate for December (Thu 1000

CET; Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Index: -23.0

Consensus Range, Index: -24.3 to -22.0

The consensus looks for the consumer sentiment index slightly

less bleak at minus 23.0 in December versus minus 24.1 in November.

Eurozone M3 Money Supply for October (Thu 1000 CET;

Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Y/Y-3-Month Moving Average: 2.8%

Consensus Range, Y/Y-3-Month Moving Average: 2.7% to 3.0%

Money growth not setting the world on fire, expected at 2.8

percent versus 3.0 percent in September.

Italy Business and Consumer Confidence for November (Thu

1000 CET; Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Consumer Confidence: 97.8

Consensus Range, Consumer Confidence: 97.6 to 98.1

Consumer confidence seen a little firmer at 97.8 versus 97.6

a month ago.

Eurozone EC Economic Sentiment for November (Thu 1100

CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Economic Sentiment: 97.0

Consensus Range, Economic Sentiment: 96.4 to 97.0

Consensus Forecast, Industry Sentiment: -8.0

Consensus Range, Industry Sentiment: -8.3 to -8.0

Consensus Forecast, Consumer Sentiment: -14.2

Consensus Range, Consumer Sentiment: -14.2 to -14.2

Economic sentiment expected at 97.0 versus 96.8 in October.

Friday

Japan Tokyo CPI for November (Fri

0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 2.8%

Consensus Range, CPI - Y/Y: 2.6% to 3.0%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.8%

Consensus Range, Ex-Fresh Food - Y/Y: 2.7% to 3.0%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.8%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.6%

to 2.8%

Consumer inflation in Tokyo, a leading indicator of the

national trend, is expected to have been little changed in November from the

previous month. The government's measures to curb gas and electricity prices

are scheduled to end during the month, a shift that is expected to put upward

pressure on prices. In addition, the Tokyo metropolitan government's removal of

its free base charge for water bills is seen adding to the firmness in overall

prices.

The core measure (excluding fresh food) is forecast to rise

2.8% on year in November, unchanged from October. Two other key gauges, the

overall CPI and the core-core index (excluding fresh food and energy), are also

expected to increase 2.8%, both essentially flat from the previous month. All

three readings have remained below 3% since June after easing from earlier

peaks.

Japan Unemployment Rate for October (Fri 0830 JST;

Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.5% to 2.7%

Japanese payrolls are expected to mark their 39th straight

rise on year in October, as the country continues to face persistent labor

shortages.

The seasonally adjusted unemployment rate is forecast to

fall to 2.5% in October after holding at 2.6% for the previous two months,

underscoring the continued tightness in Japan's labor market.

Japan Industrial Production for October (Fri 0850

JST; Thu 2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: -0.8%

Consensus Range, M/M: -1.3% to 0.6%

Consensus Forecast, Y/Y: -0.5%

Consensus Range, Y/Y: -1.2% to 0.7%

Japan's industrial production is projected to decline for

the first time in two months, falling 0.8% in October from the previous month

after rising 2.6% in September (revised up from +2.2%).

Exports to the United States, particularly automobiles,

continue to weaken under the Trump tariffs, while shipments to China are also

expected to fall, weighing on overall output.

A monthly survey by the Ministry of Economy, Trade and

Industry released last month showed manufacturers expected output to drop 0.5%

in October and extend the decline to 0.9% in November.

Japan Retail Sales for October (Fri 0850 JST; Thu

2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.1% to 1.0%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: 0.4% to 1.5%

Japanese retail sales are forecast to have risen 1.1% on year for a second straight increase after edging up a downwardly revised 0.2% in September as demand for drugs and cosmetics remains strong and cooler weather appears to have supported clothing sales. On the downside, fuel prices have been sliding and demand for vehicles remains sluggish, limiting overall retail sales growth.

The supply side data posted its first drop in 41 months (-0.9%) in August, when the dangerously hot and humid weather kept many people inside homes and offices during the day.

Industry data due on Tuesday, Nov. 25 was expected to show that department store sales recorded a third straight year-on-year increase in October, backed by demand for autumn and winter clothing. The "general merchandise" category in retail sales data, however, marked its eighth year-on-year decline in September (-2.2%) as it includes sales at both department store chains and supermarkets.

On the month, retail sales are expected to show a 0.3% rise on a seasonally adjusted basis after being flat (revised down from an initial 0.3% gain) in September and falling for two months.

Germany Retail Sales for October (Fri 0800 CEST; Fri 0700

GMT; Fri 0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.5% to 0.3%

Consensus Forecast, Y/Y: -0.2%

Consensus Range, Y/Y: -0.3% to 0.0%

Sales expected flat on the month and down 0.2 percent on

year.

France GDP for Third Quarter (Fri 0845 CET; Fri 0745

GMT; Fri 0245)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.5% to 0.5%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 0.9%

The consensus sees no revision from the flash with increases

of 0.5 percent on quarter and 0.9 percent on year in Q3.

Switzerland GDP for Third Quarter (Fri 0900 CET; Fri

0800 GMT; Fri 0300 EST)

Consensus Forecast, Q/Q-Adjusted: -0.5%

Consensus Range, Q/Q-Adjusted: -0.5% to -0.5%

No revision seen from the flash at minus 0.5 percent in Q3.

Germany Unemployment Rate for November (Fri 0955 CET;

Fri 0855 GMT; Fri 0355 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.4%

The jobless rate is seen flat at 6.3 percent in November

from 6.3 percent in October.

Italy GDP for Third Quarter (Fri 0845 CET; Fri 0745

GMT; Fri 0245)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: 0% to 0%

Consensus Forecast, Y/Y: 0.4%

Consensus Range, Y/Y: 0.4% to 0.4%

The final GDP report for Q3 is expected to show no revision

from 0.0 percent on quarter and growth of 0.4 percent on year.

Italy CPI for November (Fri 1100 CET; Fri 1000 GMT;

Fri 0500 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.1%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.4%

Inflation expected at 0.0 percent on the month and 1.3

percent on year in November versus minus 0.3 percent and 1.2 percent in

October.

Germany CPI for November (Fri 1100 CET; Fri 1000 GMT;

Fri 0500 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.5% to -0.2%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.3% to 2.4%

HICP for November

Consensus Forecast, M/M: -0.6%

Consensus Range, M/M: -0.6% to -0.6%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.4% to 2.6%

The consensus sees CPI down 0.2 percent on the month and up 2.3

percent on year in November after increases of 0.3 percent and 2.3 percent on

year in October.

India GDP for Third Quarter (Fri 1730 IST; Fri 1200

GMT; Fri 0700 EST)

Consensus Forecast, Y/Y: 7.3%

Consensus Range, Y/Y: 7.2% to 7.5%

Growth seen at 7.3 percent on year in Q3 versus 7.8 percent

in Q2.

Canada Monthly GDP for September (Fri 0830 EST; Fri

1330 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Forecasters expect growth at 0.2 percent to top Stats

Canada's preliminary estimate of plus 0.1 percent for September after dropping

0.3 percent in August.

Canada GDP for Third Quarter (Fri 0830 EST; Fri 1330

GMT)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.3% to 0.8%

Consensus Forecast, Annual Rate: 0.5%

Consensus Range, Annual Rate: 0.4% to 0.6%

GDP expected up 0.5 percent on quarter in Q3.

|