|

The Week Ahead: Highlights

US Preview

New Rotation of Fed Voters Steps in for January FOMC

Meeting

By Theresa Sheehan, Econoday Economist

The focus of the January 26 will be almost exclusively on

the FOMC meeting on Tuesday/Wednesday and Fed Chair Jerome Powell's press

briefing. There is a lot to unpack.

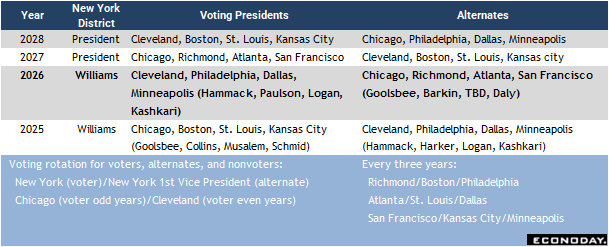

The first FOMC meeting of the calendar year is one at which

the FOMC performs a number of housekeeping tasks. The first and most visible

will be to confirm Powell as the Chair of the FOMC and New York Fed President

John Williams as the Vice Chair. The 2026 voting rotation of district bank

presidents will be in place. This means that Chicago's Austan Goolsbee and

Kansas City's Jeffery Schmid - who dissented at the December meeting in favor

of no change in rates - will not be voting. The 2026 lineup of voters is

Cleveland's Beth Hammack, Philadelphia Anna Paulson, Dallas's Lorie Logan, and

Minneapolis' Neel Kashkari. This is an interesting mix of seasoned and newer

district bank presidents. In any case, overall the district bank presidents

have been taking a cautious approach to easing monetary policy to achieve

sustainable and sustained price stability. There seems to be less likelihood of

a dissent among the district bank presidents at the January 27-28 meeting.

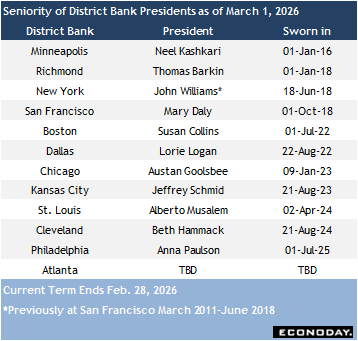

There is a full complement of voters on the Board of

Governors. Although Stephen Miran's term as governor ends on January 31. He is

still an FOMC voter until then. In fact, he can remain on the board until

President Trump nominates someone to fill the new term of February 1, 2026

through January 31, 2040 and that nominee is confirmed by the Senate. Miran has

dissented in favor of a 50 basis point rate cut at the last three FOMC meetings

and probably will again.

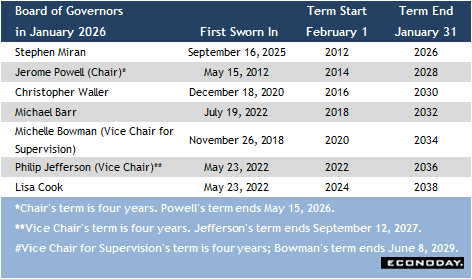

Governor Lisa Cook's legal challenges to President Trump's

attempt to remove her from the board are not over. For the moment, she

maintains her place on the board and her vote on the FOMC. The attack on

Powell's leadership via the cost of renovations to Federal Reserve buildings

has been plainly labeled a political ploy to weaken the independence of the

central bank. Powell's tenure as the Chair of the Fed runs through mid-May.

Until then, expect him to stay firmly in control of the narrative about monetary

policy. By the time Powell appears before the Senate Banking Committee and the

House Financial Services Committee in February for the Chair's semiannual

monetary policy testimony, he will be well-prepared to respond to questions

about the renovations.

Although the process of getting the economic data release

schedule back on track is not yet finished, the FOMC will have a much more

complete picture of the US economy on which to base its monetary policy

decision. A majority of policymakers may well determine that even though hiring

is weak at present, mandate for maximum employment is not at near term risk for

deterioration and that unemployment remains comfortably low. A point of greater

debate will be is inflation related to tariffs has largely passed through the

economy and if disinflation will resume to eventually reach the 2 percent

objective. At present, measures of inflation point to still elevated price

pressures but not worsening ones. Inflation expectations are more-or-less

steady for the medium term which will factor into the inflation outlook.

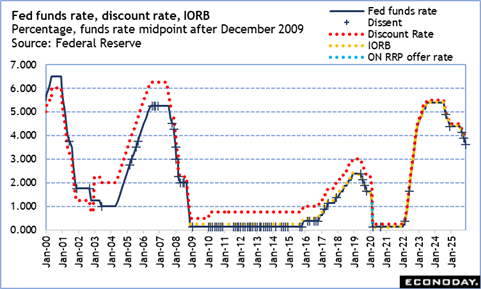

The FOMC statement is expected at 14:00 ET on Wednesday, as

usual, and should receive only minor updates from the version in December. It

is widely anticipated that the FOMC will not cut the fed funds target rate

range from the 3.50 to 3.75 percent established in December. At his December 10

press briefing, Powell noted that the range is within reach of the longer-run 3

percent mid-point that the FOMC currently sees as neutral. With the US economy

performing consistently above the longer-run GDP forecast of up 1.8 percent,

there seems little need to add stimulus and room to exercise patience to wait

for inflation to come down further. There will be no official update to the

quarterly summary of economic projections (SEP).

The FOMC will get the next senior loan officer opinion

survey for this meeting. It will be released the following Monday on February 2

at 14:00 ET. This is also the last meeting before the Chair's semiannual

monetary policy testimony in February for which the dates have not been set for

the Senate Banking Committee and House Financial Services Committee.

Powell's press briefing at 14:30 ET on Wednesday will draw

out some detail about the rate decision. However, he is likely to receive more

than the usual number of questions that he will decline to answer. The big one

is if he plans to remain on the Board of Governors for the remainder of term

which ends January 31, 2028. As to his January 11 statement regarding the

subpoena served by the Department of Justice, it is doubtful he will elaborate

beyond reinforcing that central bank independence results in demonstrably

better economic and financial market outcomes than setting rates by politic

expediency.

Europe Preview

New Round of GDP Reports Up Next

By Marco Babic, Econoday Economist

What a year 2025 was for global markets with trade

disruptions from tariffs, and countries seeking new trade parters because of US

tensions. It's anyone's guess what will happen this year. This week sees the

first estimate of fourth-quarter GDP data from Germany, France, Italy, the

Eurozone and Sweden.

The economies of all those countries have been weak for the

whole year, although Sweden has shown some resilience. Still, fourth quarter

results are unlikely to show any improvement and the year will close showing

major European economies having scratched out relatively meager expansion.

Having ended the year on a subdued note, German business

sentiment for January comes out on Monday. Together with Italian business

confidence on Wednesday, observers will have a sense of how businesses are

viewing the environment. But given recent turmoil highlighted by the events in

Davos, it's difficult to see that sentiment will have improved.

Switzerland reports its trade data for December on Thursday,

giving perhaps some indication as to whether trade flows have normalized

somewhat since US tariffs were reduced to 15 percent from 39 percent.

Looking ahead, the takeaway from Davos is that European

countries are slowly starting to consider toughening up to face down threats

from the US, with President Trump having backed down on tariffs. Nevertheless,

that is far more likely that not to be a temporary lull, with the erratic

rhetoric likely to continue. The world continues to await a decision by the US

Supreme Court on whether most of the imposed tariffs are illegal.

Asia-Pacific Preview

Australia Inflation Reports in Focus

By Brian Jackson, Econoday Economist

Monthly consumer and quarterly producer inflation data from

Australia will be the main focus, with the data closely watched ahead of the

Reserve Bank of Australia's policy meeting the following week. The RBA left

rates on hold again at their last meeting in December, with officials then

noting "signs of a more broadly based pick-up in inflation, part of which

may be persistent and will bear close monitoring". This, they assessed,

suggests that risks to inflation "have tilted to the upside". Next week's

data will provide information about whether those risks are materialising.

The Monetary Authority of Singapore is scheduled to deliver

its quarterly policy review. Recent data have showed solid growth in industrial

production and low and stable core inflation in recent months. This suggests

that officials will continue to target a similar rate of appreciation in the

nominal effective exchange rate.

Several other data releases are also scheduled. Singapore,

India, and South Korea will all report industrial production data, New Zealand

will report monthly trade and quarterly labour market data, and Hong Kong and

Taiwan will publish advance GDP estimates.

The Week Ahead: Econoday Consensus Forecasts

Monday

Singapore Industrial Production for December (Mon

1300 CST; Mon 0500 GMT; Mon 0000 EST)

Consensus Forecast, M/M: -8.0%

Consensus Range, M/M: -8.0% to -8.0%

Consensus Forecast, Y/Y: 11.0%

Consensus Range, Y/Y: 11.0% to 11.0%

Output seen down a sharp 8 percent on month but up 11

percent on year.

Germany Ifo Survey for January (Mon 1000 CET; Mon

0900 GMT; Mon 0400 EST)

Consensus Forecast, Business Climate: 88.3

Consensus Range, Business Climate: 87.3 to 88.6

Consensus Forecast, Current Conditions: 86.2

Consensus Range, Current Conditions: 85.9 to 86.5

Consensus Forecast, Business Expectations: 90.5

Consensus Range, Business Expectations: 88.5 to 91.1

Modest rebound expected to 88.3 for business climate from a

disappointing 87.6 in December.

US Durable Goods Orders for November (Mon 0830 EST; Mon

1330 GMT)

Consensus Forecast, New Orders - M/M: 3.0%

Consensus Range, New Orders - M/M: 0.2% to 5.4%

Consensus Forecast, Ex-Transportation - M/M: 0.3%

Consensus Range, Ex-Transportation - M/M: 0.3% to 1.0%

Big bounce expected after 2.2 percent decline last time. As

usual the monthly swings reflect volatile aircraft orders.

Tuesday

US Consumer Confidence for January (Tue 1000 EST; Tue

1500 GMT)

Consensus Forecast, Index: 90.0

Consensus Range, Index: 88.0 to 92.7

Confidence expected off the lows at 90.0 for January versus

89.1 in December. The University of Michigan survey showed a bounce in

sentiment and the Conference Board report is expected to follow suit. The relatively

low confidence levels reflect ongoing consumer angst over inflation and job

security.

Wednesday

Australia Monthly CPI for December (Wed 1130 AET; Wed

0030 GMT; Tue 1930 EST)

Consensus Forecast, Y/Y: 3.3%

Consensus Range, Y/Y: 2.9% to 3.7%

Inflation expected at 3.3 percent in December versus 3.4

percent in November. The range of forecasts is wide at 2.9 percent to 3.7

percent.

Australia CPI for Fourth Quarter (Wed 1130 AET; Wed

0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.7%

Consensus Range, Q/Q: 0.2% to 0.8%

Consensus Forecast, Y/Y: 3.6%

Consensus Range, Y/Y: 3.1% to 3.6%

Quarterly inflation expected at 0.7 percent in Q4 versus 1.3

percent in Q3 with help from a drop in electricity prices.

Germany GfK Consumer Climate for February (Wed 0800

CET; Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, Index: -25.5

Consensus Range, Index: -27.6 to -24.0

Confidence expected to rise a bit to minus 25.5 from minus

26.9 in January.

Canada Bank of Canada Announcement (Wed 0945 EST; Wed

1445 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.25%

Consensus Range, Level: 2.25% to 2.25%

Forecasters expect the bank to keep rates on hold at 2.25

percent as the BOC has done enough easing if things unfold as expected.

US FOMC Announcement (Wed 1400 EST; Tue 1900 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Federal Funds Rate - Target Range:

3.5% - 3.75%

Consensus Range, Federal Funds Rate - Target Range: 3.5%

- 3.75% to 3.5% - 3.75%

The consensus sees the Fed on hold with lonesome dove

Stephen Miran the only one voting for a cut.

Thursday

Eurozone M3 Money Supply for December (Thu 1000 CET;

Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Y/Y-3-Month Moving Average: 3.0%

Consensus Range, Y/Y-3-Month Moving Average: 2.9% to 3.0%

Money growth seen at 3.0 percent versus 2.9 percent in

November.

Canada Merchandise Trade for November (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Balance: -C$0.7 B

Consensus Range, Balance: -C$1.2 B to C$0.7 B

The consensus sees the balance in deficit at a similar C$0.7

billion after C$0.583 billion in October.

US International Trade in Goods and Services for November

(Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: -$45.0 B

Consensus Range, Balance: -$55.0 B to -$23.0

Imports and the deficit expected to snap back to show a

deficit of $45 billion after tariff effects slashed imports leading to a modest

$29.4 billion deficit in October.

US Jobless Claims for Week1/23 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 205K

Consensus Range, Initial Claims - Level: 195K to 215K

Claims expected up to 205K from 200k as observers see 200K

as too low to represent current conditions.

US Productivity and Costs for Third Quarter (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

4.9%

Consensus Range, Nonfarm Productivity - Annual Rate: 4.8%

to 4.9%

Consensus Forecast, Unit Labor Costs - Annual Rate: -1.9%

Consensus Range, Unit Labor Costs - Annual Rate: -2.0%

to -1.4%

Q3 expected unrevised at 4.9 percent productivity growth

with ULC unrevised at minus 1.9 percent.

US Factory Orders for November (Thu 1000 EST; Thu 1500

GMT)

Consensus Forecast, M/M: 1.3%

Consensus Range, M/M: 0.4% to 2.1%

Orders expected to reverse the 1.3 percent drop of October

with a 1.3 percent increase in November.

Friday

South Korea Industrial Production for December (Fri

0800 KST; Thu 2300 GMT; Thu 1800 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.5%

Consensus Forecast, Y/Y: -3.1%

Consensus Range, Y/Y: -4.0% to -1.0%

Japan Tokyo CPI for January (Fri 0830 JST; Thu 2330

GMT; Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 1.8%

Consensus Range, CPI - Y/Y: 1.6% to 1.9%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.2%

Consensus Range, Ex-Fresh Food - Y/Y: 2.1% to 2.2%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.6%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.4%

to 2.6%

The Tokyo consumer price index, a leading indicator of

nationwide inflation trends, is expected to decelerate further on the year in

January, with two of the three key measures easing from the previous month as

slower food and energy prices help bring inflation closer to, or even below,

the Bank of Japan's 2 percent target.

The core measure (excluding fresh food) is forecast to rise

2.2 percent on the year in January, easing from 2.3 percent in December, while

the total CPI is seen slipping below the 2 percent mark to 1.8 percent, down

from a 2.0% increase a month earlier. The core-core index (excluding fresh food

and energy) is projected to be unchanged at a 2.6 percent rise. All three

measures have remained below 3 percent since June after retreating from earlier

peaks.

Japan Unemployment Rate for December (Fri 0830 JST;

Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, Rate: 2.6%

Consensus Range, Rate: 2.5% to 2.6%

Japan's seasonally adjusted unemployment rate is seen

staying unchanged at 2.6 percent in December for a fifth straight month, while

persistent, broad-based labor shortages are expected to continue lifting

domestic payrolls, marking a 41st consecutive year-on-year increase.

Japan Industrial Production for December (Fri 0850

JST; Thu 2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -1.5% to 0.3%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 1.2% to 3.0%

Japan's industrial output is seen falling for a second

straight month in December, down 0.4 percent on the month after declining 2.7

percent (revised from down 2.6 percent) in November. The November drop was

larger than expected, as production declines in industries including

information and communications machinery, automobiles and metal products

dragged down overall output.

Trade figures released by the Ministry of Finance for

December showed that the negative impact of Trump's tariff policy continued to

weigh on auto production, as exports to the U.S. declined, dragging on overall

output. Still, the impact on other industries remained limited, helping keep

underlying output conditions relatively firm. On a year-on-year basis, December

output is expected to rise 2.3 percent after falling 2.2 percent (revised from

down 2.1 percent) in November.

Japan Retail Sales for December (Fri 0850 JST; Thu

2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: -0.6%

Consensus Range, M/M: -1.0% to -0.3%

Consensus Forecast, Y/Y: 0.4%

Consensus Range, Y/Y: -0.5% to 1.4%

Japan's retail sales are expected to rise 0.4 percent on the

year in December, extending gains for a fourth straight month, supported by

robust automobile sales and a slowdown in the decline of new passenger car

registrations.

Still, the year-on-year increase was weighed down by slower

department store sales and falling gasoline prices in December. In November,

retail sales rose 1.1 percent (revised from up 1.0 percent), lifted by strong

demand for drugs and cosmetics, solid vehicle sales and a sharp gain in

appliances, possibly reflecting increased purchases of heat pumps and other

seasonal goods.

On a month-on-month basis, retail sales are expected to post

their first decline in three months, falling 0.6 percent on a seasonally

adjusted basis, after rising 0.7 percent (revised from up 0.6 percent) in

November and gaining 1.6 percent in October.

France GDP Flash for Fourth Quarter (Fri 0730 CET; Fri

0630 GMT; Fri 0230 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.2%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.1% to 1.2%

The consensus looks for increases of 0.2 percent on quarter

and 1.2 percent on year for Q4 after 0.5 percent on quarter and 0.9 percent on

year in Q3.

Germany Unemployment Rate for December (Fri 0955 CET;

Fri 0855 GMT; Fri 0355 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.4%

Rate expected flat again at 6.3 percent.

Germany GDP Flash for Fourth Quarter (Fri 1000 CEST; Fri

0900 GMT; Fri 0400 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.3%

Consensus Forecast, Y/Y: 0.3%

Consensus Range, Y/Y: 0.2% to 0.5%

The consensus looks for increases of 0.2 percent on quarter

and 0.3 percent on year for Q4 after 0.0 percent on quarter and 0.3 percent on

year in Q3.

Eurozone GDP Flash for Fourth Quarter (Fri 1100 CET; Fri

1000 GMT; Fri 0500 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.3%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.1% to 1.5%

Eurozone Unemployment Rate for December (Thu 1100

CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.3%

Canada Monthly GDP for November (Fri 0830 EST; Fri 1330

GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.2%

Forecasters agree with Statistics Canada preliminary

estimate of 0.1 percent for November.

United States PPI-Final Demand for December (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.0% to 0.3%

Consensus Forecast, PPI - Y/Y: 2.9%

Consensus Range, PPI - Y/Y: 2.4% to 3.0%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.0% to 0.3%

US Chicago PMI for January (Mon 0945 EST; Mon 1445

GMT)

Consensus Forecast, Index: 43.8

Consensus Range, Index: 40.0 to 45.0

Not much change expected with the index at 43.8 in January versus

43.5 in December.

China CFLP Composite PMI for January (Fri 0930 CST;

Fri 0130 GMT; Thu 2030 EST)

Consensus Forecast, Manufacturing Index: 50.2

Consensus Range, Manufacturing Index: 49.8 to 50.4

Germany CPI for January (Fri 0800 CET; Fri 0700 GMT; Fri

0200 EST)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.3% to 0.2%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 1.8% to 2.3%

HICP Consensus Forecast, M/M: -0.2%

HICP Consensus Range, M/M: -0.4% to -0.1%

HICP Consensus Forecast, Y/Y: 2.1%

HICP Consensus Range, Y/Y: 1.8% to 2.1%

|