|

The Week Ahead: Highlights

Asia-Pacific Preview

Reserve Bank of India Rate Cut Decision Ahead

By Brian Jackson, Econoday Economist

The Reserve Bank of India policy meeting will be the main

focus in the Asia-Pacific. After aggressive policy easing early in the year,

the RBI has left rates on hold since June, reflecting an assessment that the

earlier cuts will support growth and that the inflation outlook is "benign". This

policy stability may be extended next week though many market players expect a

25 bp cut.

November PMI surveys for the Asia-Pacific will also be

published. With the exception of India and Singapore, these surveys have

consistently shown weak growth or contraction across the region in recent

months.

Australia will report GDP, trade and household spending data

next week, but these releases are unlikely to shift expectations for the

Reserve Bank of Australia to keep policy on hold at this meeting the following

week. South Korea will report trade, inflation, and GDP data, while Taiwan will

report inflation data.

US Preview

Markets Eye Start to Holiday Shopping Season; Data

Calendar Remains Muddled

By Theresa Sheehan, Econoday Economist

The data release schedule in the December 1 week is still

not back to normal. Some previously scheduled reports will not be released and

some delayed reports will make an appearance. Statistical agencies have not

quite finished getting the revised release schedules up to date, but the dates

of most of the important reports are now in place.

There will be no public comments from Fed officials in the

week, at least on the topic of monetary policy. The communications blackout

period around the December 9-10 FOMC meeting goes into effect at midnight on

Saturday, November 29 and runs through midnight on Thursday, December 11.

Friday, November 28 - so-called "Black Friday" - marks the

start of the traditional winter holiday shopping season. This is less true in

recent years as retailers start heavily promoting gift shopping in October. The

term "Black Friday" has become synonymous with any promotion intended to convey

the discounts are big and for limited inventory, and that the time to shop is

now.

It remains to be seen if consumers front-loaded their

holiday gift buying in October and the first half of November. In the meantime,

markets will be watching for news of the success - or lack of success - for the

first major weekend of the shopping season among retail outlets both

brick-and-mortar and online.

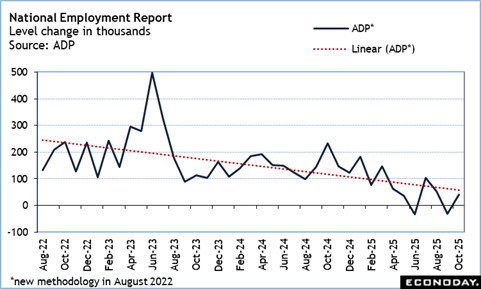

The monthly employment report for October is moved from

Friday, December 5 to Tuesday, December 16. The major labor market data in the

week will be the November numbers in the ADP national employment report and the

Challenger report on job cut plans. There is some month-to-month variation in

ADP payroll data, but on the whole the trend is lower as businesses eliminate

jobs - filled and unfilled - in uncertain times. The underlying pace of hiring

is tepid. The Challenger report is likely to continue the story that job cuts

are widespread but modest except in a few narrow sectors. In particular, the

adoption of AI tools is forcing restructuring that has particularly affected

jobs in the tech field.

The Week Ahead: Econoday Consensus Forecasts

Monday

China PMI Manufacturing for November (Mon 0945 CST;

Mon 0145 GMT; Sun 2045 EST)

Consensus Forecast, Index: 50.5

Consensus Range, Index: 49.2 to 50.5

Index expected to remain barely in expansion at 50.5 in

November versus 50.6 in October.

France PMI Manufacturing Final for November (Mon 0950

CEST; Mon 0850 GMT; Mon 0350 EST)

Consensus Forecast, Index: 47.8

Consensus Range, Index: 47.8 to 47.8

The consensus sees no revision from the November flash at

47.8, down from 48.8 in the October final.

Germany PMI Manufacturing Final

for November (Mon 0955 CEST; Mon 0855 GMT; Mon 0355 EST)

Consensus Forecast, Index: 48.4

Consensus Range, Index: 48.4 to 48.4

The consensus sees no revision from the November flash at

48.4, down from 49.6 in the October final.

Eurozone PMI Manufacturing Final for November (Mon

1000 CET; Mon 0900 GMT; Mon 0400 EST)

Consensus Forecast, Index: 49.7

Consensus Range, Index: 49.7 to 49.7

The consensus sees no revision from the November flash at

49.7, down from 50.0 in the October final.

UK PMI Manufacturing Final for November (Thu 0930

GMT; Thu 0430 EST)

Consensus Forecast, Index: 50.2

Consensus Range, Index: 50.2 to 50.2

No revision expected from the November flash at 50.2 and

versus from 49.7 in the October final.

US PMI Manufacturing Final for November (Mon 0945

EST; Mon 1445 GMT)

Consensus Forecast, Index: 51.9

Consensus Range, Index: 51.9 to 51.9

Forecasters look for no revision from the November flash at

51.9, down a bit from 52.5 in the October final.

US ISM Manufacturing Index for November (Mon 1000

EST; Mon 1500 GMT)

Consensus Forecast, Index: 49.0

Consensus Range, Index: 48.3 to 49.3

The index is expected to show similar slow contraction at 49.0

in November after 48.7 in October and 49.1 in September.

US Construction Spending for October (Mon 1000 EST;

Mon 1500 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.1%

Another month of marginal growth seen with spending up 0.1

percent in October after rising 0.2 percent in September.

Tuesday

South Korea CPI for November (Tue 0800 KST; Mon 2300

GMT; Mon 1800 EST)

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.5% to 2.6%

CPI expected up 2.6 percent on year in November after rising

by 2.4 percent in October.

Eurozone HICP Flash for November (Tue 1100 CEST; Tue 1000

GMT; Tue 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.0% to 2.2%

Consensus Forecast, Narrow Core - Y/Y: 2.5%

Consensus Range, Narrow Core - Y/Y: 2.3% to 2.7%

HICP expected sticky at 2.2 percent on year for November

versus 2.1 percent in October. Narrow core seen at 2.5 percent versus 2.4

percent.

Eurozone Unemployment Rate for October (Tue 1100

CEST; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.3%

Jobless rate seen flat at 6.3 percent in October.

Wednesday

Australia GDP for Third Quarter (Wed

1130 AET; Tue 0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.7%

Consensus Range, Q/Q: 0.5% to 1.4%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.2% to 2.2%

Growth seen improving to 0.7 percent on quarter and 2.2

percent on year in Q3 versus 0.6 percent and 1.8 percent in Q2.

China PMI Composite for November (Wed 0945 CST; Wed

0145 GMT; Tue 2045 EST)

Consensus Forecast, Services Index: 52.0

Consensus Range, Services Index: 51.9 to 52.0

Service growth seen fairly resilient at 52.0 versus 52.6 in

October.

Germany PMI Composite Final for November (Wed 0955

CET; Wed 0855 GMT; Wed 0355 EST)

Consensus Forecast, Composite Index: 52.1

Consensus Range, Composite Index: 52.1 to 52.1

Consensus Forecast, Services Index: 52.7

Consensus Range, Services Index: 52.7 to 52.7

No revision expected from the flash at 52.1 for composite

and 52.7 for services.

Eurozone PMI Composite Final for November (Wed 1000

CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Composite Index: 52.4

Consensus Range, Composite Index: 52.4 to 52.4

Consensus Forecast, Services Index: 53.1

Consensus Range, Services Index: 53.1 to 53.1

The consensus sees no revision expected from the flash at

52.4 for composite and 53.1 for services.

UK PMI Composite Final for November (Wed 0930 GMT;

Wed 0430 EST)

Consensus Forecast, Composite Index: 50.5

Consensus Range, Composite Index: 50.5 to 50.5

Consensus Forecast, Services Index: 50.5

Consensus Range, Services Index: 50.5 to 50.5

The consensus looks for no revision from the flash at 50.5

for composite and for services too.

US ADP Employment Report for November (Wed 0815 EST;

Wed 1315 GMT)

Consensus Forecast, Private Payrolls - M/M: 20K

Consensus Range, Private Payrolls - M/M: -50K to 43K

Modest job growth expected at 20K for private payrolls.

US Imports and Export Prices for September (Tue 0830

EST; Tue 1330 GMT)

Consensus Forecast, Import Prices - M/M: -0.2%

Consensus Range, Import Prices - M/M: -0.3% to 0.3%

Consensus Forecast, Import Prices - Y/Y: 0.0%

Consensus Range, Import Prices - Y/Y: -0.1% to 0.1%

Consensus Forecast, Export Prices - M/M: 0.0%

Consensus Range, Export Prices - M/M: -0.3% to 0.2%

Import prices seen down 0.2 percent on the month and export

prices flat on the month.

US Industrial Production for September (Tue 0915 EST;

Tue 1315 GMT)

Consensus Forecast, Industrial Production - M/M: 0.1%

Consensus Range, Industrial Production - M/M: -0.1%

to 0.2%

Consensus Forecast, Manufacturing Output - M/M: 0.0%

Consensus Range, Manufacturing Output - M/M: 0.0% to 0.1%

Consensus Forecast, Capacity Utilization Rate: 77.3%

Consensus Range, Capacity Utilization Rate: 77.2% to 77.7%

Another exceedingly sluggish report with output expected up

0.1 percent and capacity utilization slack at 77.3 percent, down from 77.4

percent.

US PMI Composite Final for November (Wed 0945 EST;

Wed 1345 GMT)

Consensus Forecast, Composite Index: 54.8

Consensus Range, Composite Index: 54.8 to 54.8

Consensus Forecast, Services Index: 55.0

Consensus Range, Services Index: 55.0 to 55.0

No revision expected from the flash with the composite at

54.8 and services at 55.0.

US ISM Services Index for November (Wed 0945 EST; Wed

1345 GMT)

Consensus Forecast, Services Index: 52.1

Consensus Range, Services Index: 51.8 to 53.2

A flat reading expected at 52.4 for November versus 52.1 in

October showing ongoing slow growth.

Thursday

Australia International Trade in Goods for October (Thu

1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$3.6 B

Consensus Range, Balance: A$3.0 B to A$6.0 B

The surplus is expected at A$3.6 billion versus A$3.9 in

September.

Australia Household Spending for October (Thu 1130

AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.0% to 0.6%

Spending growth expected pretty robust at 0.5 percent in

October versus 0.2 percent in September.

Eurozone Retail Sales for October (Thu 1100 CET; Thu 1000

GMT; Thu 0500 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.0% to 0.3%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 1.5% to 1.5%

Sales expected better at up 0.2 percent on the month and 1.5

percent on year versus minus 0.1 percent and up 1.0 percent in September.

US International Trade in Goods and Services for October (Thu

0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: -$66.9 B

Consensus Range, Balance: -$64.0 B to -$70.0 B

The trade gap is expected to widen to $66.9 billion.

US Jobless Claims Week 11/29 (Thu 0830 GMT; Thu 1330

EST)

Consensus Forecast, Initial Claims - Level: 225 K

Consensus Range, Initial Claims - Level: 220K to 230K

Claims seen at 225K from a low 216K last week, back toward

the 4-week moving average at 223.75K

Friday

Japan Household Spending for

September (Fri 0830 JST; Fri 2330 GMT; Fri 1930 EST)

Consensus Forecast, M/M: 0.8%

Consensus Range, M/M: -0.1% to 2.7%

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 0.3% to 2.2%

Japan's real household spending is forecast to rise 1.6% on

the year in October, marking a sixth straight month of year-on-year growth

after a 1.8% rise in September, which was driven by higher spending on

automobiles, medical services and donations.

On a month-on-month basis, household expenditure is expected

to increase 0.8% in October, following a 0.7% decline in the previous month.

The uptrend in October spending is likely supported by

stronger sales at department stores, convenience stores and supermarkets

nationwide during the month.

India Reserve Bank of India Announcement (Fri 1130

IST; Thu 0600 GMT; Thu 0100 EST)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 5.25%

Consensus Range, Level: 5.25% to 5.25%

Forecasters expect the RBI to cut by 25 basis points to 5.25

percent as inflation has been declining and growth fading. The export hit from

US tariffs is substantial.

Germany Manufacturing Orders for October (Fri 0800

CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -2.0% to 0.5%

Orders expected to retreat by 0.5 percent after jumping 1.1

percent in September.

Eurozone GDP for Third Quarter (Fri 1100 CET; Fri 1000

GMT; Fri 0500 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 1.4% to 1.4%

No revision expected from 0.2 percent on quarter and 1.4

percent on year for Q3.

Canada Labour Force Survey for November (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Employment - M/M: -5K

Consensus Range, Employment - M/M: -14K to10K

Consensus Forecast, Unemployment Rate: 7.0%

Consensus Range, Unemployment Rate: 6.9% to 7.0%

Another weak jobs report with a decline in employment and

the unemployment rate rising to 7.0 percent from 6.9 percent in October.

United States Personal Income and Outlays for September (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.4%

Consensus Range, Personal Income - M/M: 0.3% to 0.5%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.4%

Consensus Range, Personal Consumption Expenditures - M/M:

0.3% to 0.5%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.3% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.8%

Consensus Range, PCE Price Index - Y/Y: 2.8% to 2.8%

Consensus Forecast, Core PCE Price Index - M/M: 0.3%

Consensus Range, Core PCE Price Index - M/M: 0.2% to 0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.9%

Consensus Range, Core PCE Price Index - Y/Y: 2.9% to 3.0%

Income and spending both expected up a robust 0.4 percent on

the month. PCE prices seen up 0.3 percent on the month for total and core.

US Consumer Sentiment for December (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Index: 52.0

Consensus Range, Index: 50.0 to 53.0

Not a pretty picture for consumer sentiment with 52.0 expected

for the first read on December versus an abysmal 51.0 in the November final.

The index was in the 70s a year ago.

US Consumer Credit for October (Fri 1500 EST; Fri

2000 GMT)

Consensus Forecast, M/M: $9.4 B

Consensus Range, M/M: $6.0 B to $9.8 B

A trendlike rise of $9.4 billion is the call for October.

|