|

The Week Ahead: Highlights

Asia-Pacific Preview

China Activity Data in Focus

By Brian Jackson, Econoday Economist

Monthly Chinese activity data for November will be the main

focus of the Asia-Pacific data calendar. Official PMI surveys have shown

ongoing contraction in the manufacturing sectored near-stagnant conditions in

the non-manufacturing sector in November. Trade data published this week showed

a rebound in exports. At their annual economic work conference held this week,

senior officials pledged to keep fiscal policy "more proactive" and monetary

policy" moderately loose" in 2026.

The Central Bank of the Republic of China (Taiwan) holds its quarterly policy

meeting. Its main policy rate has been on hold at 2.00 percent since early

2024, and this policy stability will likely be extended next week, with recent

data showing contained inflation and strong export growth.

New Zealand reports GDP and trade data but these are unlikely to shape

expectations about the next Reserve Bank of New Zealand policy meeting, which

will not be until mid-February after the release of inflation data. India will

also report inflation and trade data next week.

Europe Preview

Big Indicators Week Ahead; ECB Seen on Hold

By Marco Babic, Econoday Economist

Europe's main even is the European Central Bank's monetary

policy decision on Thursday. But there are also other top-shelf indicators set

for release including Germany's Ifo and ZEW reports and consumer confidence.

Trade data for the Eurozone, Italy, and Switzerland are also on offer.

The ECB has kept its policy steady following its subsequent

meetings to June 5 when it last opted to lower official rates by 25 basis

points. Since then, he refinancing rate has been held at 2.15 percent and the

deposit rate at 2.00%. With its data driven approach, the central bank is

unlikely to lower rates with inflation well within the desired target range.

Germany's ZEW investor sentiment report on Tuesday and Ifo's

business confidence index on Wednesday, both for December, will give a first

reading of how the last month of the year is shaping up. In November, ZEW's

economic sentiment index contracted to 38.5 from 49.3. The Ifo business climate

index fell to 88.1 in November from 88.4, while the expectations component fell

to 90.6 from 91.6. There is little to suggest that the situation will be better

in December.

France and Italy also report business sentiment next week on

Thursday and Friday, respectively. French businesses were marginally more

pessimistic in November, while their Italian counterparts were more upbeat.

Switzerland reports its trade results for November on

Thursday but will unlikely reflect the impact of the trade agreement reached

with the US lowering tariffs from 39 percent to 15 percent. In recent months

the watch industry has been hit particularly hard as have the chemical and

pharmaceutical industries. For the Eurozone and Italy, their trade reports for

October could show a somewhat of a normalization with the European Union having

reached a trade deal, albeit an unpopular one in Europe, with the US earlier

than the Swiss government.

Over the past year, US trade policy has loomed large over

Europe's economies. Still an unknown is how the US Supreme Court will rule on

the legality of tariffs. Should they indeed be deemed illegal, it will be a

welcome development for Europe, although there is most likely to be added

uncertainty and volatility around such a development, and President Trump is

widely expected to find other ways to keep his tariffs in place.

US Preview

Markets Eye Key US Employment Report

By Theresa Sheehan, Econoday Economist

The data release schedule continues to catch up, but the

process will not be completed until February.

In the December 15 week, the big piece of the labor market

data is the November monthly employment report on Tuesday at 8:30 ET. The

December employment report will be released on Friday, January 9 as originally

scheduled. The data in the establishment survey for payrolls will include the

cancelled October employment report, while the household survey will have no

data for October and pick up again for November.

November can be a solid month for hiring as typically

soon-to-be-college graduates find jobs and some businesses act to fill open

spots before the end of a budget year. However, November 2025 comes on the

heels of the longest federal government shutdown which intensified the current

economic uncertainty. It is probable that normal seasonal adjustment patterns

are going to be thrown off. It remains to be seen if hiring rebounded after the

shutdown or if businesses remain wary about adding to payrolls. The November

unemployment rate is likely to be higher than 4.4 percent in September. How

much higher depends on if job cut plans are more about eliminating unfilled

positions or if more workers are losing jobs.

Note: The Labor Department has said, "BLS will not publish

an October 2025 Employment Situation news release. Establishment survey data

from the Current Employment Statistics survey for October 2025 will be

published with the November 2025 data. Household survey data from the Current

Population Survey were not collected for the October 2025 reference period due

to a lapse in appropriations and will not be collected retroactively. For both

surveys, the collection period for November 2025 data will be extended, and

extra processing time will be needed."

The Week Ahead: Econoday Consensus Forecasts

Monday

Japan Tankan for Fourth Quarter (Mon 0850 JST; Sun

2350 GMT; Sun 1850 EST)

Consensus Forecast, Large Manufacturer Sentiment Index:

15

Consensus Range, Large Manufacturer Sentiment

Index: 13 to 16

Consensus Forecast, Large Non-Manufacturer Sentiment

Index: 34

Consensus Range, Large Non-Manufacturer Sentiment Index:

33 to 36

Consensus Forecast, Small Manufacturer Sentiment Index:

1

Consensus Range, Small Manufacturer Sentiment

Index: -1 to 3

Consensus Forecast, Small Non-Manufacturer Sentiment

Index: 14

Consensus Range, Small Non-Manufacturer Sentiment Index:

12 to 15

FY Current, 2025

Consensus Forecast, Large Firms Capital Expenditure Plans:

12.2%

Consensus Range, Large Firms Capital Expenditure Plans:

10.0% to 13.4%

Consensus Forecast, Small Firms Capital Expenditure Plans:

0.3%

Consensus Range, Small Firms Capital Expenditure Plans:

-1.1% to 2.9%

The Bank of Japan's quarterly Tankan business sentiment

survey is expected to show a slight improvement among major manufacturers in

the December quarter, supported by the yen's continued weakness and solid

global demand tied to artificial intelligence. At the same time, the negative

effects of the Trump tariffs are expected to continue to surface, keeping the

overall outlook cautious.

Business sentiment among small manufacturers, as well as

among both large and small non-manufacturers, is expected to remain largely

unchanged from the September survey.

The Tankan diffusion index for major manufacturers is

forecast at 15, up from 14 in September and seen marking the third straight

quarterly increase. The index measuring sentiment among major non-manufacturers

is projected to remain steady at 34.

The index for smaller manufacturers is forecast to hold at 1

from September, while that for small non-manufacturers is also expected to be

unchanged at 14. The BOJ will release the results of its Tankan survey,

conducted from around mid-November to mid-December, at 0850 JST on Monday,

December 15 (1850 EST / 2350 GMT on Sunday, December 14).

China Fixed Asset Investment for November (Mon 1000

CST; Mon 0200 GMT; Sun 2100 EST)

Consensus Forecast, Year to Date on Y/Y Basis: -2.3%

Consensus Range, Year to Date on Y/Y Basis: -2.8% to -2.0%

After dropping by an unheard-of 2.2 percent in October, the

November call looks for no recovery with a drop of 2.3 percent. It's shocking

to see declines in this series after years of rapid growth.

China Industrial Production for November (Mon 1000

CST; Mon 0200 GMT; Sun 2100 EST)

Consensus Forecast, Y/Y: 5.0%

Consensus Range, Y/Y: 5.0% to 5.4%

The consensus sees output up 5.0 percent on year after

rising 4.9 percent in October

China Retail Sales for November (Mon 1000 CST; Mon

0200 GMT; Sun 2100 EST)

Consensus Forecast, Y/Y: 2.9%

Consensus Range, Y/Y: 2.7% to 3.3%

Forecasters expect sales up a very modest 2.9 percent on

year, same as in October.

Eurozone Industrial Production for October (Mon 1100

CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.3% to 0.9%

Consensus Forecast, Y/Y: 1.7%

Consensus Range, Y/Y: 1.6% to 1.8%

Output is seen up a strong 0.7 percent on the month in

October and up 1.7 percent on year versus increases of 0.2 percent and 1.2

percent in September.

Canada Housing Starts for November (Mon 0815

EST; Mon 1315 GMT)

Consensus Forecast, Annual Rate: 241K

Consensus Range, Annual Rate: 229K to 255K

After dipping to 233K in October, starts expected to recover

to 241K in November.

Canada CPI for November (Mon 0830 EST; Mon 1330 GMT)

Consensus Forecast, CPI - M/M: 0.1%

Consensus Range, CPI - M/M: 0.0% to 0.2%

Consensus Forecast, CPI - Y/Y: 2.3%

Consensus Range, CPI - Y/Y: 2.2% to 2.3%

CPI expected up 0.1 percent on month in November and 2.3 percent

on year after gains of 0.2 percent and 2.2 percent in October.

Canada Manufacturing Sales for October (Mon 0830 EST;

Mon 1330 GMT)

Consensus Forecast, M/M: -1.1%

Consensus Range, M/M: -1.1% to -1.0%

The consensus agrees with the Stats Canada preliminary

estimate calling for sales to fall back 1.1 percent in October after a big 3.3

percent rise in September.

US Empire State Manufacturing Index for December (Mon

0830 EST; Mon 1330 GMT)

Consensus Forecast, Index: 10.0

Consensus Range, Index: 5.0 to 15.4

The consensus sees moderate but slower growth at 10.0 for

December versus 18.7 in November.

US Housing Market Index for December (Mon 1000 EST; Mon

1500 GMT)

Consensus Forecast, Index: 39

Consensus Range, Index: 37 to 40

The consensus sees the index up to 39 in December from 38 in

November.

Tuesday

UK Labour Market Report for November (Tue 0700 GMT;

Tue 0200 EST)

Consensus Forecast, ILO Unemployment Rate: 5.1%

Consensus Range, ILO Unemployment Rate: 5.1% to 5.1%

Consensus Forecast, Average Earnings - Y/Y: 4.5%

Consensus Range, Average Earnings - Y/Y: 4.5% to 4.5%

The ILO jobless rate expected at 5.1 percent in November

versus 5.0 percent in October. Earnings including bonus are seen softer at up 4.5

percent after 4.8 percent in October.

France PMI Composite Flash for December (Tue 0930

CET; Tue 0830 GMT; Tue 0330 EST)

Consensus Forecast, Manufacturing Index: 48.9

Consensus Range, Manufacturing Index: 48.5 to 48.9

Consensus Forecast, Services Index: 51.5

Consensus Range, Services Index: 51.3 to 51.5

Manufacturing seen a bit better but still contracting at 48.9

versus 47.8 in November. Services expected nearly flat at 51.5 versus 51.4 in

November

Germany PMI Composite Flash for December (Tue 0930

CET; Tue 0830 GMT; Tue 0330 EST)

Consensus Forecast, Manufacturing Index: 48.7

Consensus Range, Manufacturing Index: 48.4 to 48.9

Consensus Forecast, Services Index: 53.0

Consensus Range, Services Index: 52.5 to 53.4

Manufacturing seen at 48.7 in the December flash versus 48.2

in November. Services expected at 53.0 versus 53.1 in November.

Eurozone PMI Composite Flash for December (Tue

1000 CET; Tue 0900 GMT; Tue 0400 EST)

Consensus Forecast, Composite Index: 52.8

Consensus Range, Composite Index: 52.4 to 53.6

Consensus Forecast, Manufacturing Index: 49.8

Consensus Range, Manufacturing Index: 49.6 to 50.1

Consensus Forecast, Services Index: 53.2

Consensus Range, Services Index: 53.0 to 54.0

The composite is expected at 52.8 in the December flash

versus 52.8 in November final. Manufacturing seen at 49.8 versus 49.6 in

November. Services expected at 53.2 versus 53.6 in November.

Italy CPI for November (Tue 1100 CET; Tue 1000 GMT; Tue

0500 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.2% to -0.2%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

The consensus sees no revision from the flash at minus 0.2

percent on the month and plus 1.2 percent on year for November.

UK PMI Composite Flash for December (Tue 0930

GMT; Tue 0430 EST)

Consensus Forecast, Composite Index: 51.6

Consensus Range, Composite Index: 51.4 to 51.9

Consensus Forecast, Manufacturing Index: 50.8

Consensus Range, Manufacturing Index: 50.2 to 51.2

Consensus Forecast, Services Index: 51.8

Consensus Range, Services Index: 51.5 to 52.0

The composite is expected at 51.6 in the December flash

versus 51.2 in November final. Manufacturing seen at 50.8 versus 50.2 in

November. Services expected at 51.8 versus 51.3 in November.

Germany ZEW Survey for December (Tue 1100 CET; Tue

1000 GMT; Tue 0500 EST)

Consensus Forecast, Current Conditions: -78.4

Consensus Range, Current Conditions: -81.8 to -76.6

Consensus Forecast, Economic Sentiment: 39.3

Consensus Range, Economic Sentiment: 34.0 to 45.0

Only modest improvement expected with current conditions at

minus 78.4 for December versus minus 78.7 in November. Sentiment expected at 39.3

versus 38.5 in November.

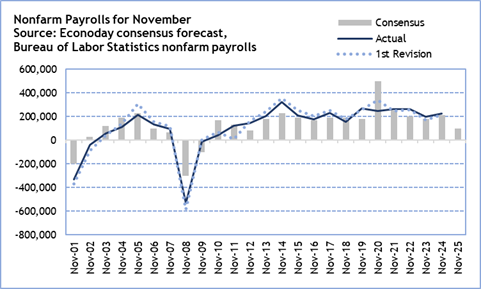

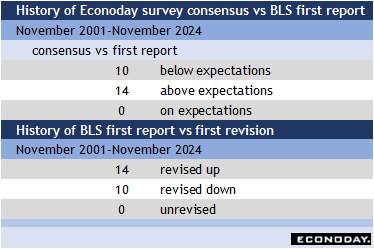

US Employment Situation for November (Tue 0830 EST; Tue

1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 40K

Consensus Range, Nonfarm Payrolls - M/M: -20K to 100K

Consensus Forecast, Unemployment Rate: 4.5%

Consensus Range, Unemployment Rate: 4.4% to 4.7%

Consensus Forecast, Private Payrolls - M/M: 30K

Consensus Range, Private Payrolls - M/M: 0K to 45K

Consensus Forecast, Manufacturing Payrolls - M/M: -5K

Consensus Range, Manufacturing Payrolls - M/M: -12K to

-3K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.3%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.6%

Consensus Range, Average Hourly Earnings - Y/Y: 3.6%

to 3.8%

Consensus Forecast, Average Workweek: 34.2

Consensus Range, Average Workweek: 34.1 to 34.3

The consensus for payrolls calls for a gain of 40K for

November with the jobless rate up to 4.5 percent.

US Housing Starts and Permits for

November (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.325 M

Consensus Range, Starts - Annual Rate: 1.310 M to

1.350 M

Consensus Forecast, Permits - Annual Rate: 1.345 M

Consensus Range, Permits - Annual Rate: 1. 310 M to

1.370

The call for November is a 1.325 million unit rate. Permits

are seen at a 1.345 million unit rate.

US PMI Composite Flash for December (Tue 0945 EST;

Tue 1445 GMT)

Consensus Forecast, Manufacturing Index: 52.0

Consensus Range, Manufacturing Index: 52.0 to 52.5

Consensus Forecast, Services Index: 53.9

Consensus Range, Services Index: 53.0 to 55.1

Manufacturing is seen at 52.0 versus 52.2 and services at 53.9

versus 54.1.

US Business Inventories for September

(Tue 1000 EST; Tue 1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.2%

Inventories seen up 0.2 percent on the month.

Wednesday

Japan Merchandise Trade for November (Wed 0850 JST;

Tue 2350 GMT; Tue 1850 EST)

Consensus Forecast, Balance: ¥47.60 B

Consensus Range, Balance: ¥-17.00 B to ¥128.30 B

Consensus Forecast, Imports - Y/Y: 0.5%

Consensus Range, Imports - Y/Y: -1.4% to 3.9%

Consensus Forecast, Exports - Y/Y: 2.6%

Consensus Range, Exports - Y/Y: 0.4% to 5.0%

Japan's export values are expected to rise for the third

consecutive year-on-year increase in November, supported by robust demand from

Europe and Asia and aided by the yen's continued weakness.

Export values are forecast to increase 2.6 percent on the

year in November following a 3.6 percent gain in October, when exports to both

Europe and Asia rose for the third straight month, while shipments to the U.S.

fell for the seventh consecutive month.

Import values are also expected to rise for the third

straight month, with an estimated 0.5 percent increase in November following a

0.7 percent gain in October and a 3.3 percent rebound in September.

Taking these factors together, the trade balance is

projected to post its first surplus in five months, estimated at a modest

surplus of ¥47.6 billion after a revised ¥226.07 billion deficit in October and

a ¥499.95 billion deficit in October 2024.

Japan Machinery Orders for October (Wed 0850 JST; Tue

2350 GMT; Tue 1850 EST)

Consensus Forecast, M/M: -2.6%

Consensus Range, M/M: -5.0% to 2.7%

Consensus Forecast, Y/Y: 3.6%

Consensus Range, Y/Y: 0.6% to 11.6%

Japan's core machinery orders, a key leading indicator of

business investment in equipment and software, are expected to return to a

downward path in October, as the impact of a major one-off order from the

chemical industry in the previous month fades.

Core machinery orders are expected to fall 2.6 percent on

the month in October, after posting their first month-on-month increase in

three months in September, when they rose a solid 4.2 percent.

On a year-on-year basis, core orders excluding those from

electric utilities and for ships are projected to rise 3.6 percent, which would

mark the 13th straight month of increase, after jumping 11.6 percent in

September and sharply beating the median economist forecast of a 7.6 percent

rise.

UK CPI for November (Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.1%

Consensus Forecast, Y/Y: 3.4%

Consensus Range, Y/Y: 3.4% to 3.5%

Numbers reassuring enough as inflation recedes enough to

allow a rate cut Thursday. UK annual inflation seen at 3.5 percent in November

after 3.6 percent in October. Month on month, the consensus looks for a lovely

0.0 percent after a 0.4 percent increase in October.

Germany Ifo Survey for December (Wed 1000 CET; Wed 0900

GMT; Wed 0400 EST)

Consensus Forecast, Business Climate: 88.2

Consensus Range, Business Climate: 87.3 to 88.5

Consensus Forecast, Current Conditions: 85.7

Consensus Range, Current Conditions: 85.0 to 86.5

Consensus Forecast, Business Expectations: 90.6

Consensus Range, Business Expectations: 89.6 to 90.9

Business climate expected almost flat at 88.2 versus 88.1 in

the prior month. Current conditions seen at 85.7 versus 85.6 and expectations unchanged

at 90.6 versus 90.6.

Eurozone HICP for November (Wed

1100 CET; Wed 1000 GMT; Wed 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.2% to 2.2%

Consensus Forecast, Narrow Core - Y/Y: 2.4%

Consensus Range, Narrow Core - Y/Y: 2.4% to 2.4%

The consensus sees no revision from the flash at 2.2 percent

on year with narrow core unchanged at 2.4 percent.

US Retail Sales for November (Wed

0830 EST; Wed 1330 GMT)

Consensus Forecast, Retail Sales - M/M: 0.2%

Consensus Range, Retail Sales - M/M: -0.5% to 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: 0.1% to 0.4%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.2%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.1% to

0.4%

Modest increases expected with sales up 0.2 percent.

US Business Inventories for October (Wed 1000 EST; Wed

1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Inventories seen up 0.2 percent on the month.

Thursday

New Zealand GDP for Third Quarter (Thu 0700 NZDT; Wed

1800 GMT; Wed 1300 EST)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.5% to 0.9%

The consensus sees the economy bouncing back by 0.9 percent

in Q3 from Q2 after declining by 0.9 percent on quarter in Q2 as volatility

remains.

France Business Climate Indicator for December (Thu

0845 CET; Thu 0745 GMT; Thu 0245 EST)

Consensus Forecast, Index: 98

Consensus Range, Index: 97 to 98

No change expected at 98.

UK BoE Announcement & Minutes (Thu 1200 BST; Thu

1100 GMT; Thu 0700 EST)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 3.75%

Consensus Range, Level: 4.00% to 3.75%

The consensus expects the BOE to cut Bank Rate by 25 basis

points as enough MPC members will be convinced inflation is coming down

alongside a tighter fiscal budget.

Eurozone ECB Announcement (Thu 1415 CET; Thu 1315

GMT; Thu 0815 EST)

Consensus Forecast, Refi Rate Change: 0 bp

Consensus Range, Refi Rate Change: 0 bp to 0

bp

Consensus Forecast, Refi Rate Level: 2.15%

Consensus Range, Refi Rate Level: 2.15% to 2.15%

Consensus Forecast, Deposit Rate Change: 0 bp

Consensus Range, Deposit Rate Change: 0 bp to 0 bp

Consensus Forecast, Deposit Rate Level: 2.00%

Consensus Range, Deposit Rate Level: 2.00% to 2.00%

Forecasters see the ECB keeping rates on hold through 2026.

US CPI for November (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.3% to 0.3%

Consensus Forecast, CPI - Y/Y: 3.1%

Consensus Range, CPI - Y/Y: 2.9% to 3.2%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.0%

Consensus Range, Ex-Food & Energy - Y/Y: 3.0% to 3.1%

CPI for November expected up 0.3 percent on the month and 0.3

percent for the core from October. On year, the call is up 3.1 percent and up 3.0

percent core.

US Jobless Claims for Week 12/13 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 225K

Consensus Range, Initial Claims - Level: 215K to 230K

Claims are expected to retreat to 225K after surging to 236K

last week from 192K a week before. The report has been volatile as the data

series struggles to account for holidays like Thanksgiving. Claims suggest stability

with the four-week moving average at 216.75K, not a troubling figure.

US Philadelphia Fed Manufacturing Index for December (Thu

0830 EST; Thu 1330 GMT)

Consensus Forecast, Index: 2.2

Consensus Range, Index: -5.0 to 8.0

The index is expected barely in expansion territory above 0 at

2.2 for December versus a marginally contractionary minus 1.7 in November.

Friday

Japan CPI for November (Fri 0830 JST; Thu 2330 GMT;

Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 2.9%

Consensus Range, CPI - Y/Y: 2.8% to 3.0%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.0%

Consensus Range, Ex-Fresh Food - Y/Y: 2.8% to 3.1%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.0%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 3.0%

to 3.1%

Japan's nationwide consumer inflation is expected to remain

little changed at around 3.0 percent on the year in November, staying well

above the Bank of Japan's 2 percent target. Upward pressure continues from

strong food and energy prices, as well as a renewed uptrend in electricity

bills following the government's termination of subsidies two months ago. At

the same time, signs of declining retail prices at supermarkets are likely to

limit the pace of overall inflation during the month.

The core CPI, excluding fresh food, is forecast to rise 3.0

percent on the year in November, steady from October and following a 2.9

percent gain in September. This will be the 51st straight month of year-on-year

increases. The total CPI is expected to rise 2.9 percent, compared with 3.0

percent in October and 2.9 percent in September. Underlying inflation, measured

by the core-core CPI that excludes both fresh food and energy, is projected

rise 3.0 percent, after a 3.1 percent increase in October and a 3.0 percent

gain in September.

Japan Bank of Japan Announcement (Fri 1130 JST; Fri

0230 GMT; Thu 2130 EST)

Consensus Forecast, Change: 25bp

Consensus Range, Change: 25bp to 25bp

Consensus Forecast, Level: 0.75%

Consensus Range, Level: 0.75% to 0.75%

At its Dec. 18-19 meeting, the Bank of Japan's nine-member

board is expected to decide either unanimously or in a majority vote to raise

the target for the overnight interest rate by 25 basis points (0.25 percentage

point) to 0.75 percent after standing pat in the previous six meetings,

encouraged by reduced uncertainty over how the protectionist U.S. trade policy

will hurt global and domestic growth and by early signs that many firms plan to

continue raising wages at a solid pace into fiscal 2026.

Less than two weeks to the December meeting, Governor Kazuo

Ueda on Dec. 1 dropped a clear hint that the board is ready to make another

gradual step toward normalizing the bank's monetary policy that is still deemed

supportive to economic activity. "At the meeting, we will examine and discuss

economic activity and prices at home and abroad as well as developments in

financial and capital markets...and will consider the pros and cons of raising

the policy interest rate and make decisions as appropriate," he told business

leaders in Nagoya, a central Japan manufacturing and commercial hub.

Germany GfK Consumer Climate for January

(Fri 1000 CET; Fri 0900 GMT; Fri 0400 EST)

Consensus Forecast, Index: -23.0

Consensus Range, Index: -23.2 to -17.0

Consumer sentiment index expected pretty steady at minus 23.0

in January versus minus 23.2 in December.

Germany PPI for November (Fri 0800 CET; Fri 0700 GMT;

Fri 0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.1% to 0.3%

Consensus Forecast, Y/Y: -2.1%

Consensus Range, Y/Y: -2.2% to -2.0%

The consensus sees wholesale prices up 0.1 percent on month

and down 2.1 percent on year in November.

Canada Retail Sales for October (Fri 0830 EST; Fri

1330 GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.0%

The consensus sees sales unchanged in October from

September, in line with the preliminary estimate.

US Existing Home Sales for November (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Annual Rate: 4.15M

Consensus Range, Annual Rate: 4.10M to 4.25M

Sales seen marginally better at 4.15 million in November

after 4.10 in October.

Eurozone EC Consumer Confidence Flash for December (Fri

1600 CET; Fri 1500 GMT; Fri 1000 EST)

Consensus Forecast, Index: -14.0

Consensus Range, Index: -14.2 to -13.5

The consensus looks for the index at minus 14.0 in December

versus minus 14.2 in November.

US Consumer Sentiment for December (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Index: 53.4

Consensus Range, Index: 53.3 to 55.0

The final December reading on consumer sentiment is expected

one tick higher at 53.4 from 53.3 in the preliminary December report. That may

be up from 51.0 in November but these are very weak and troubling readings,

down 28 percent from a year ago.

|