|

The Week Ahead: Highlights

US Preview

Inflation Data Next Up for Markets, Fed

By Theresa Sheehan, Econoday Economist

The January 12 week presents some critical data for the

upcoming FOMC meeting on January 27-28. Now that Fed policymakers have the

December employment report in hand, the situation in the labor market will be

better understood absent disruptive developments in the next two weeks. While

the labor market remains soft, there has been no surge in unemployment that

heightens risks to the maximum employment side of the dual mandate. Indeed, the

most recent unemployment rate of 4.4 percent suggests that soft hiring is due

to restructuring in an uncertain economy. A more certain outlook for businesses

could well spark fresh job gains.

What the coming week's data will say about inflation will

solidify outlooks for the next FOMC meeting.

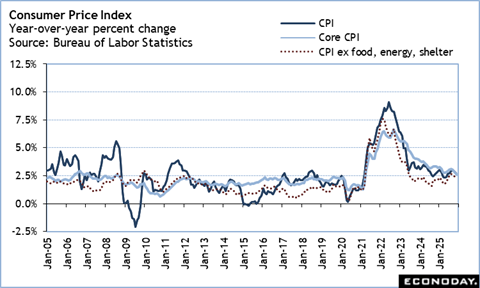

The December CPI report at 8:30 ET on Tuesday will help

clarify where and how much increased prices related to tariffs are reaching the

consumer level. It is hard to tell without the October data for comparison.

However, the November year-over-year CPI was up 2.7 percent and was up 3.0

percent in September. The core CPI was up 2.6 percent in November and up 2.7

percent in September. This suggests that at the consumer level, price increases

are moderating and could soon be below the level that the FOMC has deemed

"somewhat elevated" and nearer the 2 percent inflation objective.

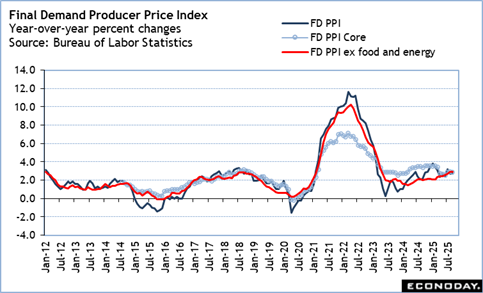

The final demand PPI report at 8:30 ET on Wednesday is for

November and will lack any numbers for October due to the government shutdown.

It may be difficult to discern if increased costs are moving through the

producer price levels.

Whether the consumer or producer price movements, it will be

important to distinguish where the price pressures are falling - in commodities

or services. It is not unusual for price gains in commodities to be transient

or exhibit volatility. Recent declines in energy prices may well drag down

headline inflation readings. But it is in services - particularly non-housing

services - that Fed policymakers will be looking for disinflation. It is in

risks to price stability that Fed policymakers have the most disagreement on

setting policy. A return to a disinflationary trend and moving within reach of

the 2 percent inflation objective could provide room for another rate cut. However, with the US economy growing faster than the longer-run forecast of 1.8

percent GDP, a majority of FOMC participants will not want to add stimulus via

less restrictive policy other than in cautious increments.

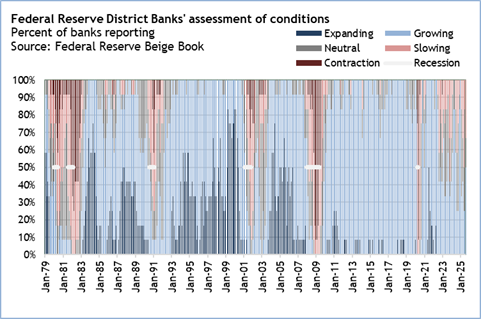

The Fed will release its next Beige Book on Wednesday at

14:00 ET. The report will cover the period between mid-November and late

December. The timing will reflect perceptions of conditions in the

post-shutdown period and will probably present a more positive tone about the

economy. Nonetheless, recent Beige Books point to an economy that is barely

growing and with little upward momentum for the near future.

The Week Ahead: Econoday Consensus Forecasts

Monday

Australia Household Spending for November (Mon 1130

AET; Mon 0030 GMT; Sun 1930 EST)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.7% to 0.7%

The consensus sees spending up 0.7 percent on month for

November after gaining 1.3 percent on the month in October.

India CPI for December (Mon 1600 IST; Mon 1030 GMT; Mon

0530 EST)

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 1.4% to 1.7%

Inflation expected to pick up to 1.5 percent on year in

December after a minuscule 0.71 percent increase in November. Price pressures

appear limited and unlikely to move up, which could lead the Reserve Bank of

India to consider rate cuts.

Tuesday

China Merchandise Trade for December (ANYTIME)

Consensus Forecast, Balance of Trade: $114.075 B

Consensus Range, Balance of Trade: $105 B to $118.9 B

Consensus Forecast, Imports - Y/Y: -0.1%

Consensus Range, Imports - Y/Y: -1.6% to 0.8%

Consensus Forecast, Exports - Y/Y: 3.0%

Consensus Range, Exports - Y/Y: 2.9% to 4.2%

The surplus is seen rising further to $114.075 billion in

December after surging to $111.68 billion in November. Imports seen down 0.1

percent, exports up 3.0 percent on year.

United States NFIB Small Business Optimism Index for December

(Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 99.4

Consensus Range, Index: 98.8 to 99.5

The consensus looks for the index up again to 99.4 in

December from 99.0 in November and 98.2 in October.

US CPI for December (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.2% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.6% to 2.7%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 2.7%

Consensus Range, Ex-Food & Energy - Y/Y: 2.6% to 2.8%

CPI for December expected up 0.3 percent for total and up

0.3 percent core. On year, the call is up 2.6 percent and up 2.7 percent core.

US New Home Sales for September (Tue 1000 EST; Tue

1500 GMT)

Consensus Forecast, Annual Rate: 710K

Consensus Range, Annual Rate: 650K to 725K

Sales expected to fall back to 710K in September after a

surging to a surprisingly strong 800K in August.

* Originally scheduled for 10/24/2025

US New Home Sales for October (Tue 1000 EST; Tue 1500

GMT)

Consensus Forecast, Annual Rate: 714K

Consensus Range, Annual Rate: 665K to 740K

Sales seen remaining depressed at 714K in October.

Wednesday

India WPI for December (Wed 12:00 IST; Wed 0130 EST)

Consensus Forecast, Y/Y: 0.30%

Consensus Range, Y/Y: 0.20% to 0.32%

United States PPI-Final Demand for November (Wed 0830

EST; Wed 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD - M/M: 0.2% to 0.3%

Consensus Forecast, PPI - Y/Y: 2.7%

Consensus Range, PPI - Y/Y: 2.6% to 2.8%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: 0.1% to 0.3%

PPI-FD expected up the same 0.3 percent on month and 2.7 percent

on year in November after 0.3 percent and 2.7 percent in October.

US Retail Sales for November (Wed 0830 EST; Wed 1330

GMT)

Consensus Forecast, Retail Sales - M/M: 0.2%

Consensus Range, Retail Sales - M/M: -0.5% to 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: 0.1% to 0.4%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.2%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.1% to

0.4%

Modest increases expected with sales up 0.2 percent.

* Originally scheduled for 12/17/2025

US Existing Home Sales for December (Wed 1000 EST; Wed

1500 GMT)

Consensus Forecast, Annual Rate: 4.23 M

Consensus Range, Annual Rate: 4.06 M to 4.30 M

Forecasters see slightly better sales at an annual 4.23 million

in December versus 4.13 million in November with lower mortgage rates.

US Business Inventories for October (Wed 1000 EST; Wed

1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Inventories seen up 0.2 percent on the month.

* Originally scheduled for 12/17/2025

Thursday

Japan PPI for December (Thu 0830 JST; Wed 2330 GMT;

Wed 1830 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.3%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.3% to 2.6%

Japan's corporate goods price index (CGPI), or producer

inflation, is expected to rise 2.4 percent from a year earlier in December,

slowing from 2.7 percent in November, when higher food and beverage prices and

gains in agricultural products, including elevated rice prices, drove the

overall trend.

On a month-on-month basis, the CGPI is projected to rise a

modest 0.1 percent in December, marking a fourth straight monthly increase,

after a 0.3 percent gain in November and a revised 0.5 percent rise in October.

South Korea Bank of Korea Announcement (Thu 1000 KST;

Thu 0100 GMT; Wed 2000 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.50%

Consensus Range, Level: 2.50% to 2.50%

Most forecasters see inflation worries keeping the Bank of

Korea on hold this time.

UK Monthly GDP for November (Thu 0700 GMT; Thu 0200

EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.1%

No growth seen after a decline of 0.1 percent in October.

Sweden CPI for December (Thu 0800 CET; Thu 0700 GMT; Thu

0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.0%

Consensus Forecast, Y/Y: 0.3%

Consensus Range, Y/Y: 0.3% to 0.3%

CPI expected flat on month and up 0.3 percent on year for

December.

UK Industrial Production for November (Thu 0700 GMT;

Thu 0200 EST)

Consensus Forecast, Industrial Production - M/M: -0.2%

Consensus Range, Industrial Production - M/M: -0.2%

to 1.0%

Consensus Forecast, Industrial Production - Y/Y: -0.8%

Consensus Range, Industrial Production - Y/Y: -0.8%

to -0.8%

Output expected to retreat by 0.2 percent on month and by 0.8

percent on year in November after an increase of 1.1 percent on the month and decrease

of 0.8 percent on year in October.

France CPI for December (Thu 0845 CET; Thu 0745 GMT; Thu

0245 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.8% to 0.8%

Consensus Forecast, HICP - M/M: 0.1%

Consensus Range, HICP - M/M: 0.1% to 0.1%

Consensus Forecast, HICP - Y/Y: 0.7%

Consensus Range, HICP - Y/Y: 0.7% to 0.7%

Forecasters see no revision in the final report for December

from the flash at 0.1 percent and 0.8 percent on year.

Eurozone Industrial Production for November (Thu 1100

CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.8% to 0.5%

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 0.9% to 2.0%

Output seen flat on month in November and up 1.4 percent on

year. In October, output jumped 0.8 percent on the month and was up 2.0 percent

on year.

US Jobless Claims for week 1/19 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 212 K

Consensus Range, Initial Claims - Level: 210 K to 227

K

Claims expected at 212 K in the latest week after ticking up

8K to 208K last week.

US Retail Sales for December (Thu 0830 EST; Thu 1330

GMT)

Consensus Forecast, Retail Sales - M/M: 0.5%

Consensus Range, Retail Sales - M/M: 0.4% to 0.6%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Range, Ex-Vehicles - M/M: 0.3% to 0.5%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.3%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.3% to

0.3%

Pretty decent rise of 0.5 percent expected.

Canada Manufacturing Sales for November (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, M/M: -1.1%

Consensus Range, M/M: -1.1% to -1.0%

Forecasters agree with Statistics Canada's preliminary

estimate of minus 1.1 percent after a drop of 1.0 percent in October.

US Philadelphia Fed Manufacturing Index for January (Thu

0830 EST; Thu 1330 GMT)

Consensus Forecast, Index: -3.5

Consensus Range, Index: -11.8 to -1.0

The consensus looks for a slightly contractionary minus 3.5.

US Empire State Manufacturing Index for January (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, Index: 1.0

Consensus Range, Index: -5.0 to 4.0

Very slight expansion at 1 is the call after a scary

23-point drop to minus 3.9 in December from 18.7 in November.

US Imports and Export Prices for November (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, Import Prices - M/M: 0.1%

Consensus Range, Import Prices - M/M: -0.2% to 0.3%

Consensus Forecast, Export Prices - M/M: 0.1%

Consensus Range, Export Prices - M/M: -0.2% to 0.2%

Modest rise of 0.1 percent expected for both imports and

exports on the month.

Friday

Germany CPI for December (Fri 0800 CET; Fri 0700 GMT;

Fri 0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.0%

Consensus Forecast, Y/Y: 1.8%

Consensus Range, Y/Y: 1.8% to 1.8%

Consensus Forecast, HICP - M/M: 0.2%

Consensus Range, HICP - M/M: 0.2% to 0.2%

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 2.0% to 2.0%

Forecasters see no revision in the final report for December

from the flash at 0.0 percent and 1.8 percent on year.

Italy CPI for December (Fri 1000 CET; Fri 0900 GMT;

Fri 0400 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

Forecasters see no revision in the final report for December

from the flash at 0.2 percent and 1.2 percent on year.

US Industrial Production for December (Fri 0915 EST; Fri

1415 GMT)

Consensus Forecast, Industrial Production - M/M: 0.1%

Consensus Range, Industrial Production - M/M: % -0.4 to

0.3%

Consensus Forecast, Capacity Utilization Rate: 76.0%

Consensus Range, Capacity Utilization Rate: 75.9% to

76.0%

A muted 0.1 percent rise in output is the call for December

with capacity at 76.0 percent, flat from November.

US Housing Market Index for January (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, HMI Index: 40

Consensus Range, HMI Index 39 to 40

The index is expected to tick up again to 40 in January from

39 in December as builder sentiment gradually recovers from last summer's lows.

|