|

The Week Ahead: Highlights

US Preview

Jobs Jobs Jobs

By Theresa Sheehan, Econoday Economist

Although the February 2 week will present a lot of data

about labor market conditions, the focus will be on Friday at 8:30 ET when the

January employment report is released.

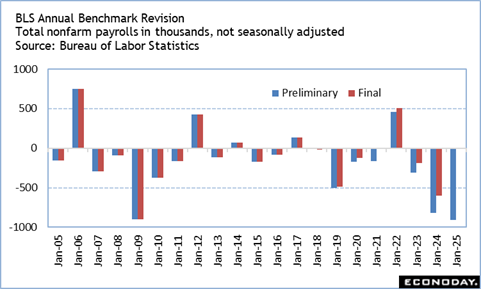

The BLS released the annual revisions to the household

survey in January with the December data. This month will be the annual

revisions to the establishment survey for which massive downward revisions are

expected for a third year in a row. The preliminary March 2025 benchmark

revision was for down 911,000, almost twice the downward revision of 598,000 in

the final 2024 data (preliminary minus 181,000) and about four times the size

of the downward revision of 187,000 in the final March 2023 numbers (preliminary

minus 187,0000). Note that in recent years it is quite common for the final

benchmark revision to be revised from the preliminary estimate, and that is

frequently smaller than the original estimate.

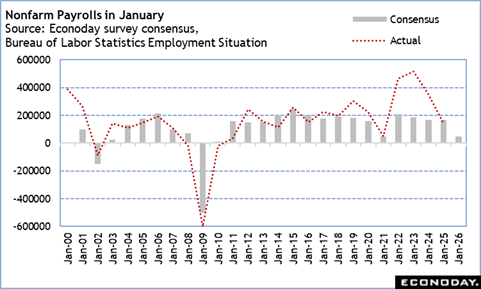

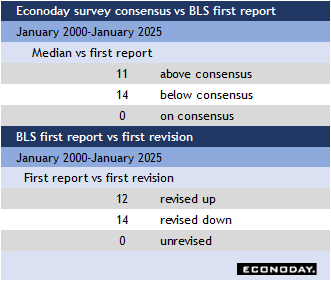

The annual revisions make forecasting the January payroll

change difficult. At this writing, the early market consensus is roughly for up

50,000. Historically, the median forecast is slightly more likely to come in

below consensus than above it, but that is also because there is a high degree

of uncertainty in putting a number on the change in payrolls. January is

typically a month to add jobs as businesses have done their end-of-year

planning for staffing, college graduates join the workforce, and school systems

resume operations after the winter break.

Seasonal adjustment of January payrolls can also be

difficult because of weather conditions if these arrive early in the month.

This year that shouldn't be a problem since the severe cold weather blanketing

much of the country did not arrive until after the January 17 end of the survey

reference period. This is also a 5-week survey period, so hiring early in

January should be fully captured.

Asia-Pacific Preview

RBA Policy Meeting in Focus as Market Sees Rate Hike

By Brian Jackson, Econoday Economist

The main focus will the Reserve Bank of Australia's policy

meeting. The RBA lowered policy rates three times last year, most recently in

August, but recent data have shown headline inflation has been above their

target range of two percent to three percent for four consecutive months. This

is widely expected to be enough to prompt a rate hike.

The Reserve Bank of India will also meet. Officials lowered

policy rates by 25 basis points at their most recent meeting in December after

data showed inflation falling well below their target range of two percent to

six percent. Inflation data for December published subsequently showed further

weakness in inflation. which may provide scope for another rate cut next week.

PMI surveys for January are the main data releases next

week, providing early indication of conditions in the new year. South Koreas

and Taiwan will both publish inflation data, New Zealand will report quarterly

labour market data, and Australia will publish monthly trade data.

The Week Ahead: Econoday Consensus Forecasts

Monday

China PMI Manufacturing for January (Mon 0945 CST;

Mon 0145 GMT; Sun 2045 EST)

Consensus Forecast, Index: 50.0

Consensus Range, Index: 50.0 to 50.5

Manufacturing seen almost flat at 50.0 in January versus

50.1 in December, an uninspiring report for the mighty manufacturing sector.

India PMI Manufacturing Final for January (Mon 1030

IST; Mon 0500 GMT; Mon 0000 EST)

Consensus Forecast, Level: 56.8

Consensus Range, Level: 56.8 to 56.8

Index expected unrevised in the January final from the

January flash at 56.8 and up from 55.0 in December.

Germany Retail Sales for December (Mon 0800 CEST; Mon

0700 GMT; Mon 0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.5%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 0.8% to 1.5%

The consensus sees sales up a marginal 0.1 percent in

December after falling 0.6 percent in November on the month, suggesting no

sales momentum at yearend. On year, sales are seen up 1.5 percent after rising

1.1 percent in November.

Sweden Swedbank PMI Manufacturing for January (Mon 0830

CEST; Mon 0730 GMT; Mon 0230 EST)

Consensus Forecast, Index: 54.0

Consensus Range, Index: 54.0 to 55.0

Expansion seen moderate but a little slower

at 54.0 in January versus 55.3 in December.

Eurozone PMI Manufacturing Final for January (Mon

1000 CET; Mon 0900 GMT; Mon 0400 EST)

Consensus Forecast, Index: 49.4

Consensus Range, Index: 49.4 to 49.4

Index expected unrevised in the January final from the

January flash at 49.4 and up from 48.8 in December.

France PMI Manufacturing Final for January (Mon 0950

CET; Mon 0850 GMT; Mon 0350 EST)

Consensus Forecast, Index: 51.0

Consensus Range, Index: 51.0 to 51.0

Index expected unrevised in the January final from the

January flash at 51.0 and up from 50.7 in December.

Germany PMI Manufacturing Final for January (Mon 0955

CET; Mon 0755 GMT; Mon 0355 EST)

Consensus Forecast, Index: 48.7

Consensus Range, Index: 48.7 to 48.7

Index expected unrevised in the January final from the

January flash at 48.7 and up from 47.0 in December.

United Kingdom PMI Manufacturing Final for January (Mon

0930 BST; Mon 0930 GMT; Mon 0430 EST)

Consensus Forecast, Index: 51.6

Consensus Range, Index: 51.6 to 51.6

Index expected unrevised in the January final from the

January flash at 51.6 and up from 50.6 in December.

United States PMI Manufacturing Final for January (Mon

0945 EST; Mon 1445 GMT)

Consensus Forecast, Index: 51.9

Consensus Range, Index: 49.5 to 52.2

Index expected unrevised in the January final from the

January flash at 51.9 and up from 51.8 in December.

United States ISM Manufacturing Index for January (Mon

0945 EST; Mon 1445 GMT)

Consensus Forecast, Index: 48.5

Consensus Range, Index: 48.0 to 49.5

The consensus looks for more doldrums for manufacturing with

the ISM index at 48.5 versus an anemic 47.9 in December.

United States JOLTS for December (Mon 1000 EST; Mon

1500 GMT)

Consensus Forecast, Job Openings: 7.245 M

Consensus Range, Job Openings: 7.000 M to 7.294 M

Job openings seen up/down at 7.245 million in December after

a lower than expected 7.15 million in November.

Tuesday

South Korea CPI for January (Tue 0800 KST; Mon 2300

GMT; Mon 1800 EST)

Consensus Forecast, CPI - M/M: 0.4%

Consensus Range, CPI - M/M: 0.4% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.0%

Consensus Range, CPI - Y/Y: 2.0% to 2.1%

CPI expected up 0.4 percent on month in January and 2.0

percent on year after gains of 0.3 percent and 2.3 percent in December.

Australia RBA Announcement (Tue 1430 AET; Tue 0330

GMT; Mon 2230 EST)

Consensus Forecast, Change: 25 bp

Consensus Range, Change: 0 bp to 25 bp

Consensus Forecast, Level: 3.85%

Consensus Range, Level: 3.60% to 3.85%

Forecasters look for the RBA to raise rates by 25 bp after

unpleasant inflation figures for December. Unlike pretty much all the other

major central banks, the RBA is not in a good place.

France CPI for January (Tue 0845 CET; Tue 0745 GMT; Tue

0245 EST)

Consensus Forecast, Y/Y: 0.7%

Consensus Range, Y/Y: 0.6% to 0.8%

CPI expected up 0.7 percent on year after 0.8 percent in

December.

Wednesday

China PMI Composite for January (Wed 0945 CST; Wed

0145 GMT; Tue 2045 EST)

Consensus Forecast, Services Index: 51.5

Consensus Range, Services Index: 51.5 to 51.7

The consensus sees services is at 51.5 versus 52.0 in

December.

India PMI Composite Final for January (Wed 1030 IST;

Wed 0500 GMT; Wed 0000 EST)

Consensus Forecast, Composite Index: 59.5

Consensus Range, Composite Index: 59.5 to 59.5

Consensus Forecast, Services Index: 59.3

Consensus Range, Services Index: 59.3 to 59.3�

No revision expected from the flash for composite at 59.5

and 59.3 for services.

Eurozone PMI Composite Final for January (Wed 0900

CET; Wed 0800 GMT; Wed 0300 EST)

Consensus Forecast, Composite Index: 51.5

Consensus Range, Composite Index: 51.5 to 51.5

Consensus Forecast, Services Index: 51.9

Consensus Range, Services Index: 51.9 to 51.9

No revision expected in the composite final from the flash

at 51.5. No change expected in services final from the flash either at 51.9.

France PMI Composite Final for January (Wed 0950 CET;

Wed 0850 GMT; Wed 0350 EST)

Consensus Forecast, Composite Index: 48.6

Consensus Range, Composite Index: 48.6 to 48.6

Consensus Forecast, Services Index: 47.9

Consensus Range, Services Index: 47.9 to 47.9

No revision expected in the composite final from the flash

at 48.6. No change expected in services final from the flash either at 47.9

Germany PMI Composite Final for January (Wed 0955

CET; Wed 0855 GMT; Wed 0355 EST)

Consensus Forecast, Composite Index: 52.5

Consensus Range, Composite Index: 52.5 to 52.5

Consensus Forecast, Services Index: 53.3

Consensus Range, Services Index: 53.3 to 53.3

No revision expected in the composite final from the flash

at 52.5. No change expected in services final from the flash either at 53.3.

UK PMI Composite Final for January (Wed 0930 GMT; Wed

0430 EST)

Consensus Forecast, Composite Index: 53.9

Consensus Range, Composite Index: 53.9 to 53.9

Consensus Forecast, Services Index: 54.3

Consensus Range, Services Index: 54.2 to 54.3

No revision expected in the composite final from the flash

at 53.9. No change expected in services final from the flash either at 54.3.

Eurozone HICP Flash for January (Wed 1100 CET; Wed

1000 GMT; Wed 0500 EST)

Consensus Forecast, HICP - Y/Y: 1.9%

Consensus Range, HICP - Y/Y: 1.7% to 2.1%

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.2% to 2.5%

The consensus looks for HICP up 1.9 percent on year and HICP

narrow core up 2.3 percent on year in January, same as 1.9 percent and 2.3

percent in December.

Eurozone PPI for December (Wed 1100 CET; Wed 1000

GMT; Wed 0500 EST)

Consensus Forecast, Y/Y: -2.0%

Consensus Range, Y/Y: -2.0% to -1.6%

Wholesale prices expected down 2.0 percent on year in

December.

US ADP Employment Report for January (Wed 0815 EST;

Wed 1315 GMT)

Consensus Forecast, Private Payrolls - M/M: 45K

Consensus Range, Private Payrolls - M/M: 30K to 65K

Private payrolls seen up another modest 45K in January after

41K in December.

US PMI Composite Final for January (Wed 0945 GMT; Wed

1445 EST)

Consensus Forecast, Composite Index: 52.8

Consensus Range, Composite Index: 52.8 to 52.8

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 52.2 to 52.5

No revision expected for the composite from the flash at

52.8 with services unrevised from the flash at 52.5 for January.

United States ISM Services Index for January (Wed 1000

EST; Mon 1500 GMT)

Consensus Forecast, Index: 53.8

Consensus Range, Index: 53.0 to 57.0

Services ISM continues its decent showing, expected at 53.8

for January versus 54.4 in December.

Thursday

Australia International Trade in Goods for December (Thu

1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$ 3.475 B

Consensus Range, Balance: A$2.6 B to A$4.9 B

The surplus is forecast at A$3.475 billion in December

versus A$2.936 billion in November.

Germany Manufacturing Orders for December (Thu 0800

CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: -2.5%

Consensus Range, M/M: -3.0% to 1.5%

After a big 5.6 percent jump in November, a retreat of 2.5

percent is the call for December, on the month.

Eurozone Retail Sales for December (Thu 1100 CEST;

Thu 1000 GMT; Thu 0500 EDT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.2% to 0.1%

Consensus Forecast, Y/Y: 1.9%

Consensus Range, Y/Y: 1.8% to 2.3%

The consensus sees sales down 0.1 percent on the month in

December after rising 0.2 percent in November. Sales on year are forecast up 1.9

percent in January after increasing 2.3 percent in December.

United Kingdom BoE Announcement & Minutes (Thu

1200 BST; Thu 1100 GMT; Thu 0700 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 3.75%

Consensus Range, Level: 3.75% to 3.75%

The consensus sees the BOE on hold at the February meeting.

For March it is a split expectation slightly favoring a rate cut.

Eurozone ECB Announcement (Thu 1415 CEST; Thu 1315

GMT; Thu 0915 EDT)

Consensus Forecast, Refi Rate Change: 0 bp

Consensus Range, Refi Rate Change: 0 bp to 0 bp

Consensus Forecast, Refi Rate Level: 2.15%

Consensus Range, Refi Rate Level: 2.15% to 2.15%

Consensus Forecast, Deposit Rate Change: 0 bp

Consensus Range, Deposit Rate Change: 0 bp to 0 bp

Consensus Forecast, Deposit Rate Level: 2.0%

Consensus Range, Deposit Rate Level: 2.0% to 2.0%

Forecasters see the ECB on hold at this meeting and likely

through 2026.

US Jobless Claims for Week1/30 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 212 K

Consensus Range, Initial Claims - Level: 208 K to 219

K

After reaching 209K in the latest week, the consensus looks

for claims up again at 212 K this week.

Friday

Japan Household Spending for December (Fri 0830 JST;

Fri 2330 GMT; Fri 1930 EST)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -3.5% to 0.1%

Consensus Forecast, Y/Y: 0.1%

Consensus Range, Y/Y: -3.7% to 1.0%

Japan's real household spending is expected to edge up 0.1

percent from a year earlier in December, after unexpectedly rising 2.9 percent

the previous month, driven by a surge in automobile purchases. On a

month-on-month basis, household spending is expected to fall for the first time

in two months in December, edging down 0.4 percent after jumping 6.2 percent a

month earlier.

India Reserve Bank of India Announcement (Fri 1130

IST; Thu 0600 GMT; Thu 0100 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 5.25%

Consensus Range, Level: 5.25% to 5.25%

Forecasters see no rate move from the RBI through year end

after 125 basis points of cuts.

Germany Industrial Production for December (Fri 0800

CET; Fri 1300 GMT; Fri 0800 EST)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -1.0% to 0.4%

Industrial output expected down 0.3 percent on the month in

December.

Germany Merchandise Trade for December (Fri 0800 CET;

Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Balance: E 14.0 B

Consensus Range, Balance: E13.0 B to E14.0 B

Slightly wider surplus expected at E14.0 billion versus

E13.0 in November.

Canada Labour Force Survey for January (Fri 0830 EST;

Fri 1330 GMT)

Consensus Forecast, Employment - M/M: 5K

Consensus Range, Employment - M/M: -10K to 22K

Consensus Forecast, Unemployment Rate: 6.8%

Consensus Range, Unemployment Rate: 6.7% to 6.8%

Jobs are expected up 5K in December and the unemployment

rate flat at 6.8 percent from 6.8 percent in November.

US Employment Situation for January (Fri 0830 EST;

Fri 1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 67K

Consensus Range, Nonfarm Payrolls - M/M: 40K to 105K

Consensus Forecast, Unemployment Rate: 4.4%

Consensus Range, Unemployment Rate: 4.3% to 4.5%

Consensus Forecast, Private Payrolls - M/M: 80K

Consensus Range, Private Payrolls - M/M: 30K to 100K

Consensus Forecast, Manufacturing Payrolls - M/M: -7K

Consensus Range, Manufacturing Payrolls - M/M: -10K to

-5K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.4%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.6%

Consensus Range, Average Hourly Earnings - Y/Y: 3.6%

to 3.8%

Consensus Forecast, Average Workweek: 34.3

Consensus Range, Average Workweek: 34.2 to 34.3

Payrolls seen up a moderate 67K and the jobless rate flat at

4.4 percent.

US Consumer Sentiment for February (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Index: 55.5

Consensus Range, Index: 53.0 to 59.0

Sentiment expected to fade to 55.5 as last month's uptick to

56.4 appears overdone.

US Consumer Credit for December (Fri 1500 EST; Fri

2000 GMT)

Consensus Forecast, M/M: $8.4 B

Consensus Range, M/M: $6.5 B to $10.0 B

A moderate gain of $8.4 billion is the call.

|