|

The Week Ahead: Highlights

Asia-Pacific Preview

No Rate Move Expected from RBA

By Brian Jackson, Econoday Economist

The Reserve Bank of Australia meeting is the main focus in

the Asia-Pacific region but the outcome is widely expected to be no change in

policy settings. Monthly CPI data published late November showed headline

inflation increased from 3.6 percent in September to 3.8 percent in October,

with underlying measures inflation also picking up. Instead, the focus next

week will be on RBA commentary on the outlook in response to this increase in

inflation. Australian labour market data and sentiment surveys will also be

released next week.

India CPI data for November will also be watched closely

after sharp falls in food prices drove headline inflation to a record low in

October, prompting a renewed cut in policy rates by the Reserve Bank of

India last week. China also reports inflation data next week, while trade data

for China and Taiwan are also scheduled for release.

US Preview

FOMC Meeting This Week amid Uncertain Economic Data

By Theresa Sheehan, Econoday Economist

The US statistical agencies continue to issue revised

release dates for the backlog of economic data reports. Much of the data set

for the December 8 week is relatively old and only brings the available

information up through the end of the third quarter.

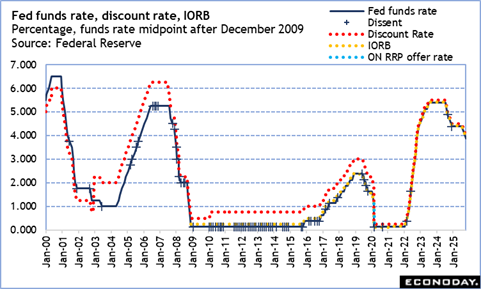

When the FOMC meets on Tuesday-Wednesday, they are going to

have to rely on much the same patchwork of information that they did at the

previous meeting on October 28-29 - most of the major government reports are

still a month behind their regular release cycle. The FOMC should have enough

to make a decision about monetary policy. A 25-basis point decrease in the fed

funds target rate range is widely expected and the most likely outcome of the

meeting.

The FOMC will release its post-meeting statement at 14:00 ET

on Wednesday. It is probable that this will be another split vote with the

majority favoring the incremental cut, one or two more wanting no change in

rate, and at least one preferring a 50-basis point cut.

The quarterly update to the summary of economic projections

(SEP) will provide some guidance about the FOMC's broad outlook. However, this

time around the forecasts will need to be read with particular caution. Until

the disruptions to data reporting are done, the FOMC has an incomplete picture

of the US economy, increasing the uncertainty behind the projections.

Chair Jerome Powell's opening remarks at his press briefing

on Wednesday at 14:30 ET will include a reminder that the SEP is not a promise

of the future path of interest rates. He will also reiterate that monetary

policy is not on a preset path, that the FOMC is data-dependent, and that the

FOMC is taking a balanced approach to setting monetary policy. He could well

repeat that there is no "risk-free path" for Fed policymakers as they try to

determine which side of the dual mandate of maximum employment and price

stability needs more attention at present. The labor market data is mixed.

Although it appears that job cuts are on the rise and hiring is weak, the

numbers are not universally to the downside. Inflation is still on the rise

even as expectations are for prices to stabilize in the near term.

The Week Ahead: Econoday Consensus Forecasts

Monday

Japan GDP for Third Quarter (Mon 0850 JST; Sun 2350

GMT; Sun 1850 EST)

Consensus Forecast, Q/Q: -0.5%

Consensus Forecast, Y/Y: -2.1%

Consensus Range, Y/Y: -2.4% to -1.6%

Japan's revised GDP data for the July-September quarter are

expected to show a slightly deeper decline, reflecting slower growth in private

corporate capital expenditure and public investment. The preliminary estimate

had already marked the first contraction in six quarters, driven by weaker

exports following the impact of U.S. tariffs.

Revised GDP is forecast to fall 0.5 percent on the quarter

(down 2.1 percent annualized), compared with the preliminary reading of -0.4

percent (down 1.8 percent annualized).

A survey released on November 17 showed that preliminary GDP

shrank 0.4 percent in the third quarter from the previous quarter. This was a

slightly smaller contraction than the consensus forecast of -0.7 percent. The

decline largely reflected a pullback in net exports, as expected after export

front-loading ahead of U.S. tariffs boosted shipments in the second quarter.

China Merchandise Trade for November (ANYTIME)

Consensus Forecast, Balance: $104.44 B

Consensus Range, Balance: $103.1 B to $108.4 B

Consensus Forecast, Imports - Y/Y: 2.5%

Consensus Range, Imports - Y/Y: 2.0% to 2.8%

Consensus Forecast, Exports - Y/Y: 4.0%

Consensus Range, Exports - Y/Y: 3.5% to 4.9%

Better overseas demand for electronics is expected to help

exports rebound by 4.0 percent in November after an unusual 1.1 percent dip in

October. Container shipping data suggests a better showing too. Imports are

seen up 2.5 percent. The trade surplus is seen at $104.44 billion, up a lot

from $90.7 billion in October.

Germany Industrial Production for October (Mon 0800

CET; Mon 0700 GMT; Mon 0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -2.0% to 1.1%

Consensus Forecast, Y/Y: -0.4%

Consensus Range, Y/Y: -0.7% to -0.1%

Output is expected up a muted 0.1 percent on the month in

October after rising 1.3 percent in September. On year, output is seen down 0.4

percent after a 1.0 percent decrease in September.

Tuesday

Australia RBA Announcement for December (Tue 1230

AET; Tue 0330 GMT; Mon 2230 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 3.60%

Consensus Range, Level: 3.60% to 3.60%

Inflation worries expected to keep the RBA on hold until Q2

2026.

Germany Merchandise Trade for October (Tue 0800 CET; Tue

0700 GMT; Tue 0200 EST)

Consensus Forecast, Balance: E15.7 B

Consensus Range, Balance: E15.0 B to E16.0 B

The consensus sees the surplus nearly flat at E15.7 billion

versus E15.3 billion in September.

US NFIB Small Business Optimism Index for November (Tue

0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 98.1

Consensus Range, Index: 97.6 to 98.2

The index is expected down again at 98.1 in November after a

soft 98.2 in October and 98.8 in September.

US Productivity and Costs for Third Quarter (Tue 0830

EST; Tue 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

3.3%

Consensus Range, Nonfarm Productivity - Annual Rate: 3.0%

to 4.0%

Consensus Forecast, Unit Labor Costs - Annual Rate: 1.0%

Consensus Range, Unit Labor Costs - Annual Rate: 0.8%

to 1.0%

The consensus sees 3.3 percent for productivity and 1.0

percent for ULC.

US JOLTS for October (Tue 1000 EST; Tues 1500 GMT)

Consensus Forecast, Job Openings: 7.20 M

Consensus Range, Job Openings: 7.10 M to 7.30 M

Job openings seen flat at 7.20 million.

Wednesday

Japan PPI for November (Wed 0830 JST; Tue 2330 GMT; Tue

1830 EST)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.5%

Consensus Forecast, Y/Y: 2.7%

Consensus Range, Y/Y: 2.5% to 2.9%

Japan's corporate goods price index (CGPI), or producer

inflation, is expected to remain firm in November, supported by a continued

uptrend in food prices, including rice, rising industrial metal prices such as

nonferrous metals, and a weaker yen that is lifting import costs. International

commodity prices are also trending higher.

The November CGPI is expected to rise 2.7 percent on the

year, unchanged from October, driven by elevated rice prices and stronger

nonferrous metals. Farm produce prices were up 31.4 percent in October versus a

revised 31.9 percent in September.

On a month-on-month basis, the CGPI is projected to rise for

the third straight month in November, increasing 0.3 percent after a 0.4

percent gain in October and a revised 0.5 percent rise in September.

China CPI for November (Wed 0930 CST; Wed 0130 GMT; Tue

2030 EST)

Consensus Forecast, Y/Y: 0.7%

Consensus Range, Y/Y: 0.3% to 0.8%

With the anti-involution campaign reducing price competition,

CPI projected to rise 0.7 percent on year in November, up from 0.2 percent in

October.

China PPI for November (Wed 0930 CST; Wed 0130 GMT;

Sun 2030 EST)

Consensus Forecast, Y/Y: -2.0%

Consensus Range, Y/Y: -2.1% to -1.9%

Forecasters expect the PPI down 2.0 percent on year in

November versus 2.1 percent in October as deflation eases a bit.

Brazil CPI for November (Wed 0900 BRT; Wed 1200 GMT;

Wed 0700 EST)

Consensus Forecast, M/M: 0.10%

Consensus Range, M/M: 0.09% to 0.2%

CPI expected up 0.10 percent on the month versus 0.09

percent in October.

US Employment Cost Index for Third Quarter (Wed 0830

EST; Wed 1330 GMT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.8% to 0.9%

Consensus Forecast, Y/Y: 3.7%

Consensus Range, Y/Y: 3.7% to 3.7%

ECI expected up 0.9 percent on the quarter and 3.7 percent

on year.

Canada Bank of Canada Announcement (Wed 0945 EST; Wed

1445 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.25%

Consensus Range, Level: 2.25% to 2.25%

No one expects another rate cut as the BOC said after its

September cut that rates are now where they need to be. Surprisingly strong

employment data have bolstered the case for no cut.

United States FOMC Announcement (Wed 1400 EST; Wed 1900

GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Federal Funds Rate - Target Range: 3.50%

to 3.75%

Consensus Range, Federal Funds Rate - Target Range:

3.50%- 3.75% to 3.75%-4.0%

After all the buildup, forecasters expect a 25 bp rate cut

as the Fed fears a weakening job market more than inflation.

Brazil Selic Rate for December (Wed 1830 BRT; Wed 2130

GMT; Wed 1630 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 15.0%

Consensus Range, Level: 15.0% to 15.0%

Forecasters see no change from the Brazilian central bank.

Thursday

Australia Labour Force Survey for November (Thu 1130

AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Employment - M/M: 20K

Consensus Range, Employment - M/M: 5K to 40K

Consensus Forecast, Unemployment Rate: 4.4%

Consensus Range, Unemployment Rate: 4.2% to 4.4%

Jobs are expected to show a 20K increase on the month in

November. The jobless rate is expected up to 4.4 percent from 4.3 percent in

October.

Switzerland SNB Monetary Policy Assessment for December (Thu

0930 CET; Thu 0830 GMT; Thu 0330 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 0%

Consensus Range, Level: 0% to 0%

Expectations call for the SNB to keep rates steady again after

holding at 0 last time.

US International Trade in Goods and Services for

September (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, Balance: $-64.1 B

Consensus Range, Balance: $-85.0 B to $-57.0 B

The trade gap is expected at a relatively narrow $64.1

billion.

US Jobless Claims Week 12/06 (Thu 0830 GMT; Thu 1330

EST)

Consensus Forecast, Initial Claims - Level: 218K

Consensus Range, Initial Claims - Level: 205K to 232K

Claims are seen rebounding to 218K after a surprise drop of

27K to 191K last week.

US Wholesale Inventories (Preliminary) for September (Thu

1000 EST; Thu 1500 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.3% to 0.1%

Inventories expected down 0.1 percent.

Friday

Germany CPI for November (Fri

0800 CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.2% to -0.2%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.3% to 2.3%

HICP Consensus Forecast, M/M: -0.5%

HICP Consensus Range, M/M: -0.5% to -0.5%

HICP Consensus Forecast, Y/Y: 2.6%

HICP Consensus Range, Y/Y: 2.6% to 2.6%

The consensus sees no revision from the flash at minus 0.2

percent on month and up 2.3 percent on year for the November final for CPI.

UK Monthly GDP for October (Fri 0700 GMT; Fri 0200

EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

Growth seen up 0.1 percent on the month in October after

declining 0.1 percent in September with support from a recovery in

manufacturing.

UK Industrial Production for October (Fri 0700 GMT; Fri

0200 EST)

Consensus Forecast, Industrial Production - M/M: 0.9%

Consensus Range, Industrial Production - M/M: 0.8% to

1.2%

Consensus Forecast, Industrial Production - Y/Y: -0.9%

Consensus Range, Industrial Production - Y/Y: -1.2%

to -0.8%

Output is expected to rebound by 0.9 percent in October on

the month after dropping 2.0 percent in September. On year, the call is down

0.9 percent.

France

CPI for November (Fri 0845 CEST; Fri 0745 GMT; Fri 0245 EST)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.1% to -0.1%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 0.9%

Consensus Forecast, HICP - M/M: -0.2%

Consensus Range, HICP - M/M: -0.2% to -0.2%

Consensus Forecast, HICP - Y/Y: 0.8%

Consensus Range, HICP - Y/Y: 0.8% to 0.8%

The consensus sees no revision from the flash at minus 0.1

percent on month and up 0.9 percent on year for the November final.

India CPI for November (Fri 1600 IST; Fri 1030 GMT; Fri

0530 EST)

Consensus Forecast, Y/Y: 0.6%

Consensus Range, Y/Y: 0.6% to 0.6%

A slightly less scary 0.6 percent is expected for November

versus 0.25 percent in October.

|